- United States

- /

- Communications

- /

- NasdaqGS:NTCT

NetScout Systems (NTCT): Valuation Perspective Following New DDoS Threat Intelligence Report

Reviewed by Simply Wall St

If you are an investor weighing your next move on NetScout Systems (NTCT), their just-released research on DDoS attacks deserves your attention. The report maps out just how rapidly attack volume, sophistication, and global impact are climbing, especially in the wake of geopolitical tensions this year. By spotlighting how AI, botnets, and hacktivist groups are reshaping the threat landscape, NetScout aims to reinforce its credibility as a go-to source for cybersecurity intelligence. This focus could influence how the market views its future prospects.

Looking at the stock's numbers over the past year, there has been a fair amount of momentum. The shares are up 27% over the past year, and 15% just in the past month, hinting at building excitement potentially fueled by ongoing ransomware headlines and now this detailed new research. On a longer horizon, though, the stock is still recovering from a rough stretch, with a three-year return in negative territory, even as revenue has edged up slightly and net income has dipped.

After a year with clear upward momentum and a fresh reminder of NetScout’s expertise, some investors may be considering whether this is an opportunity to acquire shares at a compelling value, or whether the market already reflects expectations for rising cyber threats.

Most Popular Narrative: 3.9% Undervalued

The currently popular narrative sees NetScout Systems as modestly undervalued, with a fair value just above current trading levels based on future prospects.

Market optimism appears to be driven by strong recent growth in NetScout's cybersecurity segment. This is underpinned by customers prioritizing spending to counter increasingly complex and expanding cyber threats, which could lead investors to expect above-trend long-term revenue and earnings growth.

Curious to know what justifies NetScout’s higher price tag? This narrative leans on ambitious assumptions about growth, margins, and future earnings multiples. What is the bold forecast and what market tension makes these numbers possible? Find out how these surprising projections shape the fair value behind today's headlines.

Result: Fair Value of $25.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing cloud adoption and IT stack consolidation could disrupt NetScout’s legacy products. This may challenge the case for sustained high margins and robust growth.

Find out about the key risks to this NetScout Systems narrative.Another View: What Does SWS DCF Model Suggest?

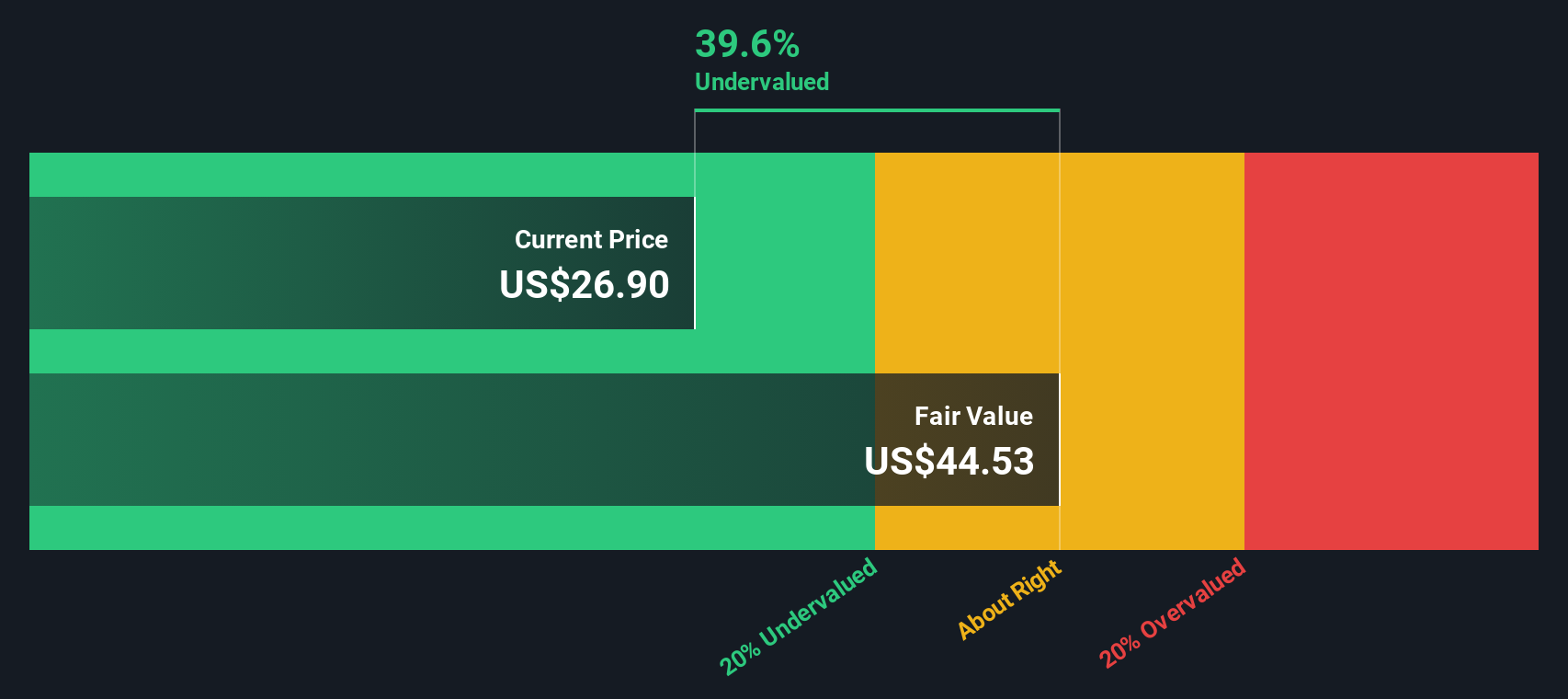

Our discounted cash flow calculation provides a different perspective on NetScout’s valuation. While the first method points to only modest upside, the SWS DCF model indicates the stock could be significantly undervalued. Which outlook best matches reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NetScout Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NetScout Systems Narrative

If you see things differently or want to start from your own analysis, keep in mind that creating your own perspective takes just minutes. Do it your way

A great starting point for your NetScout Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities abound beyond NetScout Systems, and the smartest moves come from staying ahead. Be the investor who doesn’t just follow trends, but seizes them first using these powerful stock search tools:

- Uncover prospects among fast-rising stocks with established financial strength by starting with penny stocks with strong financials.

- Spot potential value movers before the market catches on by investigating companies ranked as undervalued stocks based on cash flows.

- Tap into the next wave of innovation by targeting firms making breakthroughs in artificial intelligence, guided by AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NetScout Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:NTCT

NetScout Systems

Provides service assurance and cybersecurity solutions to protect digital business services against disruptions in the United States, Europe, Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)