- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:ZBRA

Zebra Technologies (ZBRA) Showcases AI Innovations at ZONE and Frontline AI Summit

Reviewed by Simply Wall St

Zebra Technologies (ZBRA) recently showcased AI-driven solutions at its Annual ZONE Customer Conference and Frontline AI Summit, highlighting innovations aimed at enhancing operational efficiency. Despite the company's stock rising 8%, this movement aligns with broader market trends, as the Nasdaq and S&P 500 hit record highs, led by strong tech stock performances. Events such as Zebra's product innovations and strategic collaborations, like the partnership with the NFL's Indianapolis Colts, likely complemented market momentum rather than drastically altering its trajectory. The company's financial results and share buyback program may have also underpinned investor confidence amidst favorable market conditions.

The advancements showcased at Zebra Technologies' recent conference, such as their AI-driven solutions, highlight the company's focus on innovation and operational efficiency. These initiatives have the potential to bolster long-term revenue and earnings by expanding their market presence and enhancing customer-facing technologies. While the short-term stock gain of 8% aligns with broader market trends, Zebra's long-term total shareholder return of 25.7% over the past five years provides additional context for its consistent performance. This return reflects Zebra's ability to leverage ongoing digital transformation trends.

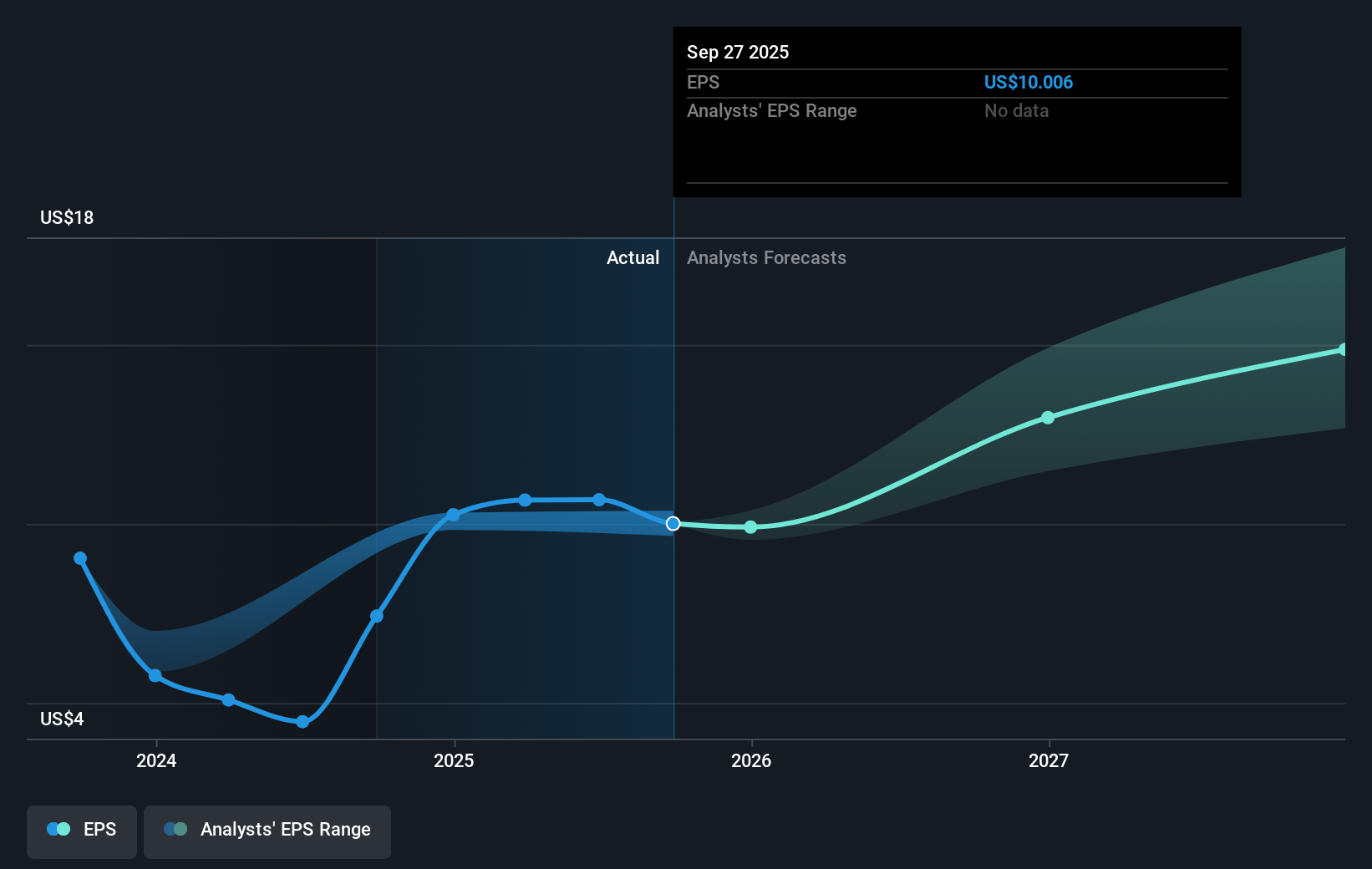

Comparing recent performance, Zebra's stock did not keep pace with the US Electronic industry, which saw a return of 41.5% over the past year. Despite this, the progress in expanding their addressable market through strategic acquisitions like Elo may still yield positive returns in the coming years. Analysts anticipate revenue growth driven by the adoption of automation and digital solutions. The projected earnings growth and margin expansion lend credibility to the consensus price target of $364.67, which is approximately 16.64% higher than the current share price of $312.65. As markets adjust to rapid technological changes, Zebra's strategic shifts toward high-margin, recurring revenue could enhance its future growth trajectory and valuation appeal.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zebra Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZBRA

Zebra Technologies

Provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)