- United States

- /

- Communications

- /

- NasdaqCM:ONDS

Some Shareholders May Object To A Pay Rise For Ondas Holdings Inc.'s (NASDAQ:ONDS) CEO This Year

Key Insights

- Ondas Holdings will host its Annual General Meeting on 18th of November

- Total pay for CEO Eric Brock includes US$200.0k salary

- The total compensation is 61% less than the average for the industry

- Ondas Holdings' EPS declined by 21% over the past three years while total shareholder loss over the past three years was 93%

The underwhelming performance at Ondas Holdings Inc. (NASDAQ:ONDS) recently has probably not pleased shareholders. At the upcoming AGM on 18th of November, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. From our analysis below, we think CEO compensation looks appropriate for now.

View our latest analysis for Ondas Holdings

Comparing Ondas Holdings Inc.'s CEO Compensation With The Industry

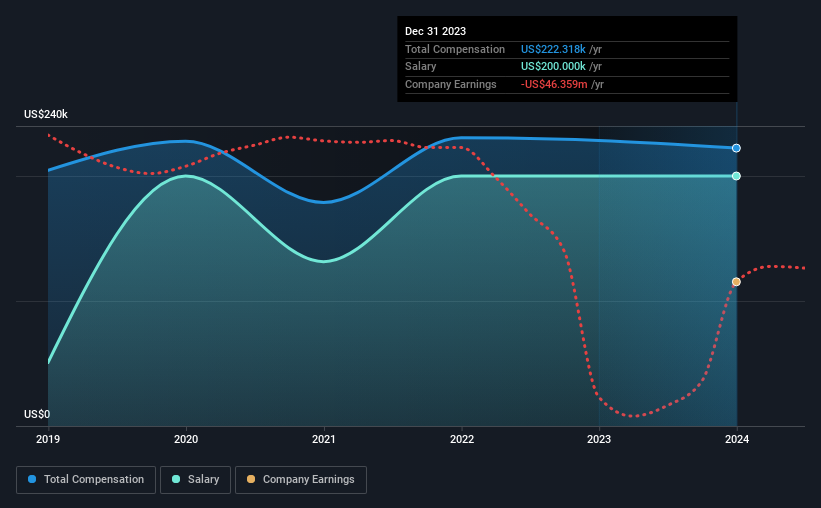

According to our data, Ondas Holdings Inc. has a market capitalization of US$57m, and paid its CEO total annual compensation worth US$222k over the year to December 2023. That's mostly flat as compared to the prior year's compensation. In particular, the salary of US$200.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the American Communications industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$563k. That is to say, Eric Brock is paid under the industry median. What's more, Eric Brock holds US$1.6m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$200k | US$200k | 90% |

| Other | US$22k | US$28k | 10% |

| Total Compensation | US$222k | US$228k | 100% |

Speaking on an industry level, nearly 20% of total compensation represents salary, while the remainder of 80% is other remuneration. According to our research, Ondas Holdings has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Ondas Holdings Inc.'s Growth

Ondas Holdings Inc. has reduced its earnings per share by 21% a year over the last three years. In the last year, its revenue changed by just 0.4%.

Overall this is not a very positive result for shareholders. And the flat revenue is seriously uninspiring. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Ondas Holdings Inc. Been A Good Investment?

With a total shareholder return of -93% over three years, Ondas Holdings Inc. shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 4 warning signs for Ondas Holdings that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ONDS

Ondas Holdings

Provides private wireless, drone, and automated data solutions in the United States and internationally.

Moderate with limited growth.

Market Insights

Community Narratives