- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:RCAT

Why We're Not Concerned Yet About Red Cat Holdings, Inc.'s (NASDAQ:RCAT) 34% Share Price Plunge

Red Cat Holdings, Inc. (NASDAQ:RCAT) shares have retraced a considerable 34% in the last month, reversing a fair amount of their solid recent performance. Regardless, last month's decline is barely a blip on the stock's price chart as it has gained a monstrous 1,294% in the last year.

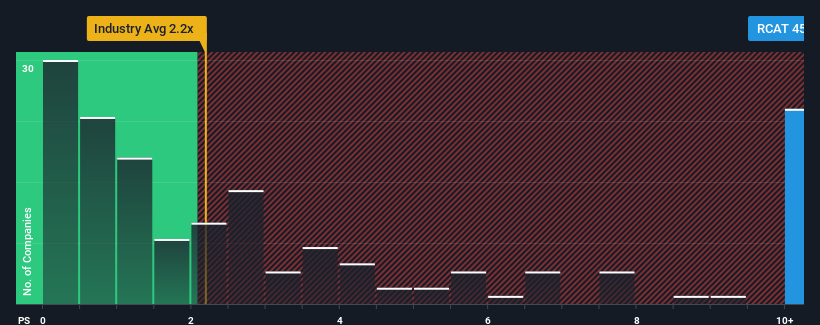

In spite of the heavy fall in price, you could still be forgiven for thinking Red Cat Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 45.5x, considering almost half the companies in the United States' Electronic industry have P/S ratios below 2.2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Red Cat Holdings

How Has Red Cat Holdings Performed Recently?

Recent times have been advantageous for Red Cat Holdings as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Red Cat Holdings will help you uncover what's on the horizon.How Is Red Cat Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Red Cat Holdings' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 95% last year. The latest three year period has also seen an excellent 126% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 325% during the coming year according to the sole analyst following the company. With the industry only predicted to deliver 9.5%, the company is positioned for a stronger revenue result.

With this information, we can see why Red Cat Holdings is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Red Cat Holdings' P/S Mean For Investors?

Red Cat Holdings' shares may have suffered, but its P/S remains high. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Red Cat Holdings shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Red Cat Holdings (1 is potentially serious) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RCAT

Red Cat Holdings

Provides products, services, and solutions to the drone industry in the United States.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026