- United States

- /

- Marine and Shipping

- /

- NYSE:GSL

Unveiling Undiscovered Gems in United States This December 2024

Reviewed by Simply Wall St

The United States market has recently experienced a 4.0% drop over the past week, yet it remains robust with a 24% increase over the last year and anticipated earnings growth of 15% per annum in the coming years. In such dynamic conditions, identifying stocks that possess strong fundamentals and growth potential can be key to uncovering hidden opportunities for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

We'll examine a selection from our screener results.

TAT Technologies (NasdaqGM:TATT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: TAT Technologies Ltd. and its subsidiaries offer solutions and services to the commercial and military aerospace, as well as ground defense industries across the United States, Israel, and internationally, with a market cap of $282.36 million.

Operations: TAT Technologies generates revenue primarily from providing solutions and services to the aerospace and defense sectors. The company has a market cap of $282.36 million, reflecting its financial position in the industry.

TAT Technologies, a nimble player in the Aerospace & Defense sector, has shown impressive earnings growth of 67.4% over the past year, outpacing industry averages. With a satisfactory net debt to equity ratio of 6.9%, its financial health appears stable despite an increase in its overall debt ratio to 14.8% over five years. Recent earnings reveal revenue for Q3 at US$40 million up from US$30 million the previous year, with net income rising to US$2.87 million from US$2.15 million. A new five-year agreement worth approximately $17 million with a major North American cargo carrier further underscores potential growth opportunities for TAT Technologies.

- Click to explore a detailed breakdown of our findings in TAT Technologies' health report.

Understand TAT Technologies' track record by examining our Past report.

Ituran Location and Control (NasdaqGS:ITRN)

Simply Wall St Value Rating: ★★★★★★

Overview: Ituran Location and Control Ltd. offers location-based telematics services and machine-to-machine telematics products, with a market cap of $609.54 million.

Operations: The company generates revenue primarily from telematics services and products, with telematics services contributing $240.37 million and telematics products adding $90.81 million.

Ituran Location and Control seems to be an intriguing player in the automotive telematics field, with strategic moves like its recent partnership with Nissan Chile. This collaboration could lead to substantial growth, as it builds on their existing success in Mexico, potentially increasing vehicle installations. The company's financial health is robust, evidenced by a debt-to-equity ratio drop from 47.6% to 0.09% over five years and a strong EBIT coverage of interest payments at 380 times. With earnings growing by 13% last year and trading at nearly 58% below estimated fair value, Ituran appears well-positioned within its industry context for future expansion opportunities.

Global Ship Lease (NYSE:GSL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Global Ship Lease, Inc. operates by owning and chartering containerships under fixed-rate charters to container shipping companies globally, with a market capitalization of approximately $755.23 million.

Operations: The company generates revenue primarily from its transportation-shipping segment, amounting to $701.48 million. Its financial performance is influenced by the fixed-rate charters it secures with container shipping companies.

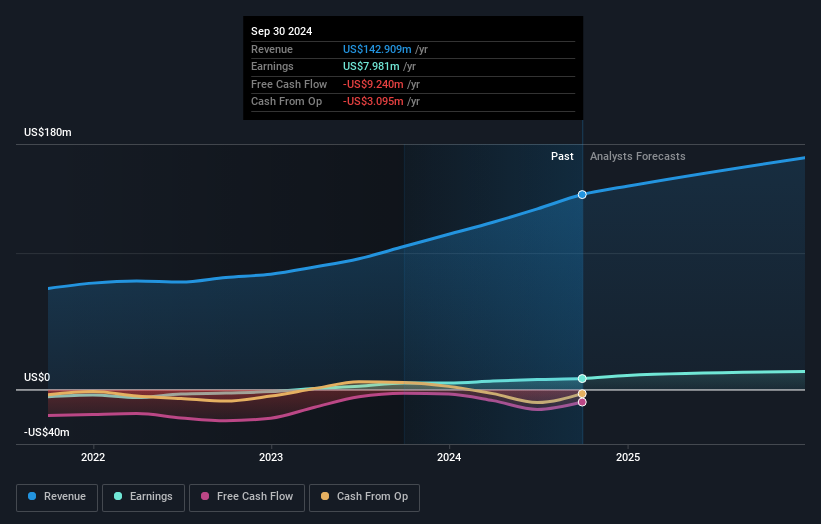

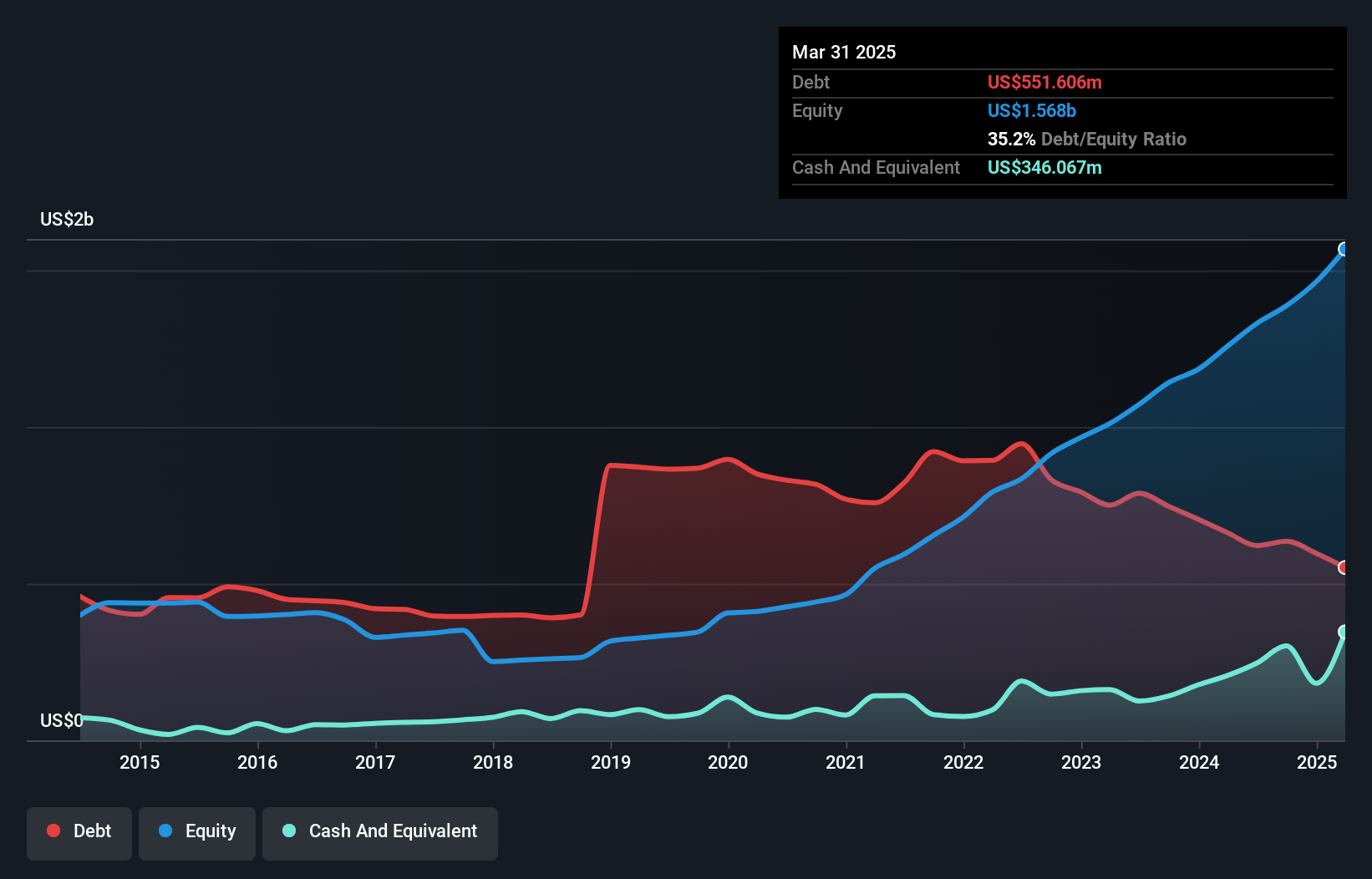

Global Ship Lease, a notable player in the shipping sector, has seen its earnings grow 48.6% annually over the past five years, though recent growth of 5.2% lagged behind the industry's 27.4%. The company’s debt to equity ratio impressively decreased from 251.4% to 45.8%, indicating improved financial health, and its net debt to equity stands at a satisfactory 24%. Recent strategic moves include acquiring four containerships for $274 million, enhancing fleet capacity and potentially generating up to $184 million in EBITDA if charter options are exercised fully. Despite these positives, earnings are forecasted to decline by an average of 8% annually over the next three years amidst industry challenges and geopolitical risks.

Seize The Opportunity

- Unlock our comprehensive list of 242 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Global Ship Lease, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GSL

Global Ship Lease

Engages in owning and chartering of containerships under fixed-rate charters to container shipping companies worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives