Last Update 21 Nov 25

Fair value Increased 7.81%WDC: Accelerating AI-Driven Demand Will Sustain Tight Supply And Margin Upside

Western Digital's analyst-derived fair value has been raised significantly, increasing from approximately $167 to $181 per share. Analysts attribute this to stronger earnings, robust demand, and improved pricing dynamics, as reflected in recent price target increases across the Street.

Analyst Commentary

Analysts have reacted positively to Western Digital's recent performance and outlook, leading to a notable round of price target increases and a general tone of optimism regarding the company's ability to capitalize on market tailwinds. However, some sources remain cautious, highlighting potential risks and moderating their recommendations in light of evolving industry dynamics.

Bullish Takeaways

- Bullish analysts point to stronger-than-expected shipments and improved pricing trends, which are lifting earnings estimates and supporting higher valuation multiples.

- Many highlight robust demand for hard disk drives and NAND memory, driven especially by accelerated investments in cloud infrastructure and artificial intelligence workloads.

- Margin improvement is a standout theme, with gross and operating margins surpassing expectations and helping to justify upward price target revisions.

- Several note the company’s leadership in certain high-capacity and next-generation storage solutions. This positions Western Digital to benefit as industry supply remains tight and lead times extend.

Bearish Takeaways

- Bearish analysts contend that while the demand environment is favorable, valuation appears stretched and current growth assumptions may be conservative. This has led to some neutral ratings despite rising targets.

- Some view recent management guidance as "conservative," especially regarding average selling prices, suggesting there is uncertainty about the sustainability of recent improvements.

- There are concerns over potential volatility given the centrality of semiconductor stocks in broader market cycles. Risks are heightened by ongoing supply chain constraints and execution challenges.

- Questions remain about the durability of the economic cycle for hard disk drives and whether current momentum can be sustained amid evolving end-market demand and competitive dynamics.

What's in the News

- Unveiled next-generation storage solutions and partnerships at Supercomputing 2025. Expanded support for AI and HPC through UltraSMR technology and broadened the Open Composable Compatibility Lab ecosystem (Key Developments).

- Completed a significant buyback by repurchasing 9.2 million shares, representing 2.66% of outstanding shares, for $702.41 million under the program announced in May 2025 (Key Developments).

- Announced a 25% increase to its quarterly cash dividend, now set at $0.125 per share, payable December 18, 2025 (Key Developments).

- Provided earnings guidance for fiscal Q2 2026, expecting revenues of $2.9 billion, plus or minus $100 million (Key Developments).

- Opened an expanded 25,600 square foot System Integration and Test (SIT) Lab to accelerate customer qualification and support growing AI-driven storage demands (Key Developments).

Valuation Changes

- The Fair Value Estimate has increased from approximately $167 to $181 per share, reflecting a noticeable upward revision in analyst assessments.

- The Discount Rate has risen slightly, from 8.27% to 8.44%, indicating a modest adjustment in risk considerations.

- Revenue Growth projections have edged higher, moving from 12.43% to 13.15%, suggesting greater optimism about top-line expansion.

- The Net Profit Margin has fallen marginally, declining from 25.51% to 25.03%, but remains robust overall.

- The Future P/E Ratio is now projected at 20.32x, up from 19.11x, implying an increase in valuation multiples compared to previous estimates.

Key Takeaways

- Deep partnerships with hyperscalers and innovative drive technologies position the company to capture strong, sustained market and margin expansion from AI-driven storage demand.

- Improved financial health and platform solutions enable ongoing investment, expanded market reach, and greater shareholder returns.

- Dependence on few cloud customers, market shifts, trade uncertainty, and emerging storage technologies threaten long-term growth, margin stability, and revenue diversification.

Catalysts

About Western Digital- Develops, manufactures, and sells data storage devices and solutions based on hard disk drive (HDD) technology in the Americas, Asia, Europe, the Middle East, and Africa.

- The explosive increase in unstructured data generated by AI applications, Agentic AI, and cloud-based services across industries is driving unprecedented storage needs. Western Digital's deep integration with leading hyperscalers (e.g., all top 5 with firm POs/LTAs covering the next 12–18 months) positions the company to benefit from secular demand, directly fueling higher long-term revenue growth.

- Higher adoption of Western Digital's larger capacity, high-value ePMR and UltraSMR drives-with rapid qualification and ramp cycles-demonstrates customer trust and enables both pricing power and favorable product mix, leading to structurally higher gross margins and improved net margins over time.

- The company's next-generation roadmap (final ePMR and upcoming HAMR drives) allows for sustained aerial density improvements and cost efficiencies, supporting continued profitability and margin expansion as data requirements grow.

- Platform solutions, targeting a new class of native AI/neo-cloud companies lacking in-house storage teams, open up incremental markets and new revenue streams, broadening Western Digital's addressable market and supporting topline growth.

- Ongoing balance sheet improvements, significant debt reduction, and robust free cash flow generation increase financial flexibility; this supports both continued R&D investment to capitalize on long-term demand trends and shareholder returns (dividends, buybacks), ultimately enhancing EPS and return on equity.

Western Digital Future Earnings and Revenue Growth

Assumptions

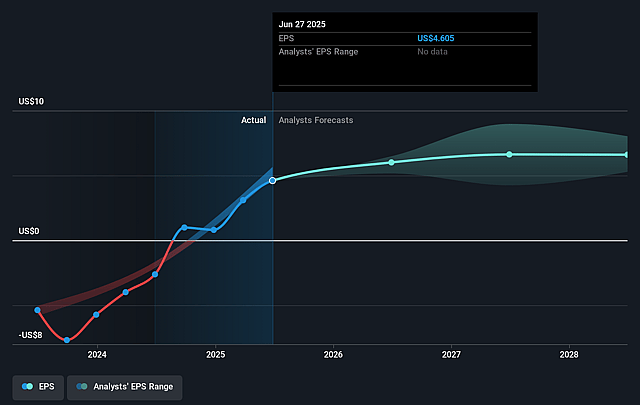

How have these above catalysts been quantified?- Analysts are assuming Western Digital's revenue will grow by 7.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.8% today to 18.1% in 3 years time.

- Analysts expect earnings to reach $2.2 billion (and earnings per share of $6.6) by about September 2028, up from $1.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.4 billion in earnings, and the most bearish expecting $1.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.5x on those 2028 earnings, down from 20.5x today. This future PE is lower than the current PE for the US Tech industry at 24.3x.

- Analysts expect the number of shares outstanding to grow by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.4%, as per the Simply Wall St company report.

Western Digital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on a small number of hyperscale/cloud customers (90%+ of revenue) exposes Western Digital to significant concentration risk-any shift to in-house custom storage or alternative technologies by these customers could materially impact long-term revenue and earnings.

- Persistent decline in consumer and flat client segment revenues (down 12% and up only 2% YoY respectively) signals growing dependence on the cyclical cloud/datacenter market, posing risks to diversified topline growth and long-term revenue stability.

- Ongoing global tariff uncertainty and potential for abrupt changes in trade policy increase operational complexity and could drive higher costs or sudden demand disruptions, leading to lower net margins and earnings volatility.

- Secular shift towards cloud-native architectures and alternative storage technologies (including increased adoption of SSDs, custom storage solutions by hyperscalers, or emerging memory types) could eventually outpace HDD/UltraSMR advancements, threatening Western Digital's long-term relevance and affecting revenue growth.

- Mix-driven gross margin improvements depend on successful ramp-up and customer adoption of new technologies (e.g., UltraSMR, HAMR); slower-than-anticipated transitions or failure in manufacturing yields and reliability could compress margins and dampen earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $89.143 for Western Digital based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $110.0, and the most bearish reporting a price target of just $62.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $11.9 billion, earnings will come to $2.2 billion, and it would be trading on a PE ratio of 18.5x, assuming you use a discount rate of 8.4%.

- Given the current share price of $94.54, the analyst price target of $89.14 is 6.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.