- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:INVZ

After Leaping 91% Innoviz Technologies Ltd. (NASDAQ:INVZ) Shares Are Not Flying Under The Radar

Innoviz Technologies Ltd. (NASDAQ:INVZ) shareholders would be excited to see that the share price has had a great month, posting a 91% gain and recovering from prior weakness. But the last month did very little to improve the 64% share price decline over the last year.

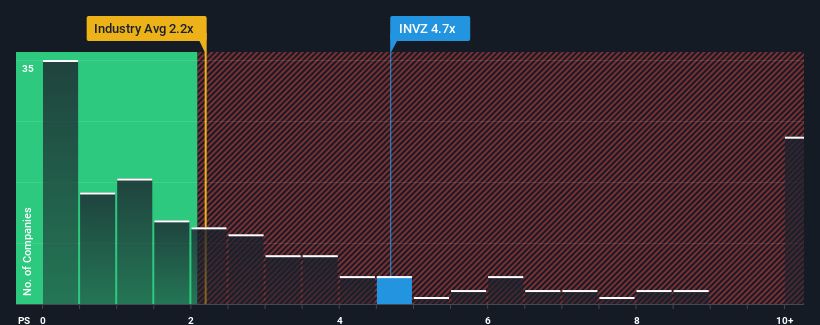

Since its price has surged higher, you could be forgiven for thinking Innoviz Technologies is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.7x, considering almost half the companies in the United States' Electronic industry have P/S ratios below 2.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Innoviz Technologies

What Does Innoviz Technologies' Recent Performance Look Like?

Recent times have been advantageous for Innoviz Technologies as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Innoviz Technologies.Is There Enough Revenue Growth Forecasted For Innoviz Technologies?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Innoviz Technologies' to be considered reasonable.

Retrospectively, the last year delivered an explosive gain to the company's top line. In spite of this unbelievable short-term growth, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 154% each year as estimated by the five analysts watching the company. That's shaping up to be materially higher than the 10% per annum growth forecast for the broader industry.

With this information, we can see why Innoviz Technologies is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The strong share price surge has lead to Innoviz Technologies' P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Innoviz Technologies shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Innoviz Technologies (at least 1 which is a bit unpleasant), and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:INVZ

Innoviz Technologies

Manufactures and sells automotive grade LiDAR sensors and perception software to enable safe autonomous driving at a mass scale.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives