- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TTMI

TTM Technologies (TTMI): Valuation Check After Sector-Wide AI Infrastructure Selloff and Big-Tech Earnings Jitters

Reviewed by Simply Wall St

TTM Technologies (TTMI) dropped about 7% after a wave of selling hit AI infrastructure and electronic component names, as disappointing big-tech earnings led investors to question how soon AI spending will translate into tangible returns.

See our latest analysis for TTM Technologies.

Even with today’s setback, the 90 day share price return of 46.07% and year to date share price return of 198.74% signal that momentum around TTM’s AI infrastructure exposure is still building rather than fading.

If this AI driven swing has your attention, it could be a good moment to see what else is moving across high growth tech and AI stocks and spot the next potential beneficiary.

With TTM now trading just below consensus targets after a huge run, the key question is whether investors are still underestimating its AI infrastructure upside or if the market has already priced in the next leg of growth.

Most Popular Narrative Narrative: 5.3% Undervalued

With shares last closing at $73.43 against a narrative fair value of $77.50, the valuation case leans modestly positive and hinges on durable AI and data center demand.

Large scale data center buildouts announced by tech giants (e.g., Google, CoreWeave, Meta) and TTM's new Wisconsin facility position the company to capture outsized demand for advanced PCBs and interconnects required for AI and cloud infrastructure, directly supporting revenue growth and long term customer relationships.

Curious how this story justifies a richer future earnings multiple, faster profit growth, and stronger margins than today? Want to see the bold assumptions driving that gap?

Result: Fair Value of $77.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps at new facilities or softer AI and data center demand could quickly challenge today’s optimism and compress that perceived valuation gap.

Find out about the key risks to this TTM Technologies narrative.

Another Lens On Valuation

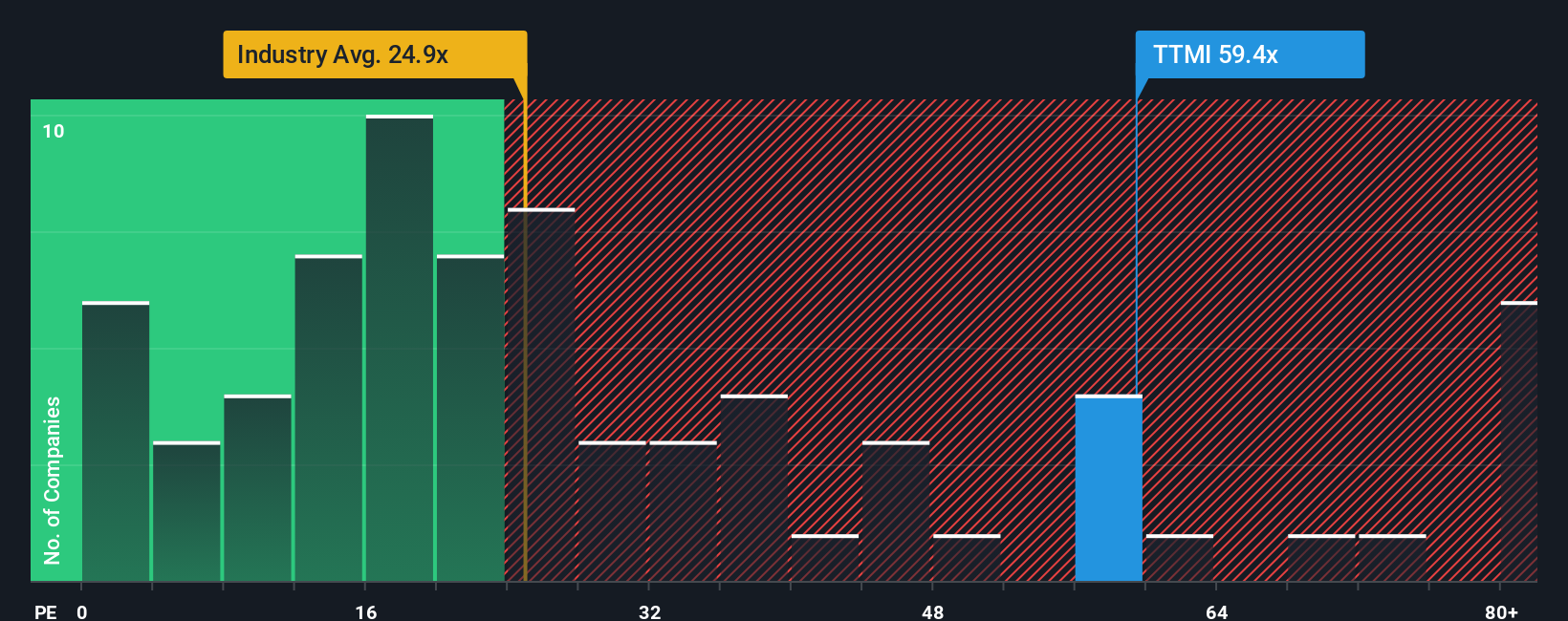

Setting the narrative aside, the trailing twelve months valuation looks stretched on earnings. The stock trades on a 57.5x price-to-earnings ratio compared with 24.8x for the US Electronic industry, and a fair ratio of 34x, which signals meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TTM Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TTM Technologies Narrative

If you are not fully convinced by this view, or prefer to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your TTM Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at TTM. Use the Simply Wall St Screener to uncover fresh opportunities that fit your strategy before other investors catch on.

- Capture potential trend shifts by scanning these 26 AI penny stocks where current revenue growth is combined with transformative technology.

- Strengthen your income strategy through these 13 dividend stocks with yields > 3% that aim to balance regular payouts with fundamental resilience.

- Refine your value search by targeting these 901 undervalued stocks based on cash flows that are trading below what their cash flows may suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TTM Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTMI

TTM Technologies

Manufactures and sells mission systems, radio frequency (RF) components and RF microwave/microelectronic assemblies, and printed circuit boards (PCB) in the United States, Taiwan, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)