- United States

- /

- Tech Hardware

- /

- NasdaqGS:WDC

Why Western Digital (WDC) Is Up 6.1% After Announcing a $2B Buyback and AI Demand Surge

Reviewed by Simply Wall St

- In recent weeks, Western Digital announced a $2 billion share buyback program and quarterly dividend, alongside reporting improved earnings estimates and robust demand for its AI-driven storage solutions.

- The company's visibility into future demand, supported by long-term agreements with major hyperscale customers and stable pricing, stands out as a significant factor supporting its operational outlook.

- We'll assess how Western Digital's commitment to shareholder returns and AI-focused growth may reshape its broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Western Digital Investment Narrative Recap

At its core, being a Western Digital shareholder depends on confidence in the company’s ability to capture growing AI-driven data storage demand while navigating concentrated exposure to a handful of hyperscale customers. The latest round of buybacks, dividend introduction, and strong earnings visibility may reinforce short-term optimism, but they do not materially reduce the largest risk: revenue concentration remains elevated and highly dependent on a select group of cloud leaders and their future technology strategies.

Of all recent announcements, the launch of a $2 billion share buyback program directly relates to the company’s focus on boosting shareholder returns amid improved operational performance. While this move signals Western Digital’s confidence in its fundamentals and cash flow, future stock performance will continue to hinge on maintaining deep hyperscaler relationships and capitalizing on secular enterprise demand, especially as storage markets remain cyclical and pricing power-sensitive.

By contrast, investors should also pay close attention to possible shifts in hyperscale customer purchasing that could signal...

Read the full narrative on Western Digital (it's free!)

Western Digital's narrative projects $11.9 billion revenue and $2.2 billion earnings by 2028. This requires 7.6% yearly revenue growth and a $0.6 billion earnings increase from $1.6 billion today.

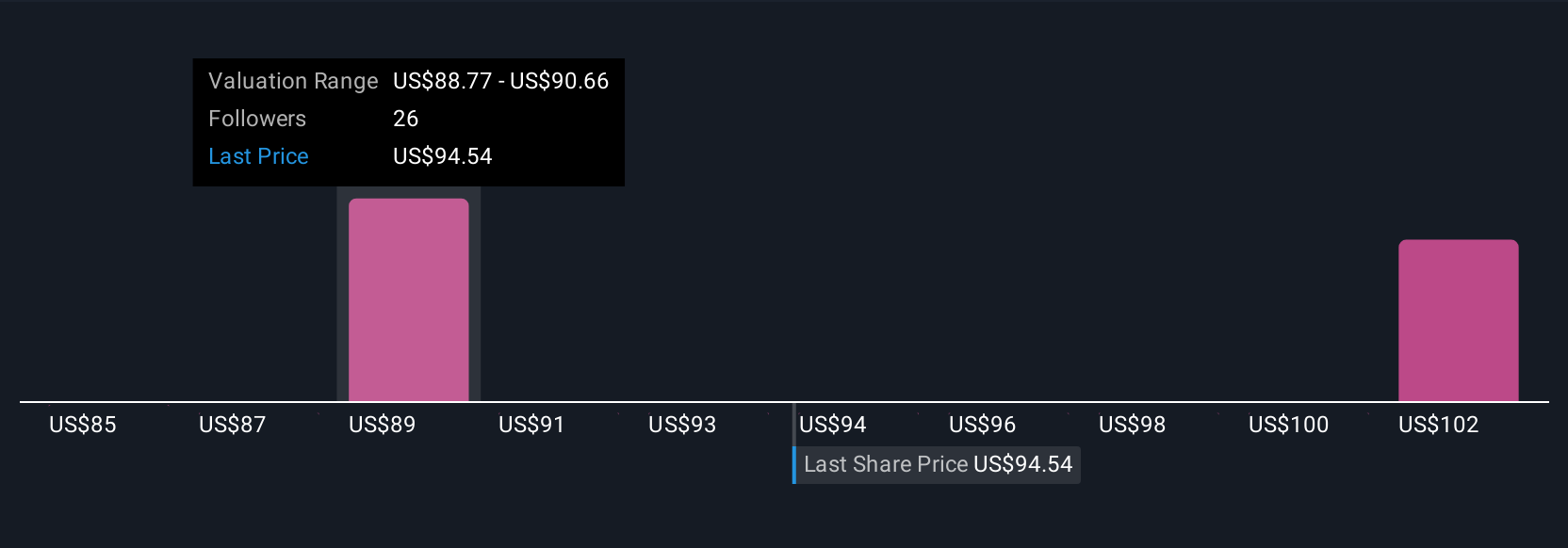

Uncover how Western Digital's forecasts yield a $89.14 fair value, a 9% downside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community estimate Western Digital’s fair value between US$85 and US$104 per share. While most focus on growth from long-term AI demand, a single major customer change could reshape the company’s earnings prospects, so it pays to review a range of viewpoints.

Explore 3 other fair value estimates on Western Digital - why the stock might be worth 13% less than the current price!

Build Your Own Western Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Digital research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Western Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Digital's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Western Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDC

Western Digital

Develops, manufactures, and sells data storage devices and solutions based on hard disk drive (HDD) technology in the United States, Asia, Europe, the Middle East, and Africa.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)