- United States

- /

- Communications

- /

- NasdaqCM:ONDS

Ondas Holdings Inc. (NASDAQ:ONDS) Stocks Shoot Up 117% But Its P/S Still Looks Reasonable

Ondas Holdings Inc. (NASDAQ:ONDS) shares have had a really impressive month, gaining 117% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 35% in the last twelve months.

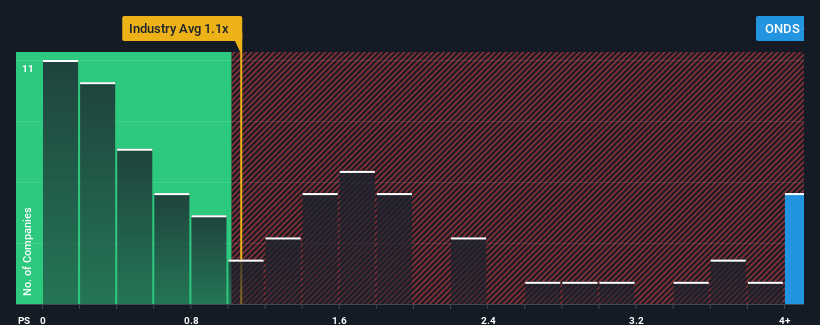

After such a large jump in price, given around half the companies in the United States' Communications industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Ondas Holdings as a stock to avoid entirely with its 6.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Ondas Holdings

What Does Ondas Holdings' Recent Performance Look Like?

Ondas Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Ondas Holdings will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Ondas Holdings?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Ondas Holdings' to be considered reasonable.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 176% as estimated by the three analysts watching the company. With the industry only predicted to deliver 0.3%, the company is positioned for a stronger revenue result.

With this information, we can see why Ondas Holdings is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Ondas Holdings' P/S?

Shares in Ondas Holdings have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Ondas Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you take the next step, you should know about the 5 warning signs for Ondas Holdings (1 is significant!) that we have uncovered.

If these risks are making you reconsider your opinion on Ondas Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ONDS

Ondas Holdings

Provides private wireless, drone, and automated data solutions in the United States and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives