- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:ZBRA

Zebra Technologies (ZBRA): Valuation Insights as New Enterprise Wins Bolster Automation Growth Narrative

Reviewed by Kshitija Bhandaru

Zebra Technologies (ZBRA) is in the spotlight after ODW Logistics chose its Symmetry Fulfillment platform, with the goal of achieving meaningful efficiency gains in e-commerce operations. A strategic partnership with Tulip also highlights Zebra’s progress in digital transformation.

See our latest analysis for Zebra Technologies.

Despite landing key deals with ODW Logistics and deepening its push into digital transformation through the Tulip partnership, Zebra Technologies has faced heavy selling pressure. The year-to-date share price return stands at -28.1%, and the one-year total shareholder return is -26.4%. Still, the company’s strong three-year total shareholder return of 7.9% hints at its longer-term resilience, even as near-term momentum remains underwhelming.

If automation trends in logistics and manufacturing have you searching for more ideas, it may be the perfect moment to discover fast growing stocks with high insider ownership

With shares trading well below analyst targets and future growth prospects driven by automation and digital transformation, investors now face a pivotal question: could this be a buying opportunity, or is all that potential already built into the price?

Most Popular Narrative: 25% Undervalued

According to the most widely followed narrative, Zebra Technologies’ fair value is pegged at $369.60, significantly higher than the last close of $275.89. This sets the stage for a debate: what factors have analysts leaning bullish despite the recent share price drop?

The accelerating shift toward automation, digital transformation, and real-time workflow optimization, driven by ongoing labor shortages, e-commerce expansion, and increased supply chain demands, continues to fuel robust demand for Zebra's portfolio (hardware, software, RFID, machine vision), supporting sustained revenue growth and long-term earnings visibility.

What’s really powering this bullish view? The narrative is betting on faster margin expansion and future profit multiples that rival the sector’s strongest players. Want to discover the underlying financial leaps and competitive advantages that fuel this valuation call? The full story is a must-read for serious investors.

Result: Fair Value of $369.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure from tariffs or weak recovery in key regions could challenge the bullish outlook and limit near-term upside for Zebra Technologies.

Find out about the key risks to this Zebra Technologies narrative.

Another View: Checking Value by Ratios

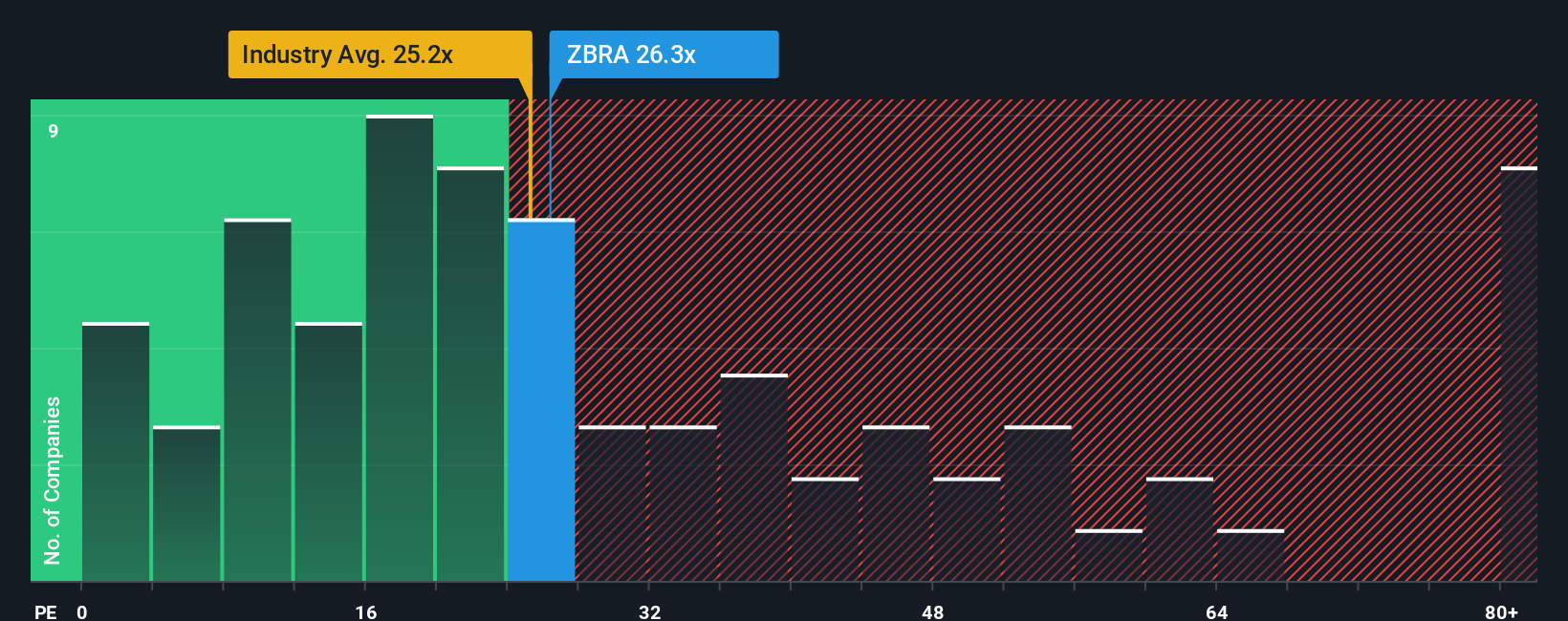

While the analyst narrative finds Zebra Technologies undervalued, our look at its price-to-earnings ratio suggests a more complex story. At 25.6x, Zebra trades slightly above the US Electronic industry average (25.5x) but well below its peer group’s 50.1x. However, the market’s fair ratio for Zebra could be closer to 31.5x. This gap signals modest opportunity. Unless the industry rerates, investors face more limited upside if expectations go unmet.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zebra Technologies Narrative

If you’re looking for a fresh perspective or want your own analysis to guide you, take a few minutes to review the numbers yourself and see what narrative you would build. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Zebra Technologies.

Looking for More Investment Ideas?

Don’t wait while others spot opportunities first. Supercharge your portfolio by following the hottest trends with three powerful ways to target what’s next.

- Boost your income and stability by tapping into these 19 dividend stocks with yields > 3% with high yields and a track record that rewards patient investors.

- Catch the next wave in healthcare innovation by checking out these 33 healthcare AI stocks with breakthrough technologies transforming patient outcomes and diagnostics.

- Ride the potential of crypto’s seismic shift by reviewing these 79 cryptocurrency and blockchain stocks working at the frontier of digital assets and blockchain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zebra Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZBRA

Zebra Technologies

Provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives