- United States

- /

- Tech Hardware

- /

- NasdaqGM:TACT

Subdued Growth No Barrier To TransAct Technologies Incorporated (NASDAQ:TACT) With Shares Advancing 26%

Despite an already strong run, TransAct Technologies Incorporated (NASDAQ:TACT) shares have been powering on, with a gain of 26% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 29% over that time.

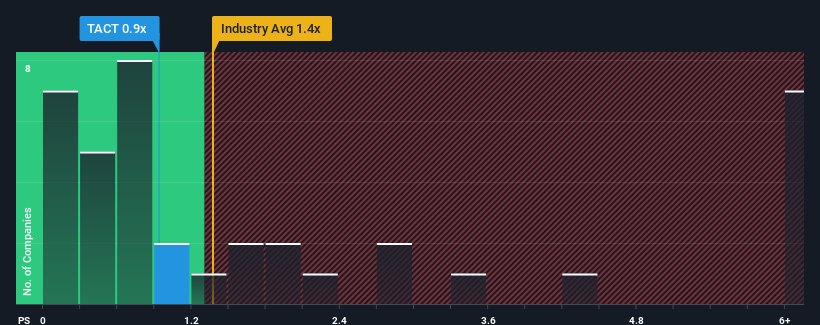

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about TransAct Technologies' P/S ratio of 0.9x, since the median price-to-sales (or "P/S") ratio for the Tech industry in the United States is also close to 1.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for TransAct Technologies

What Does TransAct Technologies' P/S Mean For Shareholders?

TransAct Technologies hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think TransAct Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For TransAct Technologies?

There's an inherent assumption that a company should be matching the industry for P/S ratios like TransAct Technologies' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 32%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 61% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 0.5% as estimated by the dual analysts watching the company. Meanwhile, the broader industry is forecast to expand by 8.1%, which paints a poor picture.

With this information, we find it concerning that TransAct Technologies is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Final Word

TransAct Technologies' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

While TransAct Technologies' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for TransAct Technologies that you should be aware of.

If you're unsure about the strength of TransAct Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TransAct Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TACT

TransAct Technologies

Designs, develops, and markets transaction-based and specialty printers and terminals in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)