- United States

- /

- Software

- /

- NasdaqGS:TRMB

Trimble (TRMB): Evaluating Valuation After a Steady Year-to-Date Share Price Climb

Trimble (TRMB) has been quietly grinding higher this year, and that alone is enough to get investors asking whether the current price still leaves meaningful upside or if expectations are finally catching up.

See our latest analysis for Trimble.

Recent gains have been steady rather than flashy, with the share price at $82.46 and an 18.29 percent year to date share price return echoing Trimble’s improving growth story. This is supported by a solid three year total shareholder return of 58.97 percent.

If Trimble’s trajectory has you thinking about what else might be quietly compounding in tech, this could be a good moment to explore high growth tech and AI stocks for more ideas.

With revenue and earnings both advancing and the share price still sitting at a near 19 percent discount to analyst targets, the key question now is simple: is Trimble a buy or is future growth already priced in?

Most Popular Narrative: 16.2% Undervalued

With Trimble’s fair value pegged near $98.45 against a recent close of $82.46, the most followed narrative points to a meaningful valuation gap.

The migration from hardware-focused, CapEx models to bundled, subscription-based offerings even in traditionally hardware-oriented segments expands the addressable market, improves revenue visibility, and increases recurring revenue mix, driving greater predictability and enhanced long-term earnings.

Want to see the engine behind that valuation gap? The narrative leans on rising recurring revenue, sharply higher margins, and a bold earnings power reset. Curious?

Result: Fair Value of $98.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, extended weakness in government spending and faster moving, AI driven competitors could easily derail Trimble’s margin expansion and recurring revenue ambitions.

Find out about the key risks to this Trimble narrative.

Another Lens on Value

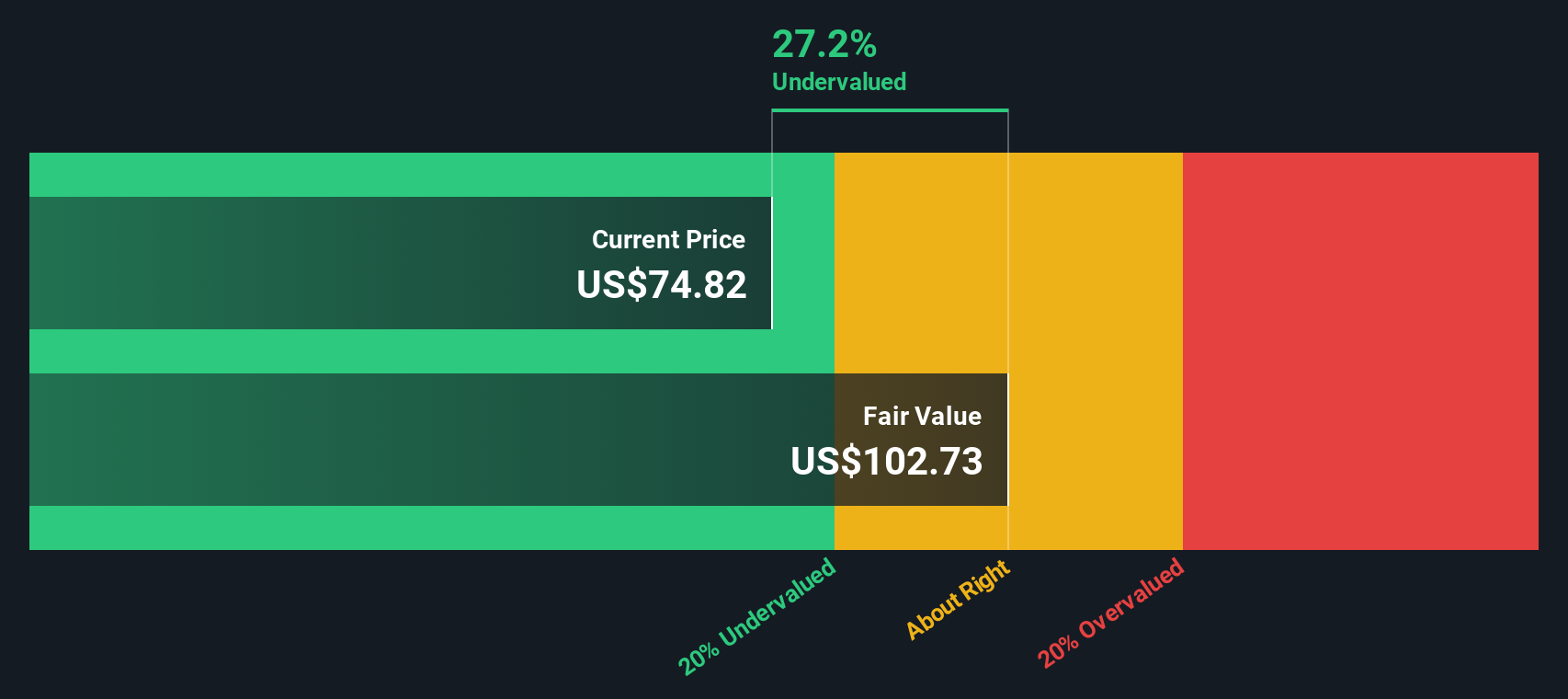

Our SWS DCF model paints an even stronger case than the narrative based fair value. On that view, Trimble at $82.46 screens as about 19 percent undervalued versus an intrinsic value near $102.10. If cash flows line up with forecasts, is the market giving you a margin of safety or signaling hidden risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Trimble Narrative

If you see the story differently or want to dig into the numbers yourself, you can quickly craft a custom view in under three minutes: Do it your way.

A great starting point for your Trimble research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning targeted stock ideas that could sharpen your next investing move.

- Explore potential multi-baggers early by reviewing these 3599 penny stocks with strong financials that already show strong balance sheets and resilient cash flows.

- Focus on these 26 AI penny stocks positioned at the intersection of innovation, scalability, and accelerating demand.

- Identify value-focused opportunities by screening these 906 undervalued stocks based on cash flows where current prices still trail long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trimble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRMB

Trimble

Provides technology solutions that enable professionals and field mobile workers to enhance or transform their work processes in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Amazon - A Fundamental and Historical Valuation

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion