- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:SNT

Shareholders May Not Be So Generous With Magal Security Systems Ltd.'s (NASDAQ:MAGS) CEO Compensation And Here's Why

Performance at Magal Security Systems Ltd. (NASDAQ:MAGS) has been reasonably good and CEO Dror Sharon has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 15 August 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for Magal Security Systems

Comparing Magal Security Systems Ltd.'s CEO Compensation With the industry

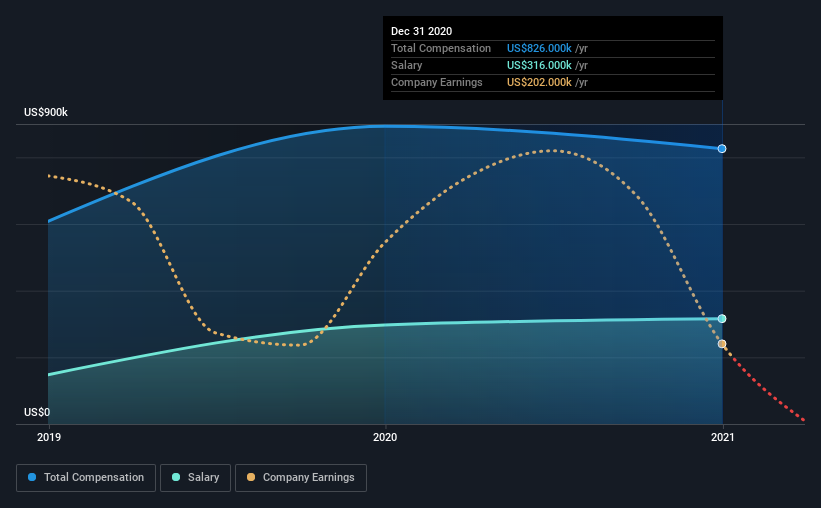

Our data indicates that Magal Security Systems Ltd. has a market capitalization of US$104m, and total annual CEO compensation was reported as US$826k for the year to December 2020. That's a slight decrease of 7.5% on the prior year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$316k.

For comparison, other companies in the industry with market capitalizations below US$200m, reported a median total CEO compensation of US$436k. Hence, we can conclude that Dror Sharon is remunerated higher than the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$316k | US$297k | 38% |

| Other | US$510k | US$596k | 62% |

| Total Compensation | US$826k | US$893k | 100% |

On an industry level, around 29% of total compensation represents salary and 71% is other remuneration. It's interesting to note that Magal Security Systems pays out a greater portion of remuneration through salary, compared to the industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Magal Security Systems Ltd.'s Growth Numbers

Magal Security Systems Ltd. has seen its earnings per share (EPS) increase by 7.7% a year over the past three years. In the last year, its revenue is down 3.3%.

We would argue that the lack of revenue growth in the last year is less than ideal, but the modest improvement in EPS is good. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Magal Security Systems Ltd. Been A Good Investment?

Magal Security Systems Ltd. has generated a total shareholder return of 4.8% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Magal Security Systems.

Important note: Magal Security Systems is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Magal Security Systems or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:SNT

Senstar Technologies

Provides physical, video, and access control security products and solutions worldwide.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)