- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:LASR

Will Analyst Optimism on LASR Reveal a Turning Point in nLIGHT’s Competitive Positioning?

Reviewed by Sasha Jovanovic

- In recent weeks, nLIGHT received a Momentum Style Score of B and a Zacks Rank of #2 (Buy), reflecting strong earnings estimate revisions and positive analyst sentiment.

- This combination of momentum and upgraded earnings expectations has caught the attention of investors, indicating increased confidence in nLIGHT’s operational outlook and market direction.

- We’ll examine how these favorable earnings estimate revisions could influence nLIGHT’s broader investment narrative and future growth prospects.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

nLIGHT Investment Narrative Recap

To be a shareholder in nLIGHT, you need to believe in its expanding pipeline in aerospace and defense and the potential for advanced laser solutions to drive multi-year revenue growth. The recent upgrade in nLIGHT’s Zacks Rank and Momentum Style Score underlines momentum driven by positive earnings estimate revisions, but it does not fundamentally alter near-term reliance on large U.S. defense programs, which remains the most important catalyst, and the largest risk, should government priorities shift or program funding change.

Among recent announcements, nLIGHT’s growing defense contracts such as the $171 million HELSI-2 initiative highlight the company's core short-term growth catalyst: its increased presence in U.S. defense spending. This contract aligns directly with earnings momentum, serving both as validation of current analyst optimism and further concentration on opportunities in directed energy, though progress still depends heavily on defense sector demand and execution.

Yet, even with heightened analyst confidence, a persistent risk remains that heavy exposure to fluctuating government defense budgets could...

Read the full narrative on nLIGHT (it's free!)

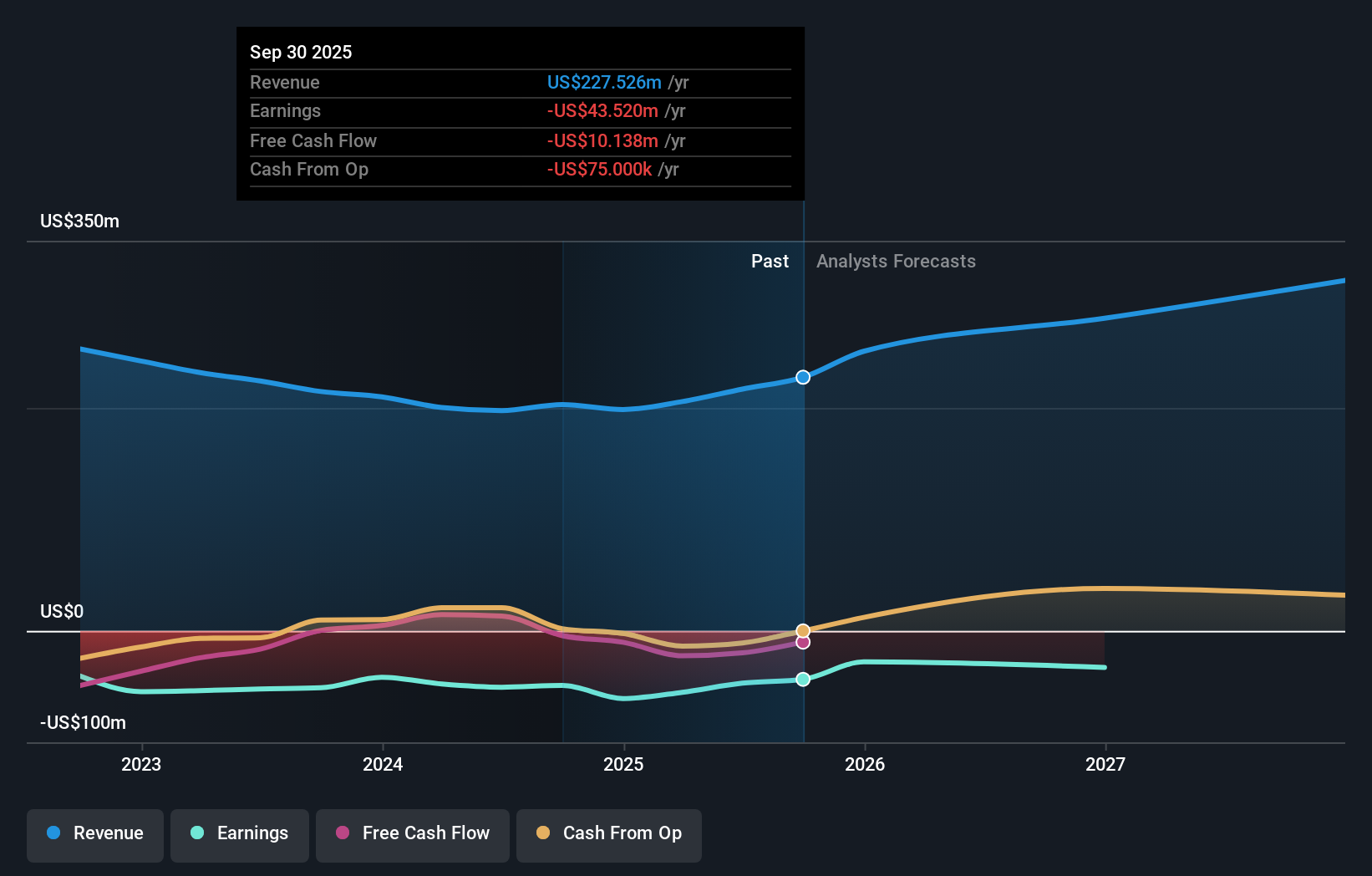

nLIGHT's outlook anticipates $310.5 million in revenue and $28.1 million in earnings by 2028. This is based on a projected 12.7% annual revenue growth rate and represents a $75.1 million increase in earnings from the current level of -$47.0 million.

Uncover how nLIGHT's forecasts yield a $28.08 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates from three members of the Simply Wall St Community range from US$10.01 to US$28.08 per share, reflecting sharply different outlooks. With recent momentum tied to defense contracts, it is important to consider how concentrated government spending could rapidly shift investors’ expectations in either direction.

Explore 3 other fair value estimates on nLIGHT - why the stock might be worth less than half the current price!

Build Your Own nLIGHT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your nLIGHT research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free nLIGHT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate nLIGHT's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LASR

nLIGHT

Designs, develops, manufactures, and sells semiconductor and fiber lasers for industrial, microfabrication, and aerospace and defense applications.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)