- United States

- /

- Capital Markets

- /

- NYSE:VRTS

Uncovering NetScout Systems And 2 Other US Small Cap Gems With Solid Foundations

Reviewed by Simply Wall St

As the U.S. market navigates a landscape marked by mixed performances in major indices and anticipation of interest rate cuts from the Federal Reserve, small-cap stocks present intriguing opportunities for investors looking beyond the headline-grabbing tech giants. In this environment, identifying stocks with solid foundations—such as strong financial health, innovative products, or robust growth potential—can be key to uncovering hidden gems like NetScout Systems and other promising small-cap companies.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 75.89% | 1.93% | -1.42% | ★★★★★★ |

| Morris State Bancshares | NA | 3.34% | 3.70% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

NetScout Systems (NTCT)

Simply Wall St Value Rating: ★★★★★★

Overview: NetScout Systems, Inc. offers service assurance and cybersecurity solutions to safeguard digital business services globally, with a market cap of approximately $1.80 billion.

Operations: NetScout Systems generates revenue primarily from its Computer Networks segment, amounting to $834.86 million. The company's market capitalization stands at approximately $1.80 billion.

NetScout Systems, a US-based company, has shown resilience with its AI-driven cybersecurity solutions and solid performance in both enterprise and federal segments. Despite challenges from cloud migration risks, NetScout remains debt-free and reported a net loss of US$3.68 million for Q1 2025 compared to US$443.38 million the previous year, reflecting significant improvement. The company's recent share repurchase of 761,249 shares for US$15.02 million highlights its commitment to enhancing shareholder value. With projected annual revenue growth of 2.8% over three years and a focus on innovation, NetScout is strategically positioned in the evolving cybersecurity landscape amidst rising demand for sophisticated network monitoring solutions.

Genie Energy (GNE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Genie Energy Ltd., with a market cap of $403.84 million, operates through its subsidiaries to provide energy services both in the United States and internationally.

Operations: Genie Energy generates revenue primarily from its Genie Retail Energy segment, which accounts for $435.62 million, while its Genie Renewables segment contributes $21.25 million.

Genie Energy, a small player in the energy sector, has shown impressive earnings growth of 37% over the past year, surpassing industry averages. Despite its debt to equity ratio increasing from 1.7% to 4.8% over five years, the company remains financially sound with more cash than total debt and positive free cash flow at US$54.68 million as of September 2024. Recent buybacks saw Genie repurchase shares worth US$2.73 million between April and June 2025, boosting investor confidence despite net income dropping to US$2.82 million for Q2 compared to last year's figure of US$9.61 million.

Virtus Investment Partners (VRTS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Virtus Investment Partners, Inc. is a publicly owned investment manager with a market capitalization of approximately $1.34 billion.

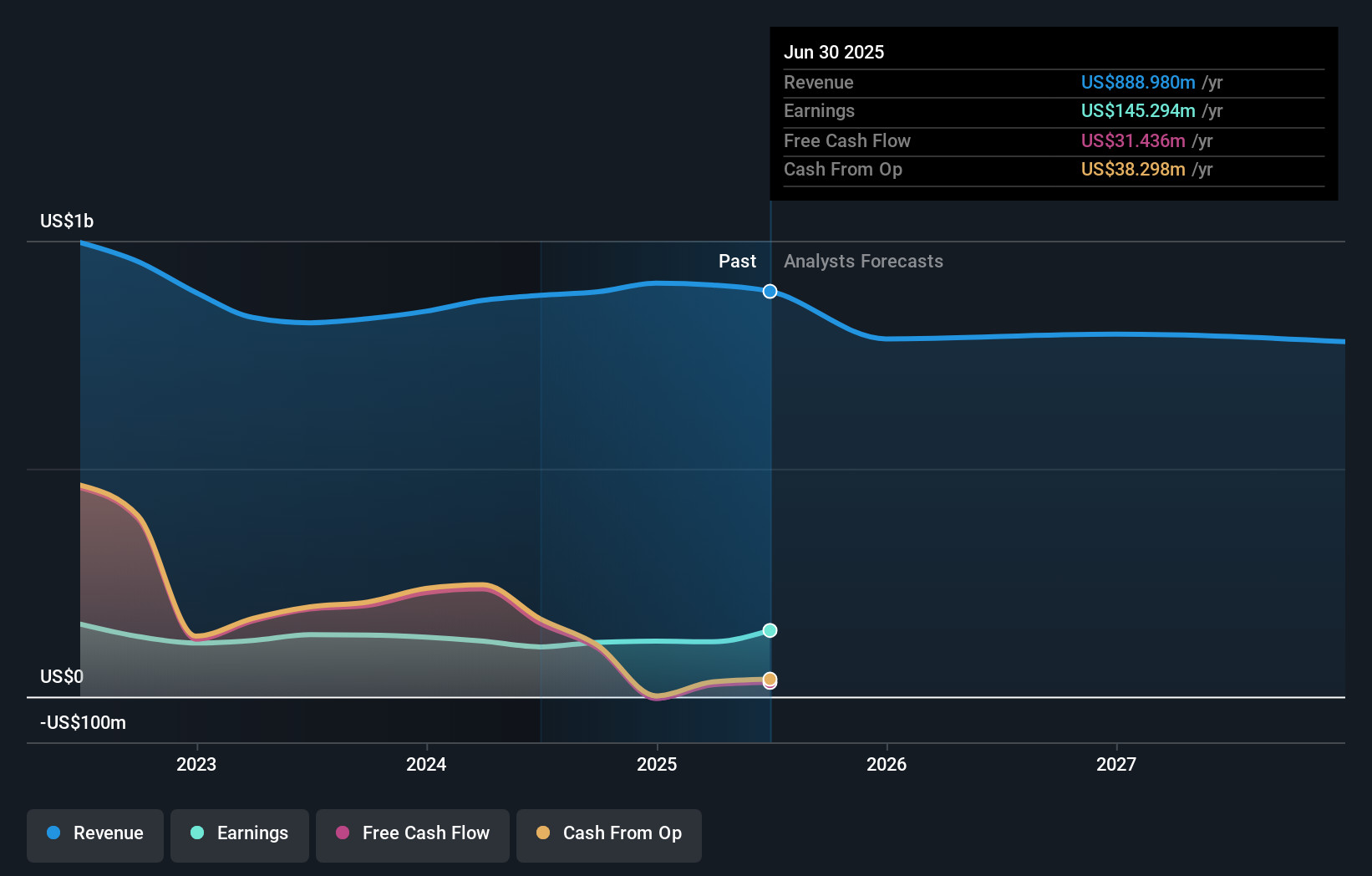

Operations: Virtus generates revenue primarily through its asset management services, with reported revenues of $888.98 million.

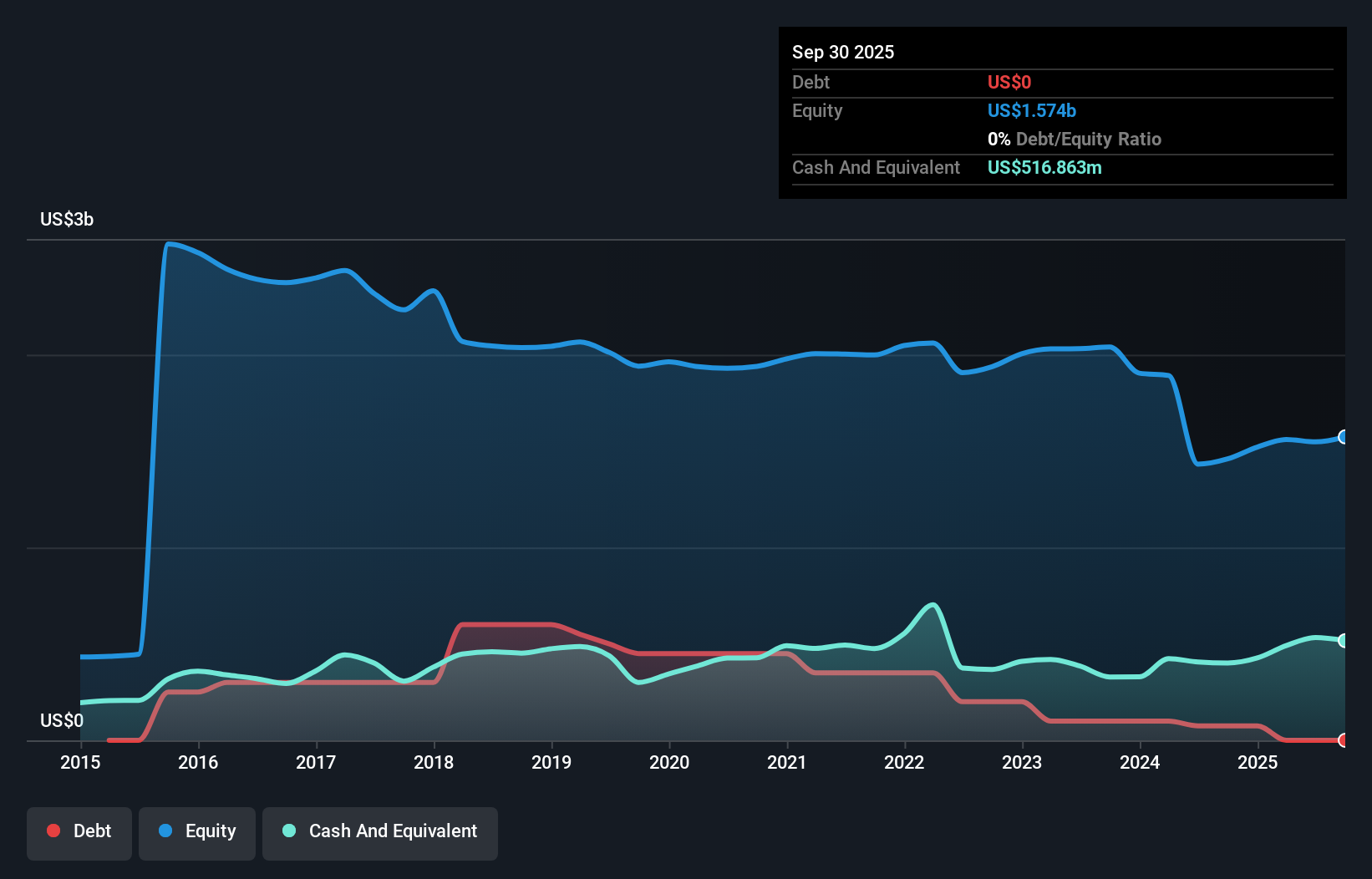

Virtus Investment Partners, a notable player in the investment management sector, has shown impressive earnings growth of 33% over the past year, outpacing its industry peers. The company's debt-to-equity ratio improved from 31% to 22.6% over five years, reflecting prudent financial management. Despite being dropped from several Russell indices recently, Virtus continues to demonstrate strong profitability with positive free cash flow and a net income increase to US$42.37 million for Q2 2025 compared to US$17.61 million last year. Additionally, it has repurchased shares worth $29.1 million in recent months and announced a dividend increase by 7%.

Seize The Opportunity

- Discover the full array of 283 US Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRTS

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion