- United States

- /

- Communications

- /

- NasdaqGS:GILT

Gilat Satellite Networks (NasdaqGS:GILT): Evaluating Valuation Following $42 Million SkyEdge IV Platform Order

Reviewed by Simply Wall St

Gilat Satellite Networks (NasdaqGS:GILT) just revealed $42 million in fresh orders for its SkyEdge IV platform, with delivery set for the coming year. This sizeable deal shows accelerating demand for advanced satellite connectivity solutions across sectors.

See our latest analysis for Gilat Satellite Networks.

This latest $42 million order comes as Gilat Satellite Networks enjoys a burst of positive momentum, highlighted by the company’s recent showcase at the 2025 Annual Meeting & Exposition. The 1-year total shareholder return sits at a remarkable 191.5%, and accelerating 30-day and 90-day share price returns indicate that investor enthusiasm for next-generation connectivity is building quickly.

If Gilat's surge has you on the lookout for what could be next, consider the opportunity to discover See the full list for free.

With shares posting a 191.5% return over the past year but now trading above analyst price targets, the real question for investors is whether there is still upside left, or if the future has already been priced in.

Most Popular Narrative: 30.4% Overvalued

Gilat Satellite Networks last closed at $14.34, which is over 30% above the narrative fair value of $11.00. This gap spotlights the optimism already priced in by the market and sets up a revealing narrative behind the numbers.

Growing global investment in secure, mission-critical satellite connectivity, driven by increased geopolitical tensions, public infrastructure modernization, and digital inclusion initiatives, continues to expand Gilat's addressable market. This is evidenced by record new defense contracts and major government programs in regions such as Latin America and Europe. This trend may support significant revenue growth and enhance long-term earnings visibility.

Curious which bold growth assumptions are driving the lofty price target? Find out what’s fueling those aggressive revenue projections and how future profit margins could surprise even seasoned investors. Will the optimism stand up to scrutiny or unravel under closer examination? Dive in to see just how ambitious this narrative gets.

Result: Fair Value of $11.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing gross margin growth and delays in production ramp-up could threaten the bullish outlook for Gilat if challenges persist in the coming quarters.

Find out about the key risks to this Gilat Satellite Networks narrative.

Another View: Discounted Cash Flow Tells a Different Story

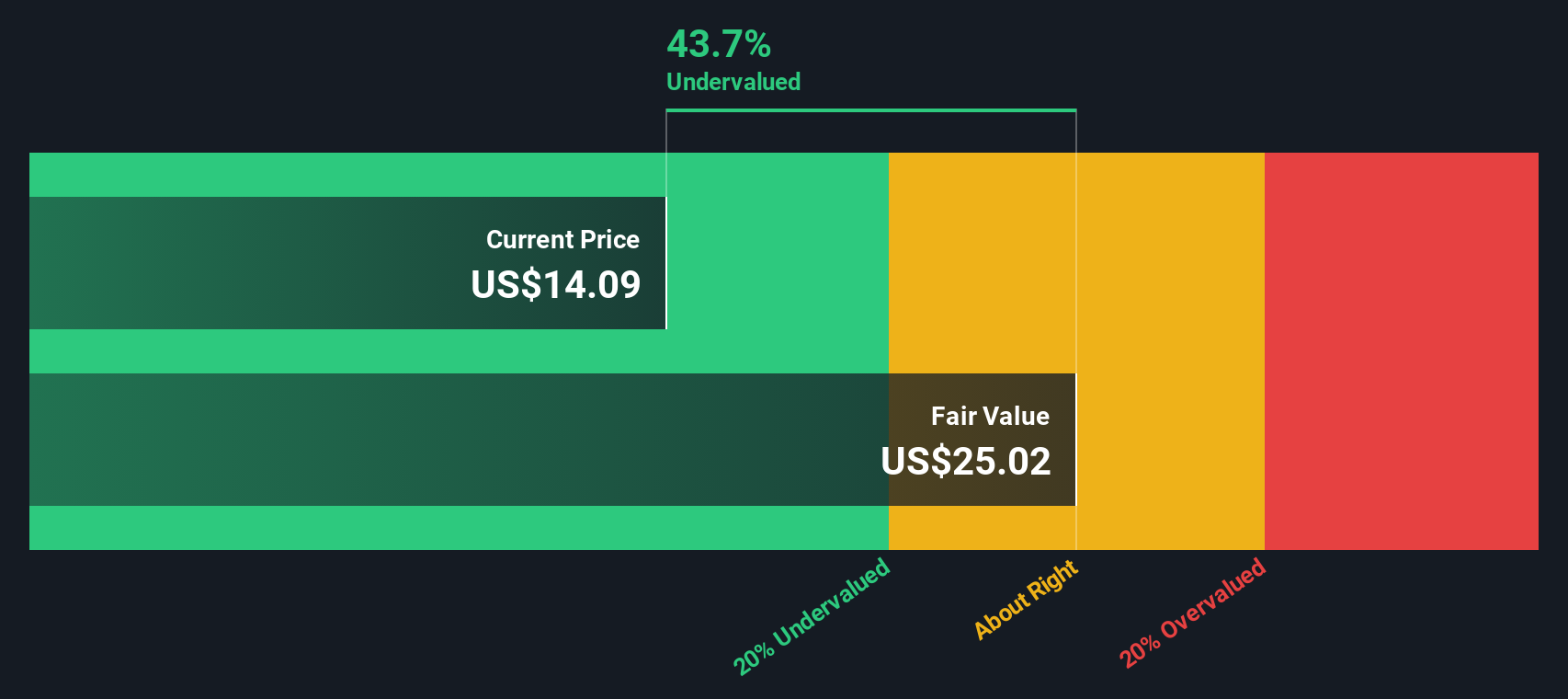

While the consensus price target suggests the shares are overvalued, our DCF model values Gilat Satellite Networks at $25.10, which is 42.9% above the current share price. This model factors in the company’s long-term cash flows and growth, pointing toward untapped upside. Which perspective feels more convincing to you?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Gilat Satellite Networks for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Gilat Satellite Networks Narrative

If you see things differently or want to dive deeper into the details, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your Gilat Satellite Networks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Shortcut your search for the next big winner by zeroing in on standout stocks across trending sectors. See what you could be missing out on below, as opportunity moves fast!

- Catch market momentum and tap into these 875 undervalued stocks based on cash flows to see which companies may be trading below their true worth before the crowd catches on.

- Unlock the latest opportunities in medical innovation and breakthroughs with these 33 healthcare AI stocks, targeting high-potential stocks transforming the future of healthcare.

- Supercharge your portfolio’s income by evaluating these 17 dividend stocks with yields > 3%, featuring companies with steady yields above 3% and a proven track record of rewarding investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILT

Gilat Satellite Networks

Provides satellite-based broadband communication solutions in Israel, the United States, Peru, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)