- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:INVZ

Why Investors Shouldn't Be Surprised By Innoviz Technologies Ltd.'s (NASDAQ:INVZ) 29% Share Price Surge

Innoviz Technologies Ltd. (NASDAQ:INVZ) shares have continued their recent momentum with a 29% gain in the last month alone. The last month tops off a massive increase of 219% in the last year.

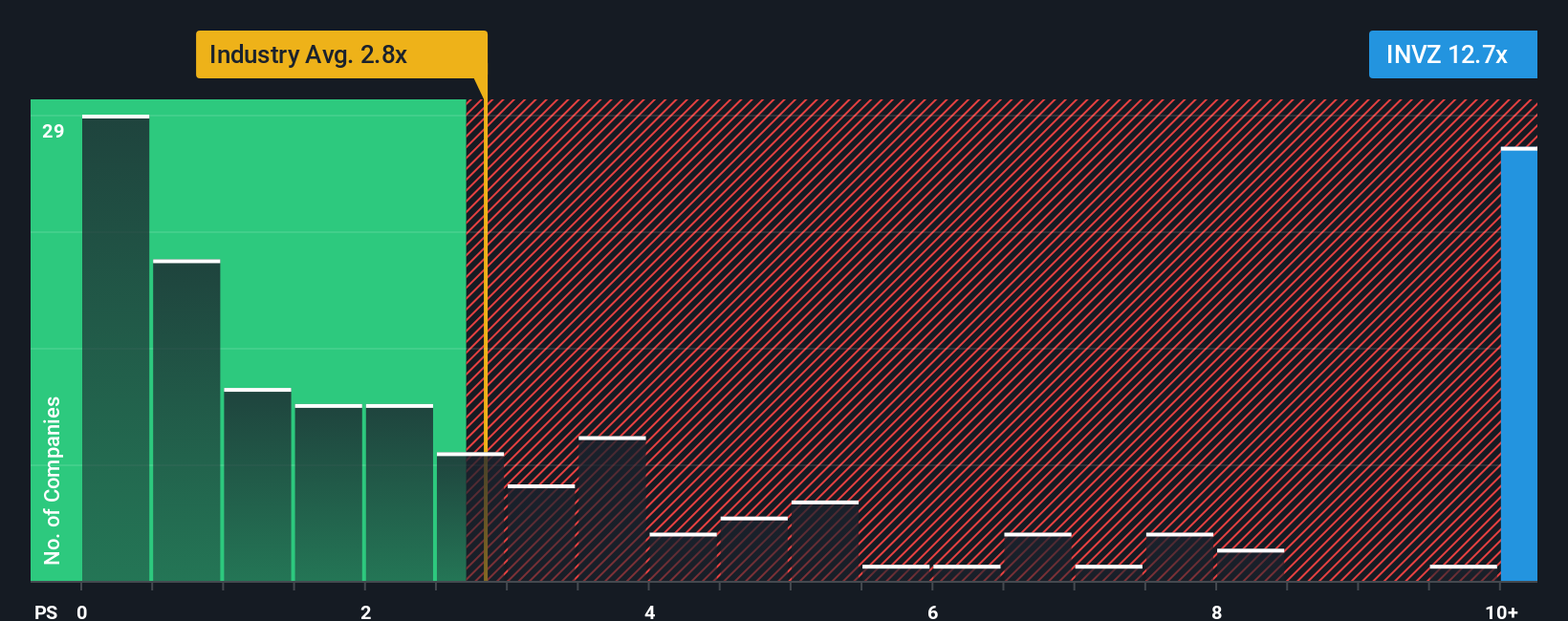

Following the firm bounce in price, when almost half of the companies in the United States' Electronic industry have price-to-sales ratios (or "P/S") below 2.8x, you may consider Innoviz Technologies as a stock not worth researching with its 12.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Innoviz Technologies

How Innoviz Technologies Has Been Performing

Innoviz Technologies' revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Innoviz Technologies will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Innoviz Technologies would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 17% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 128% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 14% per annum, which is noticeably less attractive.

With this in mind, it's not hard to understand why Innoviz Technologies' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Innoviz Technologies' P/S

Innoviz Technologies' P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Innoviz Technologies maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electronic industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Innoviz Technologies you should be aware of.

If you're unsure about the strength of Innoviz Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:INVZ

Innoviz Technologies

Manufactures and sells automotive grade LiDAR sensors and perception software to enable safe autonomous driving at a mass scale.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success