- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:OSIS

OSI Systems (OSIS): Earnings Growth Slows, Challenging Bullish Narratives on Valuation

Reviewed by Simply Wall St

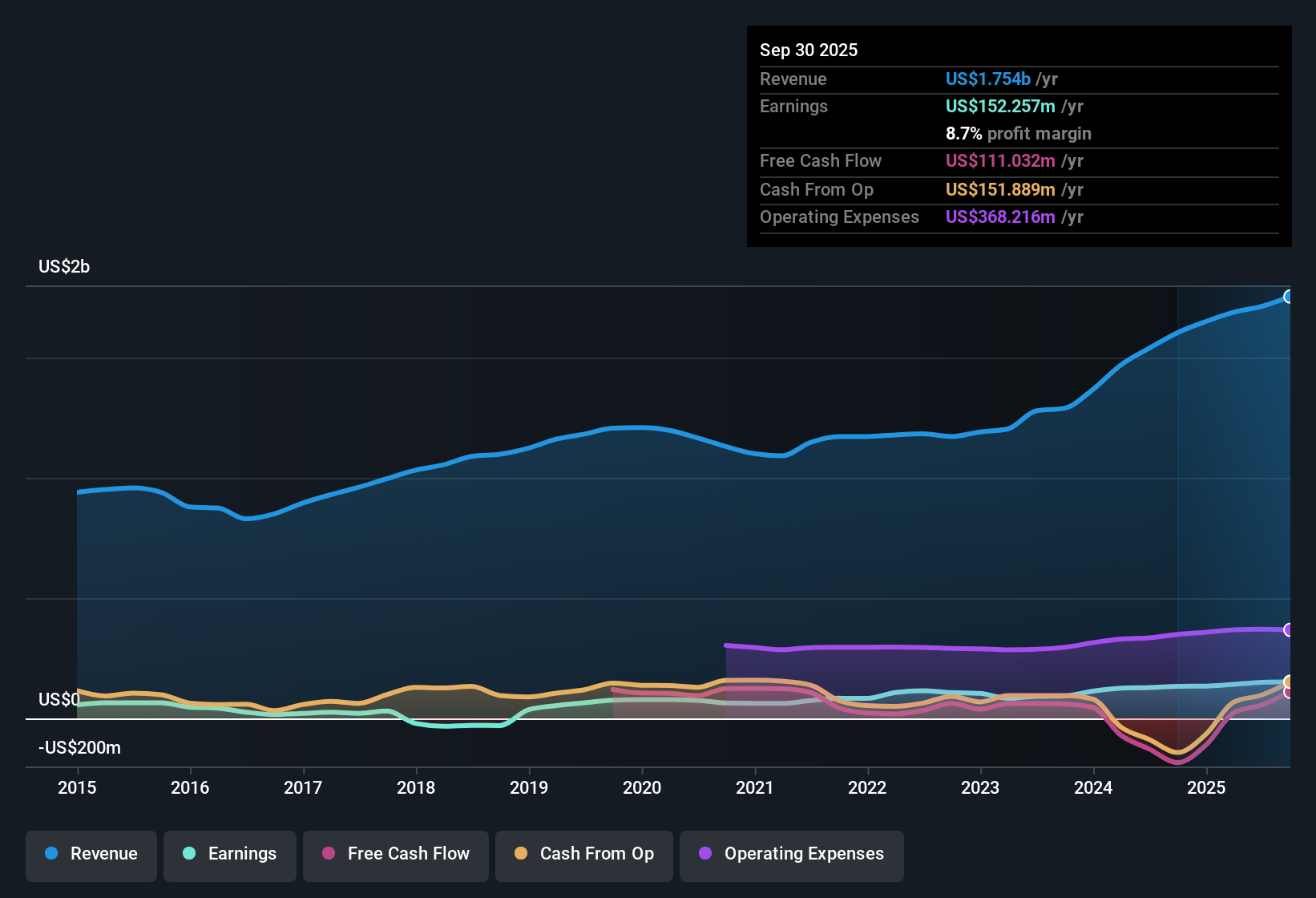

OSI Systems (OSIS) posted earnings growth of 14.3% over the most recent year, trailing its robust five-year annual average of 16.1%. Net profit margins edged up to 8.7% from 8.3% a year ago, while analysts expect annualized earnings growth to moderate to 11.34% and revenue to increase by 5.4% a year, lagging the broader US market's 10.3% forecast. The company’s PE ratio sits at 30.8x, below peer average but ahead of the sector, and shares are trading at $278.46, a premium to estimated fair value. Recent results reflect ongoing quality but slowing growth momentum.

See our full analysis for OSI Systems.Now, let's see how these headline results stack up against the most widely discussed narratives in the market. Some will be confirmed, while others might be up for debate.

See what the community is saying about OSI Systems

Service Contracts Now Outpace Product Sales

- Service-based revenue is growing faster than product sales, with analysts and filings pointing to service contracts and platforms like CertScan as key drivers behind more predictable, higher-margin income.

- Analysts' consensus view highlights that this shift supports future operating margin expansion and earnings resilience below the surface, with

- Record service contract growth and adoption fueling stability as legacy one-off product orders become less central.

- Greater customer diversification and the move toward recurring revenue streams creating a firmer base for long-term growth.

- Consensus narrative notes that recurring service revenues and expanding contracts are helping to counterbalance risks from government contract execution and healthcare underperformance, indicating a more robust earnings outlook than headline growth alone suggests.

- Curious how analysts see recurring revenues reshaping OSI's growth? Dig into the full consensus view at 📊 Read the full OSI Systems Consensus Narrative.

Backlog and Customer Diversification Drive Pipeline

- Record backlog levels now underpin OSI's revenue pipeline, signaling solid future demand that extends beyond legacy contracts, particularly as the company expands into new geographies and customer segments.

- Analysts' consensus view sees this as a key support for OSI's strategy, noting:

- The global push for infrastructure and event security, driven by U.S. government funding and international trends, is expected to sustain backlog replenishment and revenue visibility.

- Broadening the customer base, especially beyond large contracts like Mexico, helps buffer against individual account volatility and reduces concentration risk.

Premium Valuation Versus Industry and Fair Value

- OSI shares trade at a P/E ratio of 30.8x compared to the U.S. Electronic industry’s 25x, and at a significant premium to the DCF fair value of $193.94, with the current price of $278.46 well above analyst consensus target of 273.67.

- According to the consensus narrative, investors are weighing higher quality earnings, improved margins, and future growth against slower projected revenue expansion and a valuation above both industry average and fair value, with:

- Analyst estimates reflecting confidence in continued top-line progress and earnings momentum, but highlighting that much of this positivity may already be priced in.

- The gap between current price, fair value, and price target suggests that upside could be more limited from here unless new catalysts emerge.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for OSI Systems on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got your own take on the numbers? Share your perspective and shape your unique narrative in just a few minutes. Do it your way

A great starting point for your OSI Systems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Although OSI Systems continues to deliver quality earnings, its slower projected revenue growth and premium valuation could limit near-term upside for investors seeking better value.

If you’re looking for companies trading below fair value with more upside potential, use our these 833 undervalued stocks based on cash flows to spot promising opportunities today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OSIS

OSI Systems

Designs and manufactures electronic systems and components in the United States and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion