- United States

- /

- Communications

- /

- NasdaqGS:LITE

A Look at Lumentum Holdings (LITE) Valuation Following $1.1 Billion Convertible Notes Offering and Growth Outlook

Reviewed by Simply Wall St

Lumentum Holdings (LITE) just wrapped up a $1.1 billion convertible senior notes deal, and that is turning heads among investors. Whenever a company taps the fixed income market in this way, it raises questions about how its capital structure is shifting and what management may do with the added financial flexibility. At the same time, the move comes as Lumentum leans into the ramp-up of next-generation modules and watches demand swell from big hyperscaler clients. Both of these factors could feed its growth story over the coming year.

This is not happening in isolation. Shares have been on an upswing this year, with the past three months showing strong momentum and the total return over twelve months just shy of 2%. That pace easily outstrips the company’s longer-term gains over three or five years, suggesting that market enthusiasm has accelerated lately. Combined with a healthy bump in both annual revenue and net income, these recent moves look like more than just a short-term bump.

Given all this recent action, the big question is clear: Are investors looking at a compelling opportunity, or is the market already pricing in Lumentum’s projected growth?

Most Popular Narrative: 6.8% Overvalued

The prevailing narrative sees Lumentum Holdings as currently overvalued by nearly 7% compared to its fair value estimate. This perspective is based on aggressive projections for growth, profitability, and market positioning in the years ahead.

"Rapid acceleration of demand for advanced optical components due to global AI, cloud computing, and hyperscale data center growth is positioning Lumentum for sustained top-line expansion. This is evidenced by 67% year-over-year growth in Cloud & Networking and marked increases in EML and laser shipments, directly supporting revenue growth and operating leverage."

Wondering what lies beneath this lofty valuation? The narrative describes an ambitious growth roadmap with bold leaps in revenue and earnings, betting on technology leadership and customer adoption. Find out which financial leaps make analysts confident about Lumentum's premium and discover what numbers really fuel the company’s high price expectations.

Result: Fair Value of $139.84 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on a few large cloud customers and ongoing production constraints could challenge Lumentum's ambitious growth projections in the months ahead.

Find out about the key risks to this Lumentum Holdings narrative.Another View: SWS DCF Model Suggests Undervaluation

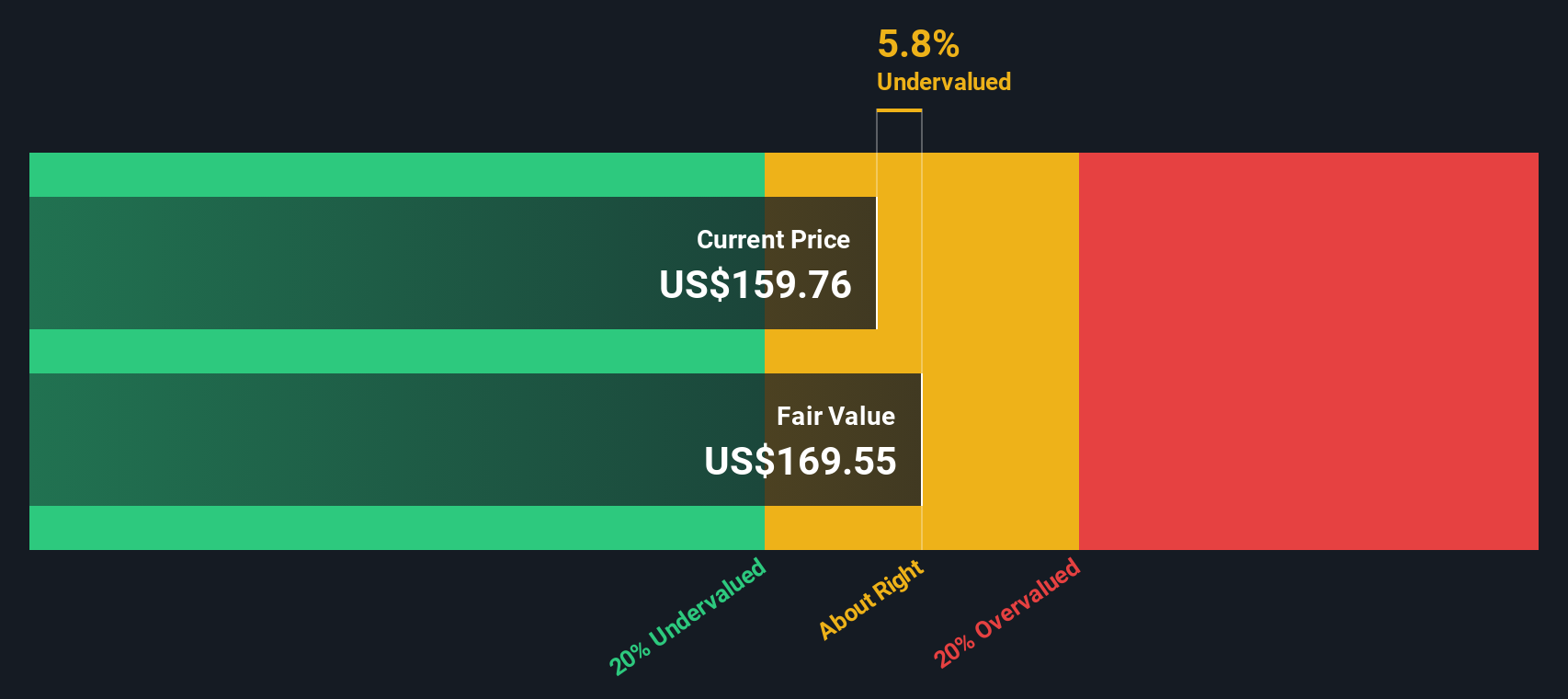

While the market-based approach points to Lumentum trading above fair value, the SWS discounted cash flow model takes a different stance and sees the shares as undervalued. Which outlook will ultimately prove right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Lumentum Holdings Narrative

If you want to take a different angle or dig into the details yourself, you can build your perspective in just a few minutes. Do it your way

A great starting point for your Lumentum Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye out for fresh opportunities. Take the next step by jumping on trends and sectors that could reshape your portfolio before everyone else catches on.

- Tap into the minds behind artificial intelligence as you browse breakthrough tech innovators through our AI penny stocks.

- Uncover businesses offering sustainable cash flow advantages with our shortcut to undervalued stocks based on cash flows.

- Capture the potential of tomorrow’s quantum pioneers by searching leading-edge advancements via quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>