Key Takeaways

- Accelerated adoption of advanced storage technologies and strong leadership are set to drive substantial margin expansion, market share gains, and product differentiation.

- Supply-demand discipline, long-term customer agreements, and operational agility position Western Digital for sustained pricing power, volume growth, and improved earnings quality.

- Increasing competition from new storage technologies, regulatory pressures, and concentrated buyers threaten Western Digital's profitability and future competitiveness amidst operational and innovation constraints.

Catalysts

About Western Digital- Develops, manufactures, and sells data storage devices and solutions in the United States, China, Hong Kong, Europe, the Middle East, Africa, rest of Asia, and internationally.

- Analyst consensus expects strong demand for mass storage in the age of AI, but these projections likely understate the degree to which Western Digital can achieve high-margin, sustained revenue growth as AI, IoT, and edge computing cause the total addressable market for advanced HDD and SSD products to expand faster and farther than currently modeled.

- While analysts broadly believe Western Digital's innovation in high-density HDDs and upcoming HAMR technology will enhance margins, this likely underestimates the speed and scale by which rapid adoption of 28, 32, and 36 terabyte drives will drive pricing power, yield improvements, and expanded net margins as cloud and hyperscale data grows exponentially.

- The transformational leadership of the new CEO and Chief Product Officer-each with deep hyperscale and cloud expertise-positions Western Digital to capture outsized share in next-generation storage architectures, resulting in a step-function increase in long-term customer commitments, product differentiation, and structural gross margin expansion.

- Tight supply-demand balance, increased duration of long-term agreements with hyperscaler customers out to mid-2026, and industry-wide removal of excess HDD capacity minimize downside risk, supporting pricing discipline and allowing Western Digital to extract premium ASPs, thereby accelerating both revenue and EPS growth above current expectations.

- Operational agility stemming from global supply chain resiliency, vertical integration, and the company's robust intellectual property portfolio enables Western Digital to expand into emerging markets and new use cases worldwide, driving multi-year volume growth and improving both capital efficiency and overall earnings quality.

Western Digital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Western Digital compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Western Digital's revenue will decrease by 9.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.8% today to 18.6% in 3 years time.

- The bullish analysts expect earnings to reach $2.1 billion (and earnings per share of $5.89) by about July 2028, up from $1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.6x on those 2028 earnings, down from 22.0x today. This future PE is lower than the current PE for the US Tech industry at 19.5x.

- Analysts expect the number of shares outstanding to grow by 1.58% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.63%, as per the Simply Wall St company report.

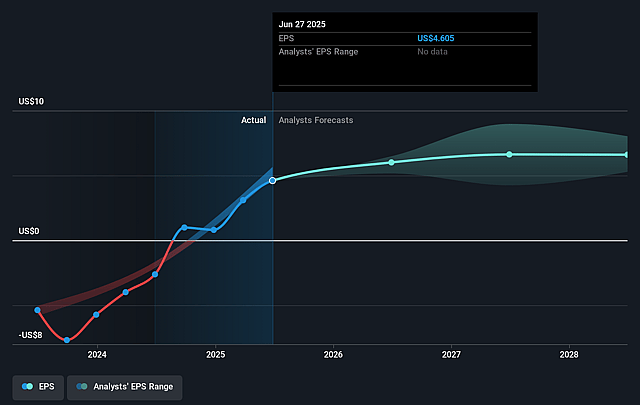

Western Digital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing shift towards cloud-based storage, SaaS models, and alternative storage technologies threatens long-term demand for Western Digital's consumer hardware storage solutions, which could contract the company's addressable market and reduce long-run revenues.

- The company's business is heavily reliant on traditional HDDs, which are facing growing scrutiny over energy efficiency and sustainability compared to solid-state technologies; this could lead to diminished attractiveness of legacy products and compress gross margins over time.

- Persistent global trade tensions, tariff volatility, and evolving supply chain dynamics-issues specifically called out in management's commentary-introduce input cost inflation and operational disruptions, heightening risk to both earnings stability and net margins.

- Growing buyer concentration as hyperscale customers dominate the market increases Western Digital's exposure to their purchasing power, which could pressure pricing and erode profitability as margins and sales volumes become increasingly dictated by a small set of powerful buyers.

- Western Digital's history of tightly managed, and at times limited, capital expenditures for innovation and R&D-combined with ongoing legal disputes and a significant deleveraging imperative-could constrain the company's ability to remain competitive in next-generation memory and storage, impacting future revenue growth and sustainable earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Western Digital is $85.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Western Digital's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $40.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $11.5 billion, earnings will come to $2.1 billion, and it would be trading on a PE ratio of 18.6x, assuming you use a discount rate of 8.6%.

- Given the current share price of $67.06, the bullish analyst price target of $85.0 is 21.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Western Digital?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.