- United States

- /

- Tech Hardware

- /

- NasdaqCM:QUBT

Quantum Computing (NasdaqCM:QUBT) Sees 155% Price Surge Over Last Quarter

Reviewed by Simply Wall St

Quantum Computing (NasdaqCM:QUBT) has seen a significant surge in its stock price, climbing 155% over the last quarter. This remarkable growth coincided with the company's inclusion in multiple Russell indices, which likely enhanced its visibility and attractiveness to investors. Additionally, the successful private placement that raised $20 million and the strategic appointment of a new CFO, Christopher Roberts, could have reinforced positive investor sentiment. The shipment of a commercial entangled photon source marked Quantum's tangible progress in bringing quantum technologies to market. These events combined at a time of overall market stability to support the stock's considerable upward trajectory.

Over the past year, Quantum Computing Inc. (NasdaqCM:QUBT) has experienced a very large total shareholder return of 2,393.92%. This exceptional long-term performance stands out against the broader US market, which returned 11.4% over the same period, and the tech industry, which saw a negative return of 10.2%. These figures highlight Quantum's ability to outperform both the market and its industry peers over the last year.

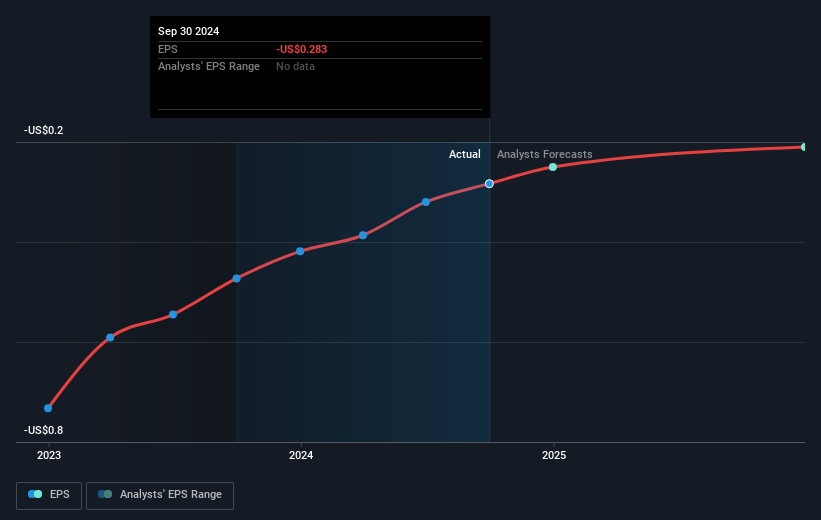

The company's recent inclusion in multiple indices, successful private placements, and strategic leadership changes have likely played a role in bolstering investor confidence, potentially influencing revenue and earnings forecasts. Although Quantum continues to operate at a loss, its earnings improvements in Q1 2025 suggest progress. Sales increased to US$0.039 million from US$0.027 million year-over-year, and the net income turned positive at US$16.98 million. This financial position nuances the share price's climb relative to its consensus analyst price target of US$18.50, with only a slight discount, indicating investors may find future growth prospects promising, despite the inherent challenges of achieving profitability.

Jump into the full analysis health report here for a deeper understanding of Quantum Computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quantum Computing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:QUBT

Quantum Computing

An integrated photonics company, provides quantum machines to commercial and government markets in the United States.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Hims & Hers Health aims for three dimensional revenue expansion

West Africa's 20 Baggers Gold Play (Nigeria/Senegal)

Tesla’s Nvidia Moment – The AI & Robotics Inflection Point

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Early mover in a fast growing industry. Likely to experience share price volatility as they scale