- United States

- /

- Communications

- /

- NasdaqCM:ONDS

A Look at Ondas Holdings’s Valuation Following Major Fundraise and Push Into Defense Autonomy

Reviewed by Kshitija Bhandaru

Ondas Holdings has just wrapped up a major public offering, securing over $400 million to fuel its next phase of growth. In addition, the company’s launch of Ondas Capital points to fresh ambitions in unmanned and autonomous tech for defense markets.

See our latest analysis for Ondas Holdings.

Ondas Holdings’ recent funding haul and strategic launches have electrified investor sentiment, with the 30-day share price return jumping 88.7% and an astounding 1-year total shareholder return of 1,065%. This is momentum few in the sector can match right now.

If major moves in autonomy and defense have your attention, now is the perfect moment to see what’s next in aerospace and security. Explore See the full list for free..

With shares soaring in response to recent milestones, investors are left to wonder if Ondas Holdings’ stock still has headroom or if the market has already priced in every bit of future growth and opportunity.

Most Popular Narrative: 28% Overvalued

Ondas Holdings’ widely followed narrative places fair value well below the stock’s last close, creating a significant gap and fueling debate about lofty expectations. This valuation relies on the business’s prospects in new growth areas, prompting closer scrutiny of what is driving the premium.

The expansion of OAS’s market presence, with increased customer engagement and government contracts in defense sectors in Israel and the UAE, is set to secure additional military customers. This suggests potential revenue growth and improved market diversification.

What is driving that sharp premium? The most popular narrative projects an aggressive turnaround, relying on substantial growth rates and optimistic margin assumptions. Interested in which blue-sky forecasts are factored into this number? The details inside might surprise you.

Result: Fair Value of $8.17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as volatile margins and execution delays could quickly undermine the optimistic narrative if growth does not materialize as projected.

Find out about the key risks to this Ondas Holdings narrative.

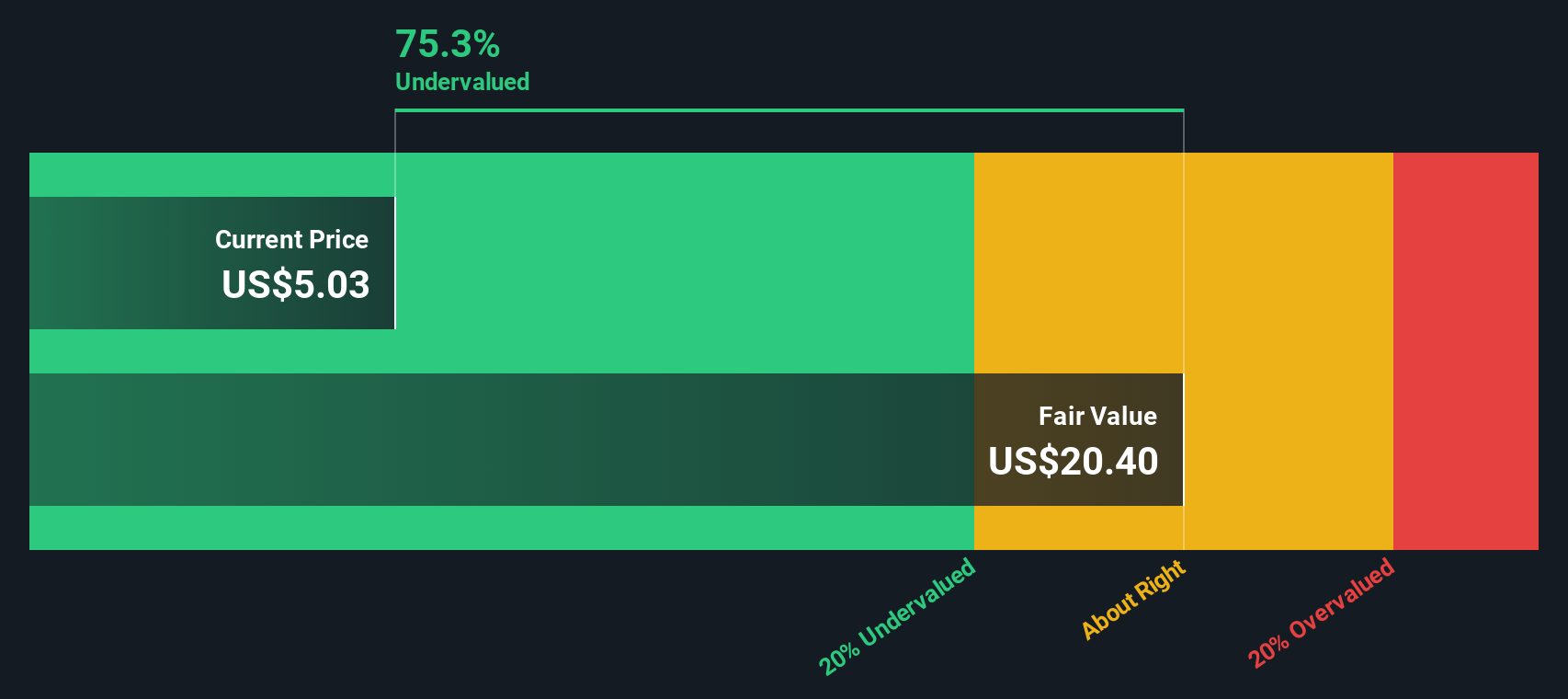

Another View: Our DCF Model Sees Undervaluation

Looking through the lens of our SWS DCF model, the narrative shifts. While the most popular narrative suggests the shares are overvalued, our DCF model finds Ondas Holdings trading about 20.7% below its fair value estimate. This difference highlights how sensitive valuations can be to underlying assumptions. Which outlook will ultimately prove right in such a fast-moving sector?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ondas Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ondas Holdings Narrative

If you have a different perspective or want to take a hands-on approach, you can dig into the data and craft your own story in just a few minutes with Do it your way.

A great starting point for your Ondas Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart moves start by seeing what the market is missing. Use the Simply Wall Street Screener to tap into unique opportunities driving tomorrow’s returns before everyone else.

- Uncover stocks positioned for big gains by checking out these 3576 penny stocks with strong financials with robust financial health and growth potential many overlook.

- Supercharge your portfolio with these 891 undervalued stocks based on cash flows that market algorithms believe are trading below their true worth right now.

- Position yourself ahead of tech's next wave and seize opportunities with these 25 AI penny stocks as artificial intelligence disrupts entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ONDS

Ondas Holdings

Provides private wireless, drone, and automated data solutions in the United States and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives