- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

Super Micro Computer (NasdaqGS:SMCI) Partners With DataVolt for US$20 Billion AI Infrastructure

Reviewed by Simply Wall St

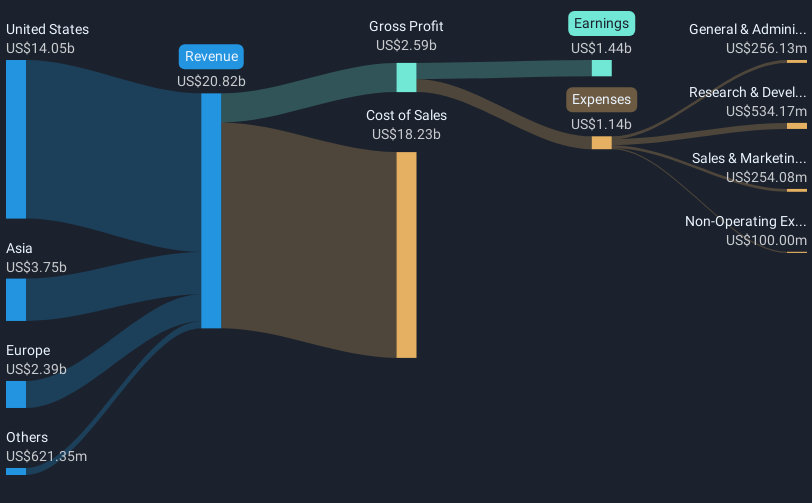

Super Micro Computer (NasdaqGS:SMCI) recently announced a strategic partnership with DataVolt to develop hyperscale AI campuses in Saudi Arabia, focusing on renewable energy technologies. This collaboration highlights the company's commitment to sustainability and innovation in AI infrastructure, which aligns with market enthusiasm for tech stocks. The announcement appeared to bolster investor confidence, contributing to Super Micro's impressive 37% price rise over the past week. This performance coincides with the tech-driven Nasdaq's uptrend and broad market optimism following positive U.S.-China trade developments and promising economic indicators, providing a favorable backdrop for Super Micro's stock appreciation.

The partnership between Super Micro Computer and DataVolt underscores the firm's focus on innovative, sustainable AI infrastructure, potentially bolstering its long-term growth outlook. This initiative aligns with the company's expansion strategy, enhancing its prospects in renewable-energy-powered data centers. Over five years, Super Micro's total shareholder return was an impressive 1647.22%, indicating substantial growth. In the past year, however, the company's performance lagged behind the tech industry, which returned 21.7%. The contrast in performance highlights fluctuations in shareholder returns, emphasizing the importance of viewing current news in the context of longer-term trends.

The announcement of the partnership could positively impact analysts' revenue and earnings forecasts by accelerating demand for Super Micro's AI platforms. Analysts predict revenue will increase 25.1% annually, with profit margins expected to rise to 9.2% by 2028. Despite these optimistic projections, it is crucial to consider ongoing risks such as potential platform transition delays or geopolitical uncertainties. Currently, Super Micro's share price sits at US$32.94, which is below the average analyst price target of US$48.76, suggesting potential room for share price growth if forecasts are realized. As investors assess the implications of this new venture, ongoing developments will be pivotal in validating or adjusting these expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives