- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:LFUS

What Littelfuse (LFUS)'s Strong Q2 Beat and Bullish Outlook Means For Shareholders

Reviewed by Sasha Jovanovic

- Littelfuse recently reported a strong second quarter with revenues up 9.8% year on year, surpassing analysts' expectations and projecting earnings per share above consensus for the next quarter.

- This outperformance highlights sustained demand for electronic components in high-growth areas like data centers and telecommunications, supporting sector-wide resilience despite ongoing economic uncertainties.

- We'll explore how Littelfuse's above-expectation revenue growth and optimistic earnings guidance could influence its investment narrative going forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Littelfuse Investment Narrative Recap

To be a Littelfuse shareholder, you have to believe in rising global demand for electronic components driven by expansion in data centers, telecommunications, and electrification trends, which counterbalance the company’s exposure to cyclical sectors like automotive and industrials. Littelfuse’s Q2 outperformance and strong guidance support the company’s near-term growth catalyst of operational strength, but ongoing execution challenges in the power semiconductor segment remain the most important risk for the business. The recent performance does not eliminate this risk, but demonstrates encouraging progress.

A recent announcement most relevant to the current growth catalyst is Littelfuse’s latest quarterly sales and guidance update, as management confirmed Q2 2025 net sales of US$613.41 million and forecasted Q3 sales between US$610 million and US$630 million, both exceeding prior expectations, which offers near-term confidence in revenue outlook despite sector volatility.

However, investors should be aware that even with positive momentum, the ongoing softness in power semiconductor volumes is a key area to watch for...

Read the full narrative on Littelfuse (it's free!)

Littelfuse's narrative projects $2.9 billion revenue and $400.8 million earnings by 2028. This requires 8.6% yearly revenue growth and a $293.6 million earnings increase from $107.2 million earnings today.

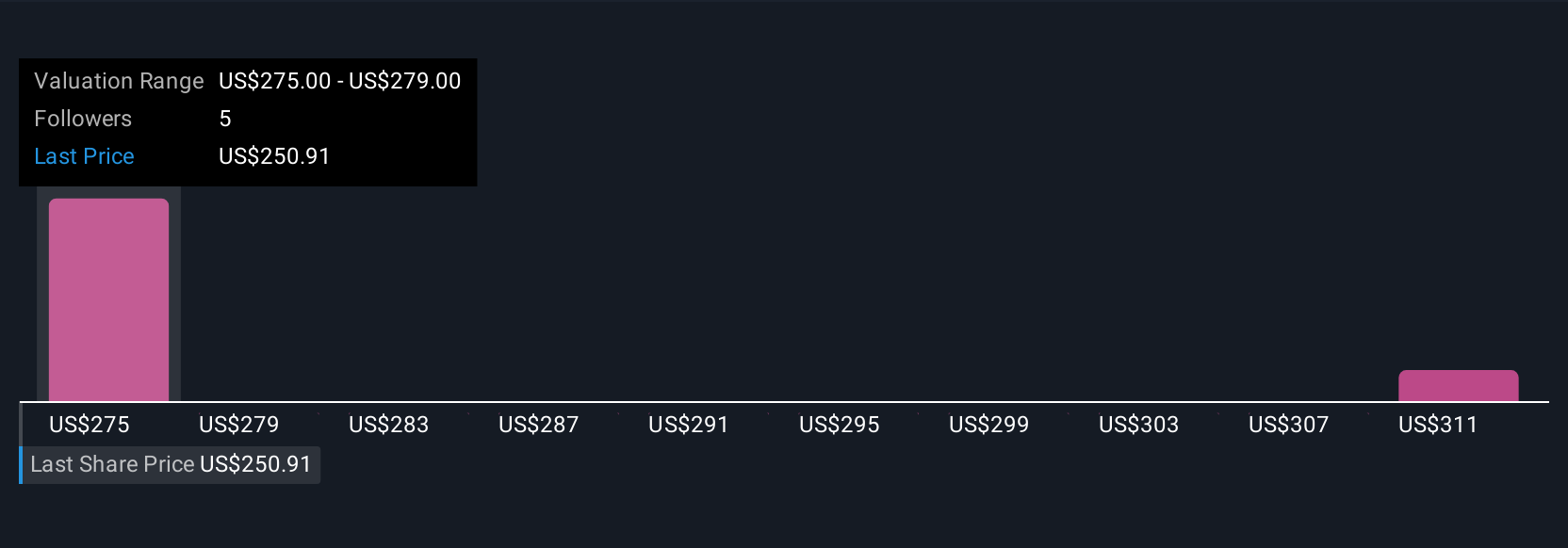

Uncover how Littelfuse's forecasts yield a $300.00 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Two community-driven fair value estimates for Littelfuse range from US$286.03 to US$300, reflecting different earnings and growth outlooks. With power semiconductor execution still in focus, see how your view compares to the wider Simply Wall St Community.

Explore 2 other fair value estimates on Littelfuse - why the stock might be worth just $286.03!

Build Your Own Littelfuse Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Littelfuse research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Littelfuse research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Littelfuse's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LFUS

Littelfuse

Designs, manufactures, and sells electronic components, modules, and subassemblies.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives