- United States

- /

- Communications

- /

- NasdaqGS:HLIT

Harmonic (HLIT): Valuation Insights Following New NESN Partnership in Live Sports Streaming

Reviewed by Simply Wall St

Harmonic (HLIT) just announced a major partnership with New England Sports Network, joining forces with Astound Business Solutions to enhance NESN’s live sports video delivery and ad monetization. The agreement places Harmonic’s technology at the forefront in a competitive sector.

See our latest analysis for Harmonic.

Following these broadcast technology wins, Harmonic’s share price has shown some resilience, rising 13.6% over the past 90 days. However, the year-to-date share price return stands at -21.3%. Looking longer term, total shareholder return remains healthy at nearly 59% over five years. Recent 12-month total returns are decidedly negative, which suggests that momentum has yet to fully rebound despite a strong operational pipeline.

If you’re looking to uncover more names driving innovation in tech and media, take this chance to discover See the full list for free.

With recent partnerships and innovations making headlines, investors are right to wonder if Harmonic’s current valuation is a bargain based on near-term setbacks or if the market has already priced in its growth prospects.

Most Popular Narrative: 2% Undervalued

Comparing the narrative’s fair value estimate of $10.50 to Harmonic’s last close at $10.29, there is minimal room for upside. This narrow gap highlights how closely analyst consensus aligns with the current price, putting the focus on the underlying drivers.

Accelerating global demand for high-speed broadband and the ongoing transformation to next-generation virtualized broadband networks (including Fiber-to-the-Home and Unified DOCSIS 4.0) are driving a multi-year upgrade cycle among operators. Harmonic's leadership and recent customer wins in these areas signal a strong pipeline and are likely to fuel significant future revenue growth as operators ramp deployments in 2026 and beyond.

Want to know what makes this price target tick? A bold industry transformation, a bet on big operational wins, and optimistic growth built into future multiples. The catch? Only the full narrative reveals if these assumptions can really hold up as the broadband era accelerates.

Result: Fair Value of $10.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weak cable upgrade spending and Harmonic's reliance on a few major clients could challenge the company's growth momentum if conditions fail to improve.

Find out about the key risks to this Harmonic narrative.

Another View: What About the DCF?

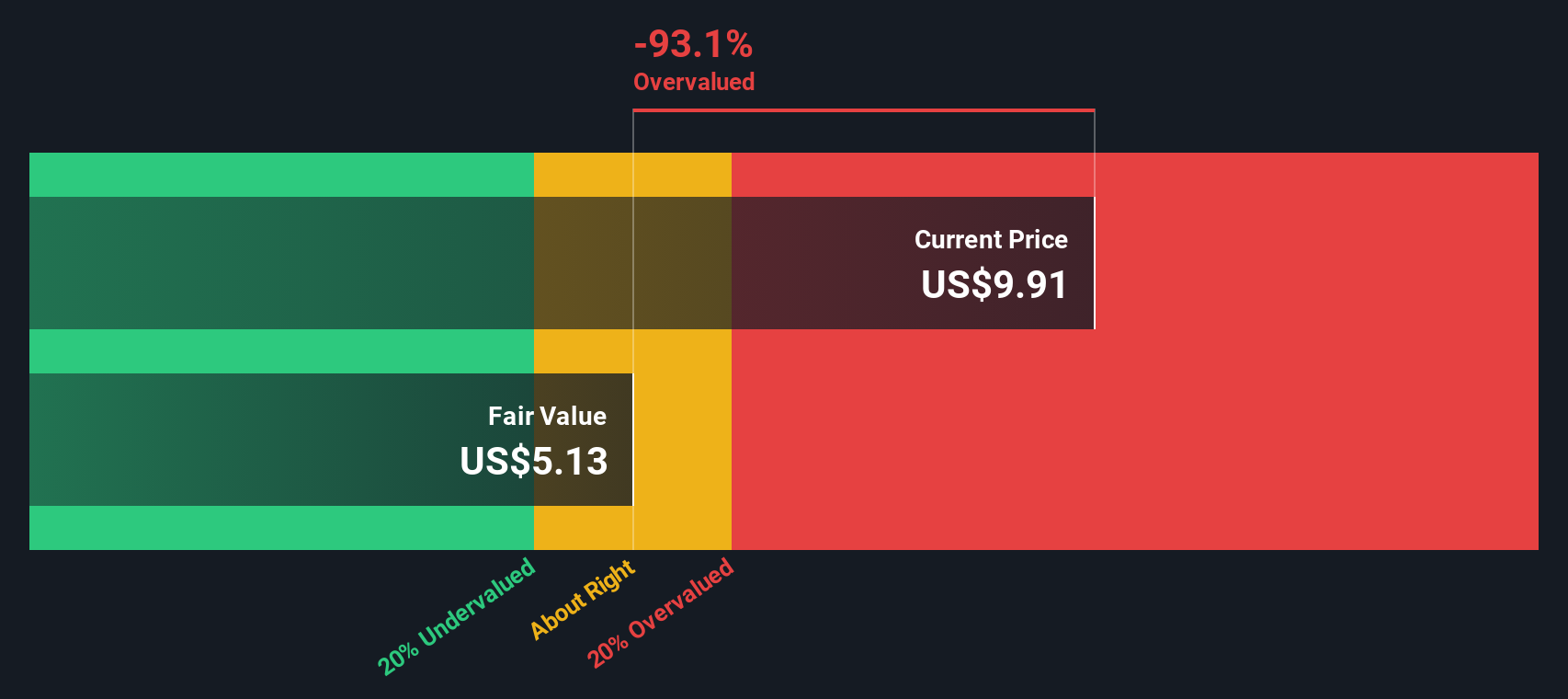

While the analyst consensus suggests Harmonic is just slightly undervalued, the SWS DCF model presents a different perspective. According to our DCF model, Harmonic's current price is well above its estimated fair value, which may indicate potential overvaluation if long-term cash flow projections are not met. Which perspective aligns more closely with your own outlook on Harmonic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Harmonic for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Harmonic Narrative

If you see the story differently or want to interpret the data for yourself, you can build your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Harmonic.

Looking for More Investment Ideas?

Don't miss your chance to find standout opportunities. Uncover strategies and stocks that could give your portfolio an edge with these targeted screens:

- Spot undervalued gems poised for a turnaround and boost your investment confidence by reviewing these 875 undervalued stocks based on cash flows.

- Capture compounding income potential and see which companies are rewarding shareholders by checking out these 17 dividend stocks with yields > 3%.

- Get ahead of the AI revolution by searching through these 24 AI penny stocks at the forefront of machine learning and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Harmonic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HLIT

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)