- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:OSIS

OSI Systems (OSIS): Assessing Valuation After $37 Million Security Systems Order Signals Demand

Reviewed by Kshitija Bhandaru

OSI Systems (OSIS) reported that its Security division secured a $37 million order for cutting-edge radio frequency communication and surveillance systems. Investors often view these sizable contracts as positive signals for future sales momentum and revenue visibility.

See our latest analysis for OSI Systems.

Following this major contract win, OSI Systems' stock has been on a roll, with the share price climbing over 55% year-to-date and delivering a standout 1-year total shareholder return of 72%. Recent momentum suggests that investors are increasingly confident about the company's growth prospects and ability to secure significant deals.

If these moves in security tech have you curious, this could be the perfect moment to discover even more fast-growing stocks with high insider ownership. fast growing stocks with high insider ownership

Still, with the stock's rapid ascent, some may wonder whether the best gains are behind it or if recent success is just the beginning for OSI Systems. Is this a buying opportunity, or has the market already priced in the company's future growth?

Most Popular Narrative: 2.9% Overvalued

With OSI Systems last closing at $256.66 while the most widely tracked fair value estimate is $249.50, the market is trading at a premium to where consensus expects it. To understand what underpins this view, consider the structural shifts and demand drivers highlighted in the most popular narrative.

Significant, multi-year funding from recent U.S. government legislation for border, port, infrastructure, and large-scale event security (including the "Big Beautiful Bill" and Golden Dome program) is expected to drive a sustained increase in demand for advanced security screening systems and RF/radar technologies. This development positions OSI for higher long-term revenue growth and expansion of its addressable market.

Curious about what it really takes to justify today's stock price? Analysts are building their targets on bold growth forecasts and ambitious margin expansion. Want to see which financial leap powers that price? Find the full story in the narrative.

Result: Fair Value of $249.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as heavy reliance on government contracts and ongoing challenges in the healthcare division could threaten OSI Systems' projected earnings growth.

Find out about the key risks to this OSI Systems narrative.

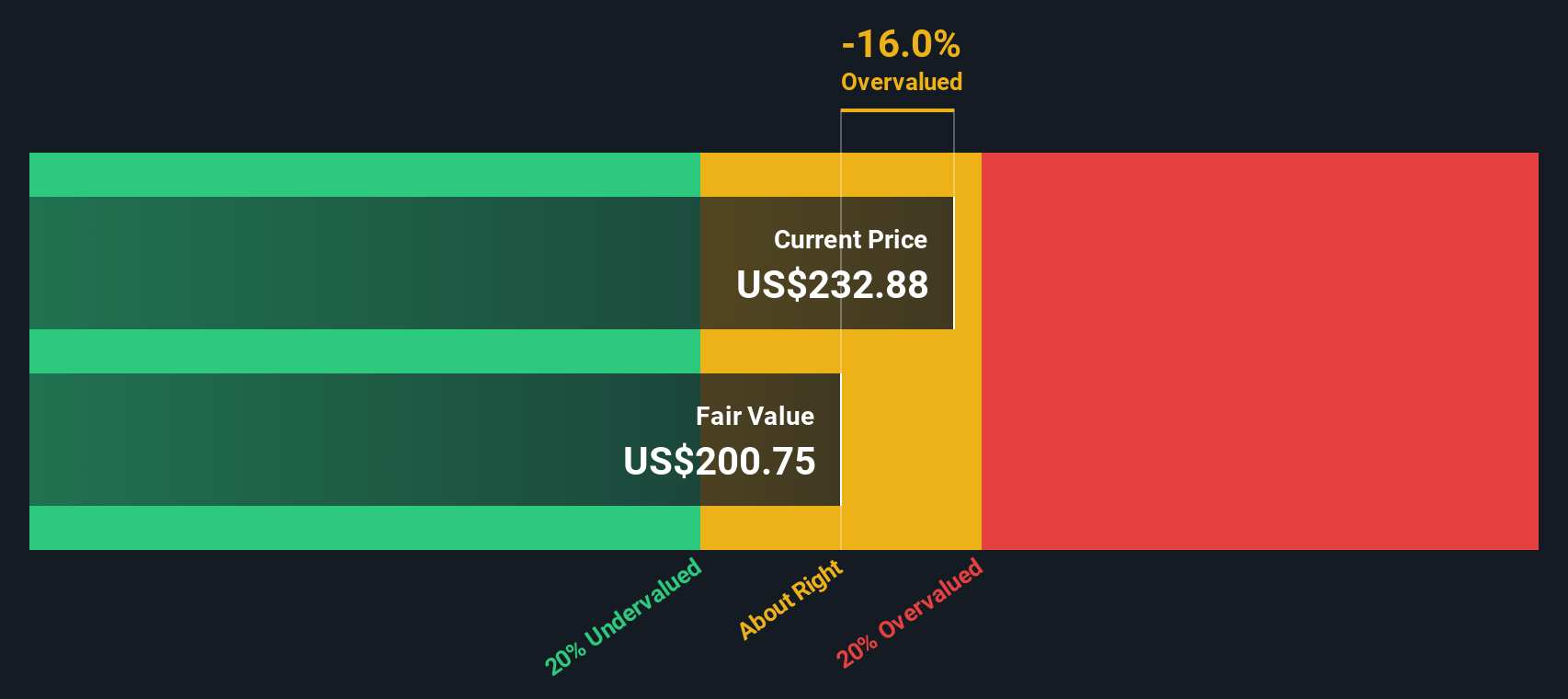

Another View: Our DCF Model Tells a Different Story

While analysts using multiples believe OSI Systems is trading at a premium, our SWS DCF model arrives at a much lower fair value of $196.05. This result suggests the company is significantly overvalued at its current price. Could this wide gap indicate greater downside risk than the market expects?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own OSI Systems Narrative

If the expert consensus doesn't quite fit your perspective or you want to dive deeper on your own, you're free to craft a personalized story about OSI Systems in just a few minutes. Do it your way

A great starting point for your OSI Systems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't stop at one stock when tomorrow's winners could be hiding in plain sight. Broaden your portfolio with proven strategies and get ahead of the herd.

- Boost your income potential by tapping into these 18 dividend stocks with yields > 3%, which offers strong yields above 3% and resilient performance across market cycles.

- Level up your growth strategy by targeting innovators with these 24 AI penny stocks, leading breakthroughs in artificial intelligence and transforming entire industries.

- Seize value opportunities with these 870 undervalued stocks based on cash flows, trading below their true worth based on robust cash flow analysis and future upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OSIS

OSI Systems

Designs and manufactures electronic systems and components in the United States and internationally.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives