- United States

- /

- Communications

- /

- NasdaqGS:ITRN

Ituran Location and Control Ltd. (NASDAQ:ITRN) Stock Rockets 32% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, Ituran Location and Control Ltd. (NASDAQ:ITRN) shares have been powering on, with a gain of 32% in the last thirty days. The last 30 days bring the annual gain to a very sharp 70%.

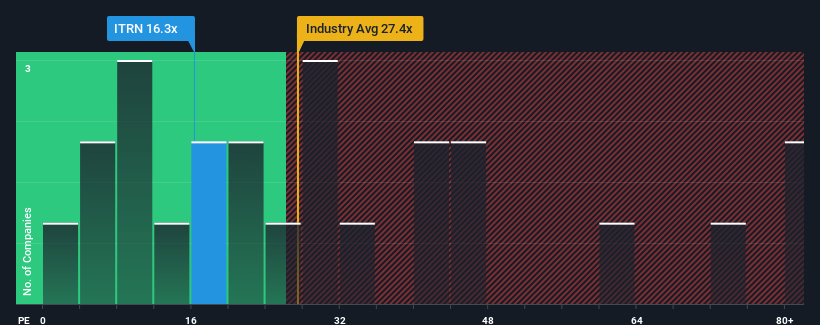

Although its price has surged higher, it's still not a stretch to say that Ituran Location and Control's price-to-earnings (or "P/E") ratio of 16.3x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 18x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's superior to most other companies of late, Ituran Location and Control has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Ituran Location and Control

Does Growth Match The P/E?

In order to justify its P/E ratio, Ituran Location and Control would need to produce growth that's similar to the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 12% last year. This was backed up an excellent period prior to see EPS up by 64% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 8.0% over the next year. Meanwhile, the rest of the market is forecast to expand by 14%, which is noticeably more attractive.

In light of this, it's curious that Ituran Location and Control's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

What We Can Learn From Ituran Location and Control's P/E?

Its shares have lifted substantially and now Ituran Location and Control's P/E is also back up to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Ituran Location and Control currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Ituran Location and Control, and understanding should be part of your investment process.

You might be able to find a better investment than Ituran Location and Control. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ITRN

Ituran Location and Control

Provides location-based telematics services and machine-to-machine telematics products in Israel, Brazil, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026