- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:REFR

Companies Like Research Frontiers (NASDAQ:REFR) Are In A Position To Invest In Growth

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So should Research Frontiers (NASDAQ:REFR) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Research Frontiers

Does Research Frontiers Have A Long Cash Runway?

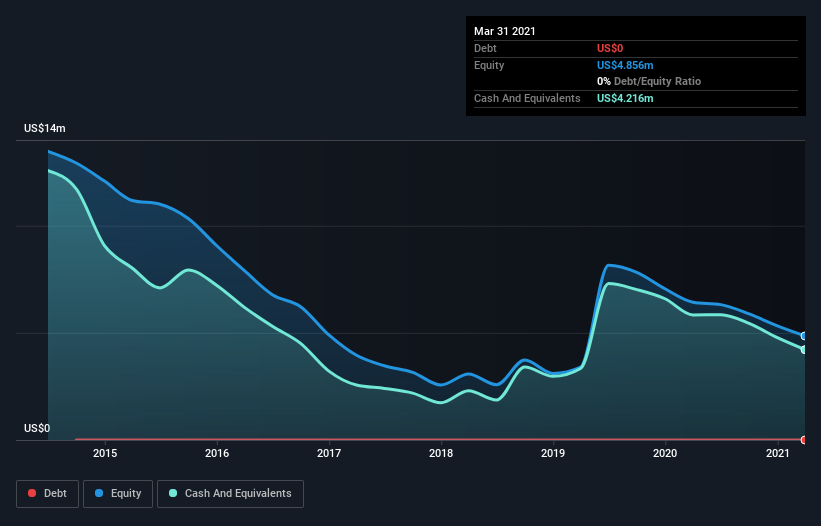

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In March 2021, Research Frontiers had US$4.2m in cash, and was debt-free. Importantly, its cash burn was US$2.2m over the trailing twelve months. That means it had a cash runway of around 23 months as of March 2021. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. Depicted below, you can see how its cash holdings have changed over time.

How Is Research Frontiers' Cash Burn Changing Over Time?

In our view, Research Frontiers doesn't yet produce significant amounts of operating revenue, since it reported just US$685k in the last twelve months. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. Cash burn was pretty flat over the last year, which suggests that management are holding spending steady while the business advances its strategy. Admittedly, we're a bit cautious of Research Frontiers due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

How Easily Can Research Frontiers Raise Cash?

While its cash burn is only increasing slightly, Research Frontiers shareholders should still consider the potential need for further cash, down the track. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of US$76m, Research Frontiers' US$2.2m in cash burn equates to about 2.9% of its market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

How Risky Is Research Frontiers' Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way Research Frontiers is burning through its cash. For example, we think its cash burn relative to its market cap suggests that the company is on a good path. Although its increasing cash burn does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. On another note, we conducted an in-depth investigation of the company, and identified 3 warning signs for Research Frontiers (1 is a bit concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you’re looking to trade Research Frontiers, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:REFR

Research Frontiers

Together with other subsidiary, engages in the development and marketing of technology and devices to control the flow of light worldwide.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026