- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:RCAT

Red Cat Holdings, Inc.'s (NASDAQ:RCAT) P/S Is Still On The Mark Following 75% Share Price Bounce

Red Cat Holdings, Inc. (NASDAQ:RCAT) shares have continued their recent momentum with a 75% gain in the last month alone. The last 30 days were the cherry on top of the stock's 1,176% gain in the last year, which is nothing short of spectacular.

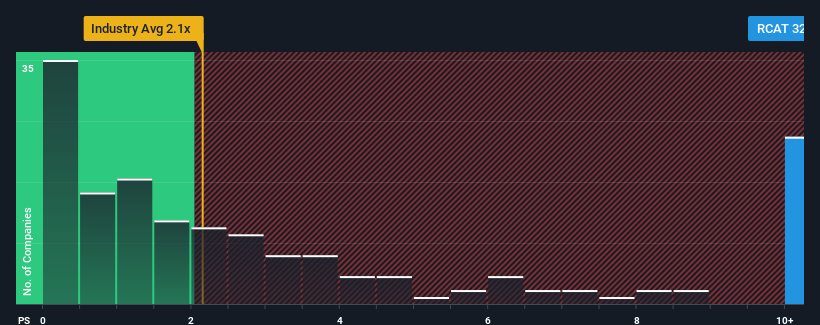

Since its price has surged higher, given around half the companies in the United States' Electronic industry have price-to-sales ratios (or "P/S") below 2.1x, you may consider Red Cat Holdings as a stock to avoid entirely with its 32.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Red Cat Holdings

How Red Cat Holdings Has Been Performing

Red Cat Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Red Cat Holdings will help you uncover what's on the horizon.How Is Red Cat Holdings' Revenue Growth Trending?

Red Cat Holdings' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. The latest three year period has also seen an excellent 223% overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 277% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 9.1%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Red Cat Holdings' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The strong share price surge has lead to Red Cat Holdings' P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Red Cat Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - Red Cat Holdings has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RCAT

Red Cat Holdings

Provides products, services, and solutions to the drone industry in the United States.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026