- United States

- /

- Specialty Stores

- /

- NYSE:CATO

August 2025's Top Penny Stocks To Watch

Reviewed by Simply Wall St

The U.S. market has recently experienced a surge, with major indices like the Dow Jones reaching record highs following Federal Reserve Chair Jerome Powell's indication of potential interest rate cuts. In this context, the allure of penny stocks remains significant, offering investors access to smaller or newer companies that might not be on everyone's radar but could present unique opportunities for growth. Despite their historical connotations, penny stocks can still hold value when they are backed by strong financials and a clear path forward; we'll explore three such examples that stand out in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.77 | $643.76M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.14 | $246.78M | ✅ 4 ⚠️ 2 View Analysis > |

| WM Technology (MAPS) | $1.03 | $180.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.94 | $25.49M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $88.83M | ✅ 3 ⚠️ 2 View Analysis > |

| Table Trac (TBTC) | $4.59 | $22.18M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.95 | $6.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.81 | $85.42M | ✅ 3 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.68 | $154.7M | ✅ 3 ⚠️ 1 View Analysis > |

| TETRA Technologies (TTI) | $4.25 | $547.78M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 389 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Lantronix (LTRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lantronix, Inc. develops, markets, and sells industrial and enterprise IoT products and services across various global regions with a market cap of $125.62 million.

Operations: Lantronix generates $143.16 million in revenue from its Computer Networks segment.

Market Cap: $125.62M

Lantronix, Inc., with a market cap of US$125.62 million, is navigating the penny stock landscape by leveraging its strengths in IoT and industrial connectivity solutions. Recent developments include securing a US$15 million revolving credit facility to bolster working capital and corporate purposes, reflecting financial prudence amidst unprofitability. The company's strategic moves such as the launch of the NTC-500 Series 5G router and collaboration with Teal Drones for defense applications highlight its focus on innovation and market expansion. While Lantronix remains unprofitable, it has reduced losses over five years and maintains sufficient cash runway due to positive free cash flow growth.

- Click here to discover the nuances of Lantronix with our detailed analytical financial health report.

- Examine Lantronix's earnings growth report to understand how analysts expect it to perform.

Coherus Oncology (CHRS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Coherus Oncology, Inc. is a biopharmaceutical company focused on researching, developing, and commercializing cancer immunotherapies in the United States with a market cap of $124.36 million.

Operations: The company generates revenue of $272.21 million from its segment focused on developing and commercializing biosimilar products.

Market Cap: $124.36M

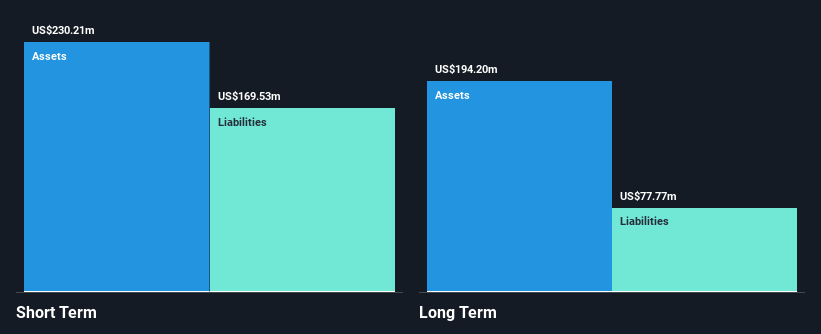

Coherus Oncology, Inc., with a market cap of US$124.36 million, is navigating challenges in the penny stock arena while maintaining a focus on cancer immunotherapies. Despite receiving a Nasdaq deficiency notice for its stock price, the company has demonstrated robust financial management with short-term assets exceeding liabilities and becoming profitable recently. However, significant insider selling raises concerns about internal confidence. The company's recent earnings report showed substantial net income improvement due to large one-off gains, but future earnings are forecasted to decline significantly. Coherus's strategic collaboration in clinical trials underscores its commitment to innovation and growth potential.

- Click to explore a detailed breakdown of our findings in Coherus Oncology's financial health report.

- Assess Coherus Oncology's future earnings estimates with our detailed growth reports.

Cato (CATO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Cato Corporation, along with its subsidiaries, operates as a specialty retailer of fashion apparel and accessories primarily in the southeastern United States, with a market cap of $53.44 million.

Operations: No specific revenue segments are reported for this specialty retailer focused on fashion apparel and accessories.

Market Cap: $53.44M

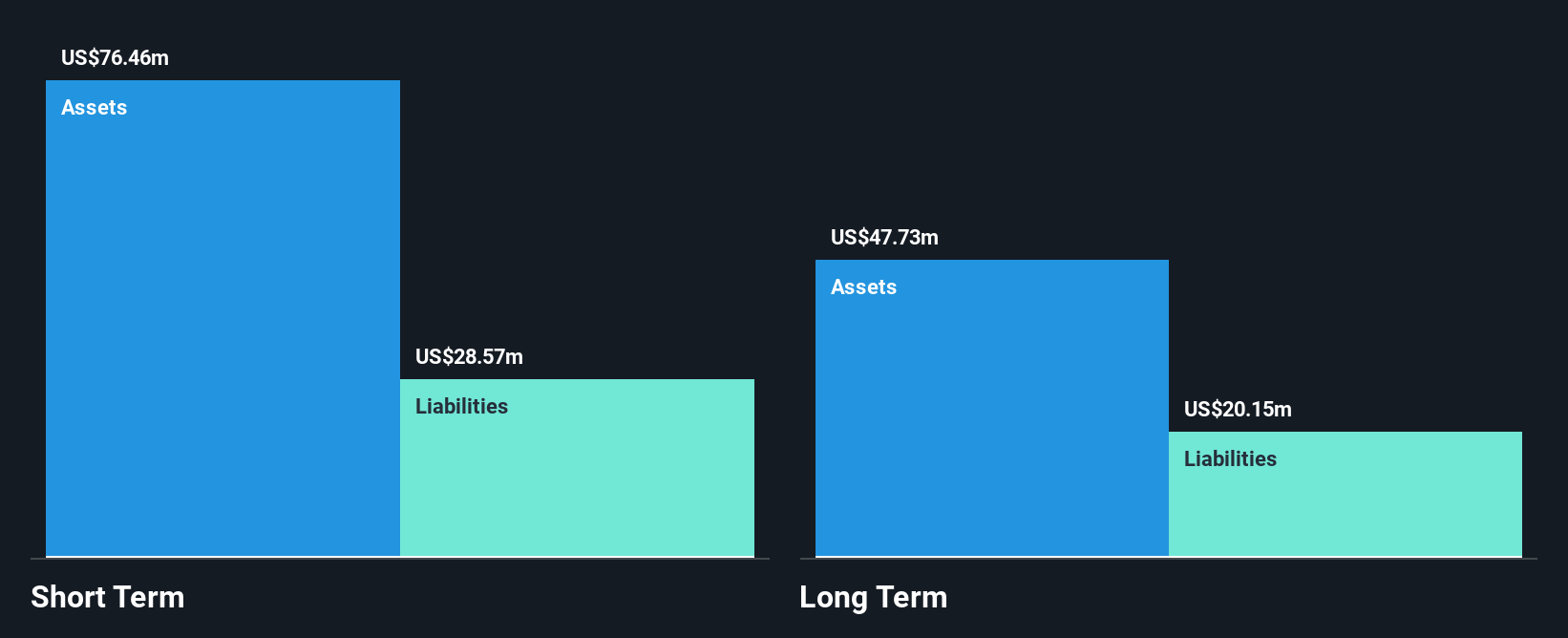

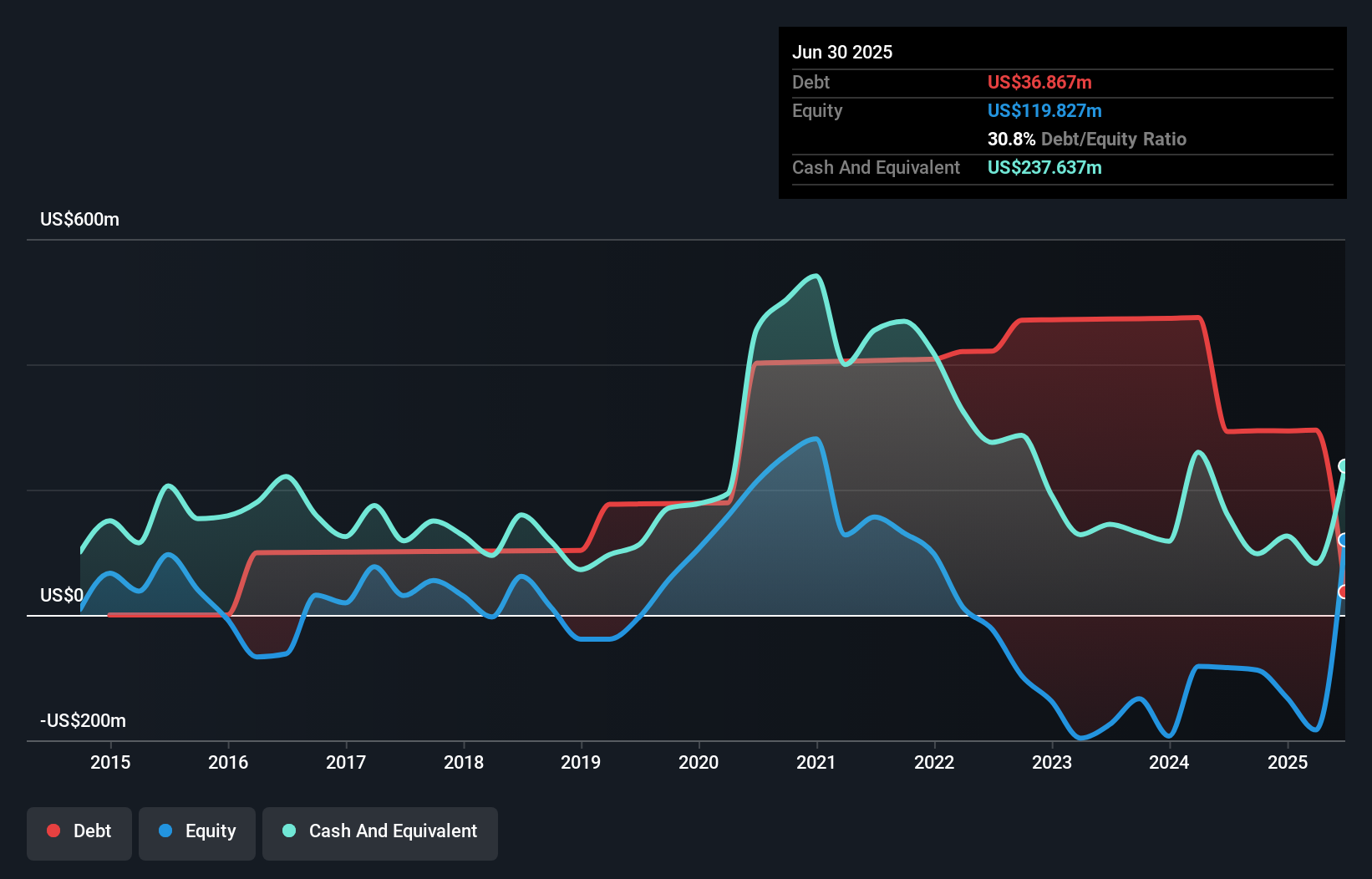

Cato Corporation, with a market cap of US$53.44 million, has shown mixed performance in the penny stock landscape. Recent earnings reports indicate an increase in quarterly revenue to US$176.51 million and net income to US$6.83 million compared to the previous year, yet the company remains unprofitable overall with a negative return on equity of -15.6%. Despite its financial challenges, Cato's short-term assets exceed both its short and long-term liabilities, indicating solid liquidity management without debt concerns. However, high share price volatility persists alongside declining earnings over recent years, which may impact investor sentiment.

- Navigate through the intricacies of Cato with our comprehensive balance sheet health report here.

- Explore historical data to track Cato's performance over time in our past results report.

Seize The Opportunity

- Jump into our full catalog of 389 US Penny Stocks here.

- Curious About Other Options? The end of cancer? These 27 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CATO

Cato

Operates as a specialty retailer of fashion apparel and accessories primarily in the southeastern United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives