- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:ZBRA

Investing in Zebra Technologies (NASDAQ:ZBRA) five years ago would have delivered you a 60% gain

When you buy and hold a stock for the long term, you definitely want it to provide a positive return. Better yet, you'd like to see the share price move up more than the market average. Unfortunately for shareholders, while the Zebra Technologies Corporation (NASDAQ:ZBRA) share price is up 60% in the last five years, that's less than the market return. However, more recent buyers should be happy with the increase of 49% over the last year.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

Check out our latest analysis for Zebra Technologies

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Zebra Technologies actually saw its EPS drop 4.0% per year.

So it's hard to argue that the earnings per share are the best metric to judge the company, as it may not be optimized for profits at this point. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We are not particularly impressed by the annual compound revenue growth of 1.9% over five years. So why is the share price up? It's not immediately obvious to us, but a closer look at the company's progress over time might yield answers.

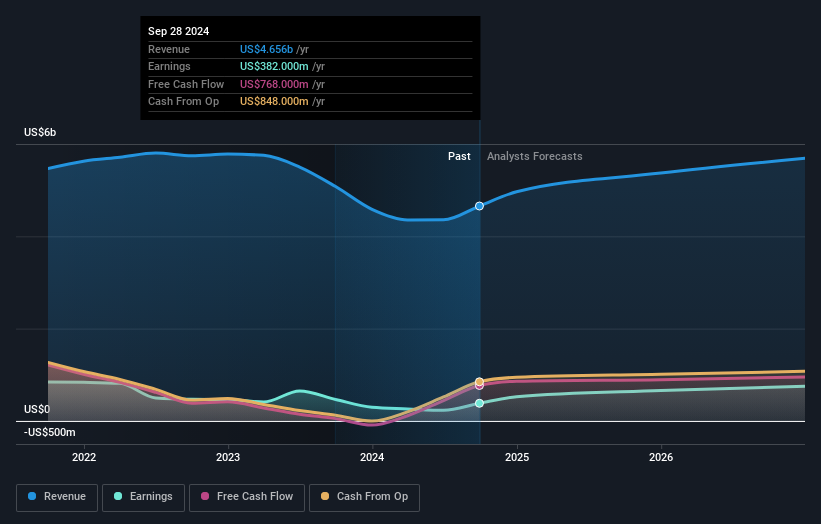

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Zebra Technologies is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

It's good to see that Zebra Technologies has rewarded shareholders with a total shareholder return of 49% in the last twelve months. That gain is better than the annual TSR over five years, which is 10%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Zebra Technologies that you should be aware of before investing here.

Of course Zebra Technologies may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zebra Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ZBRA

Zebra Technologies

Provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives