- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TRMB

Trimble (NasdaqGS:TRMB) Enhances SketchUp With New Visualization and Interoperability Features

Reviewed by Simply Wall St

Trimble (NasdaqGS:TRMB) recently launched a notable update to its SketchUp® software, enhancing visualization and interoperability, which facilitated design efficiency improvements. Despite these advancements, the company's shares experienced a 1.44% decline over the last quarter. This period also saw the company report a robust earnings performance for Q4 2024 with strong revenue and net income growth. Concurrently, Tremble announced a new $1 billion share repurchase program, outlining a visible commitment to shareholder value. However, external factors such as broader market conditions may have influenced its performance, amidst a mixed trading environment where the S&P 500 and Nasdaq Composite indexes faced downward pressures. Economic uncertainties and tariff announcements contributed to volatility across the tech sector, potentially impacting investor sentiment and Trimble's stock price. Overall, the interplay of positive company-specific developments was overshadowed by macroeconomic factors, mirroring the 3.6% slide in the stock market over the same period.

Unlock comprehensive insights into our analysis of Trimble stock here.

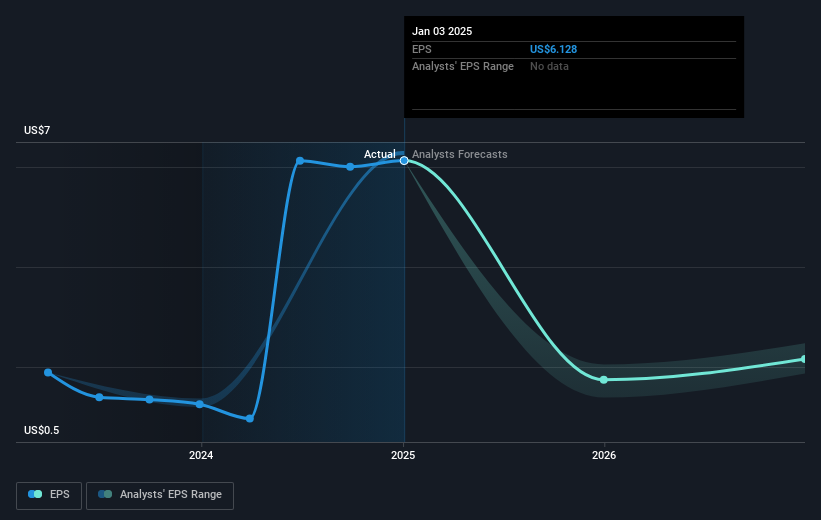

Over the past five years, Trimble has achieved a total shareholder return of 75.97%. This impressive growth can be attributed to various significant developments, including the company's substantial earnings growth, with an annual increase of 20.1%. During the same period, Trimble's earnings growth over the past year outpaced the Electronic industry, which experienced a decline in earnings, reflecting Trimble's strong position in its sector. Furthermore, the company's strategic collaborations, such as the extension with Qualcomm to enhance autonomous vehicle solutions, have likely bolstered investor confidence.

Moreover, Trimble has been valued favorably in terms of its Price-To-Earnings Ratio compared to peers, emphasizing its good value position in the market. The announcement of a US$1 billion share repurchase program has also underscored the firm's commitment to returning value to shareholders. These factors, combined with the company's sizable increase in net income to US$1.50 billion most recently, illustrate Trimble's overall competitive advantage and robust financial health over this five-year trajectory.

- Analyze Trimble's fair value against its market price in our detailed valuation report—access it here.

- Gain insight into the risks facing Trimble and how they might influence its performance—click here to read more.

- Is Trimble part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trimble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRMB

Trimble

Provides technology solutions that enable professionals and field mobile workers to enhance or transform their work processes worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives