- United States

- /

- Communications

- /

- NasdaqGS:GILT

Why Gilat Satellite Networks (GILT) Is Up 16.7% After Securing Major US Army SATCOM Terminal Deal

Reviewed by Sasha Jovanovic

- Gilat Satellite Networks announced that its subsidiary, Gilat DataPath, has secured over US$7 million in orders to supply advanced transportable SATCOM terminals to the U.S. Army, with deliveries planned for completion by year-end 2025.

- This substantial defense contract underscores the growing relevance of Gilat's technology in supporting mission-critical military communications and the company's role in addressing evolving security requirements.

- We'll examine how the recent U.S. Army contract underscores Gilat's strengthening presence in defense sector communications infrastructure.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Gilat Satellite Networks Investment Narrative Recap

To see value in Gilat Satellite Networks, an investor needs confidence in the ongoing demand for secure, mission-critical satellite communications, especially in defense and government markets. The new US$7 million U.S. Army contract affirms Gilat's positioning as a supplier of rugged defense solutions and strengthens its order backlog, which remains the company's primary near-term catalyst. However, this contract alone does not significantly lessen ongoing margin pressure as the business mix continues to shift toward competitive, potentially lower-margin defense offerings.

Among recent announcements, the multimillion-dollar deal with Israel's Ministry of Defense from August 12 stands out. This earlier contract, also focused on SATCOM systems, reinforces Gilat's growing presence in defense infrastructure and shows resilience in government-related revenue, both important to supporting future earnings momentum while demand from commercial markets remains unsettled.

Yet, in contrast, investors should be particularly attentive to ongoing gross margin compression as revenue mix shifts and...

Read the full narrative on Gilat Satellite Networks (it's free!)

Gilat Satellite Networks' narrative projects $648.6 million revenue and $35.0 million earnings by 2028. This requires 22.9% yearly revenue growth and a $12.6 million earnings increase from $22.4 million today.

Uncover how Gilat Satellite Networks' forecasts yield a $11.00 fair value, a 23% downside to its current price.

Exploring Other Perspectives

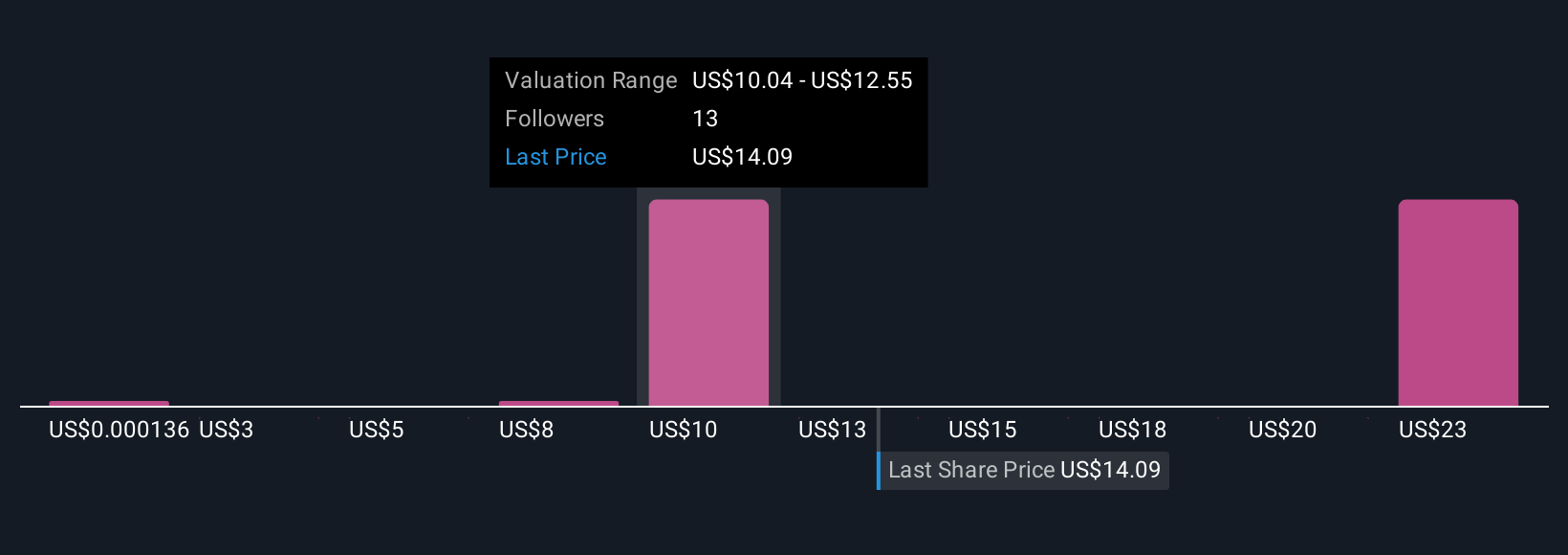

Simply Wall St Community members assigned fair values for Gilat from as low as US$0.0001 to US$25.08, based on four distinct analyses. Despite recurring defense contract wins, concerns over sustained margin pressure could continue to shape performance expectations across the market's diverse viewpoints.

Explore 4 other fair value estimates on Gilat Satellite Networks - why the stock might be worth as much as 77% more than the current price!

Build Your Own Gilat Satellite Networks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gilat Satellite Networks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Gilat Satellite Networks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gilat Satellite Networks' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILT

Gilat Satellite Networks

Provides satellite-based broadband communication solutions in Israel, the United States, Peru, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)