- United States

- /

- Tech Hardware

- /

- NasdaqGS:WDC

Western Digital (WDC) Is Up 14.6% After Surpassing Quarterly Estimates and Raising Forward Guidance

Reviewed by Simply Wall St

- In recent days, Western Digital received a wave of positive analyst sentiment following its quarterly results surpassing expectations and management's upbeat guidance for the months ahead.

- This renewed attention highlights Western Digital's expanding role in enabling AI-driven data workloads for hyperscalers, cloud providers, and enterprises worldwide.

- We'll explore how the firm's robust quarterly performance and bullish analyst outlook may bolster Western Digital's longer-term investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Western Digital Investment Narrative Recap

To be a Western Digital shareholder, you need to believe in the continued growth of global data storage needs, especially from AI and cloud innovation, and Western Digital’s ability to deliver the technology that hyperscalers and enterprises require. While the recent surge in analyst sentiment and positive earnings guidance strengthens confidence in near-term hyperscaler demand, a major catalyst for the company, it does not significantly reduce the ongoing risk that a few customers still account for the majority of revenue, nor the potential impact should these firms shift to custom or alternative storage solutions.

One of the most relevant announcements tied to these catalysts is Western Digital’s introduction of advanced storage solutions for AI and cloud workloads in May 2025. These new offerings directly target the expanding needs of hyperscale and enterprise customers, underlining the company’s focus on staying at the forefront of data infrastructure, a vital point given the recent analyst optimism.

But while enthusiasm for AI-powered growth is strong, investors should also be aware that heavy reliance on a narrow set of hyperscale customers could mean...

Read the full narrative on Western Digital (it's free!)

Western Digital's outlook points to $11.8 billion in revenue and $2.2 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 7.3% and an earnings increase of $0.6 billion from the current $1.6 billion.

Uncover how Western Digital's forecasts yield a $88.10 fair value, a 4% downside to its current price.

Exploring Other Perspectives

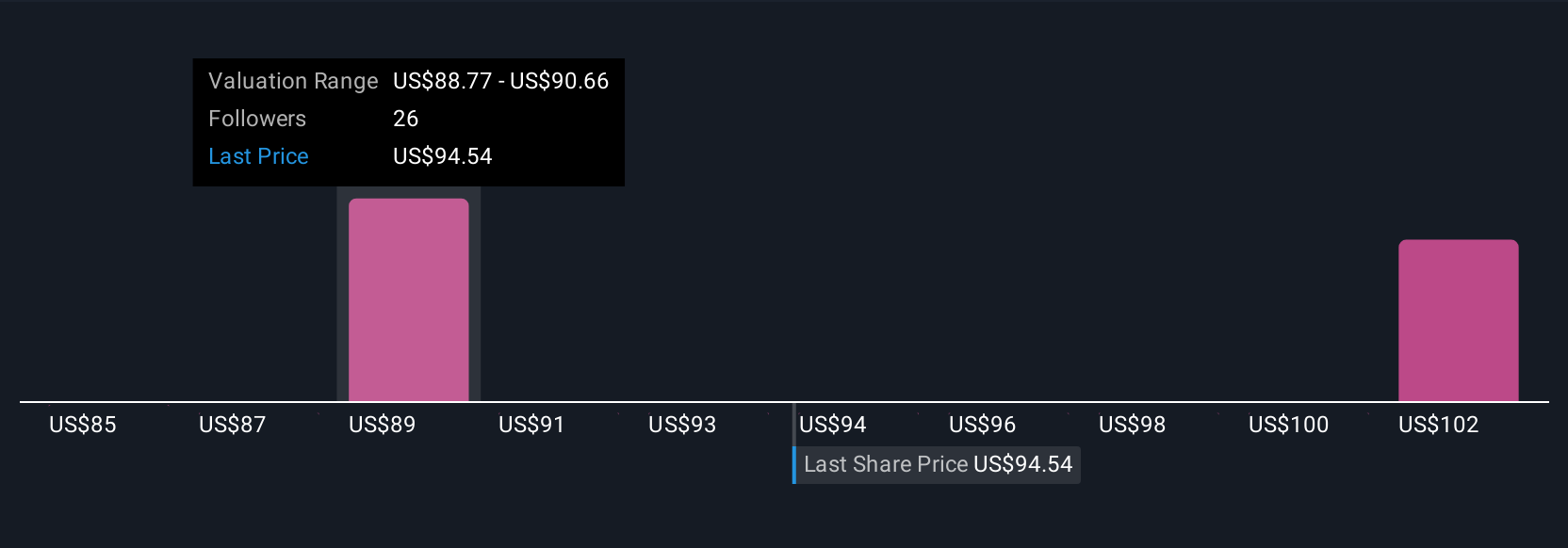

Simply Wall St Community members see Western Digital’s fair value ranging widely from US$85 to above US$103 across three separate perspectives. Many highlight the company’s deep relationships with hyperscalers as a growth driver, but this also introduces significant concentration risk for future revenues.

Explore 3 other fair value estimates on Western Digital - why the stock might be worth 8% less than the current price!

Build Your Own Western Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Digital research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Western Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Digital's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDC

Western Digital

Develops, manufactures, and sells data storage devices and solutions based on hard disk drive (HDD) technology in the United States, Asia, Europe, the Middle East, and Africa.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives