- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:FLEX

How Flex’s Liquid Cooling Deployment with Equinix Could Reshape the FLEX Investment Story

- Flex announced it has deployed a fully integrated, rack-level liquid cooling solution at the Equinix Co-Innovation Facility in Ashburn, Virginia, incorporating JetCool’s advanced liquid cooling technologies and demonstrating significant reductions in data center water and power consumption.

- This collaboration underscores Flex’s unique ability to address global data center challenges with end-to-end manufacturing, supply chain expertise, and lifecycle support for next-generation high-density computing environments.

- We will examine how Flex’s new liquid cooling deployment with Equinix could impact its investment narrative, especially as demand for efficient data center solutions grows.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Flex Investment Narrative Recap

To be a shareholder in Flex, you need to believe that the company’s end-to-end manufacturing strength and rapid innovation in data center cooling are well positioned to catch the ongoing demand for AI and cloud infrastructure. The recent Equinix liquid cooling deployment showcases Flex's technical expertise, but does not substantially alter the key short-term catalyst, which remains continued revenue growth from major hyperscale clients. The biggest risk continues to be Flex’s exposure to customer concentration within the data center segment; this news does not mitigate that challenge in a material way.

Among Flex’s recent announcements, its expanding partnership with NVIDIA to create modular AI factory systems is the most relevant complement to the Equinix news. Both highlight how Flex is deepening relationships with leaders in high-performance computing. These collaborations tie directly into the company’s major growth catalyst, the global shift toward more intensive, energy-efficient data center infrastructure, and reinforce Flex’s importance in that supply chain.

Yet, unlike near-term growth drivers, investors should also be mindful of the ongoing risk from customers pursuing their own in-house cooling and power manufacturing solutions...

Read the full narrative on Flex (it's free!)

Flex is projected to reach $29.1 billion in revenue and $1.3 billion in earnings by 2028. This outlook assumes a 3.7% annual revenue growth rate and an increase in earnings of approximately $409 million from the current $891 million.

Uncover how Flex's forecasts yield a $74.37 fair value, a 24% upside to its current price.

Exploring Other Perspectives

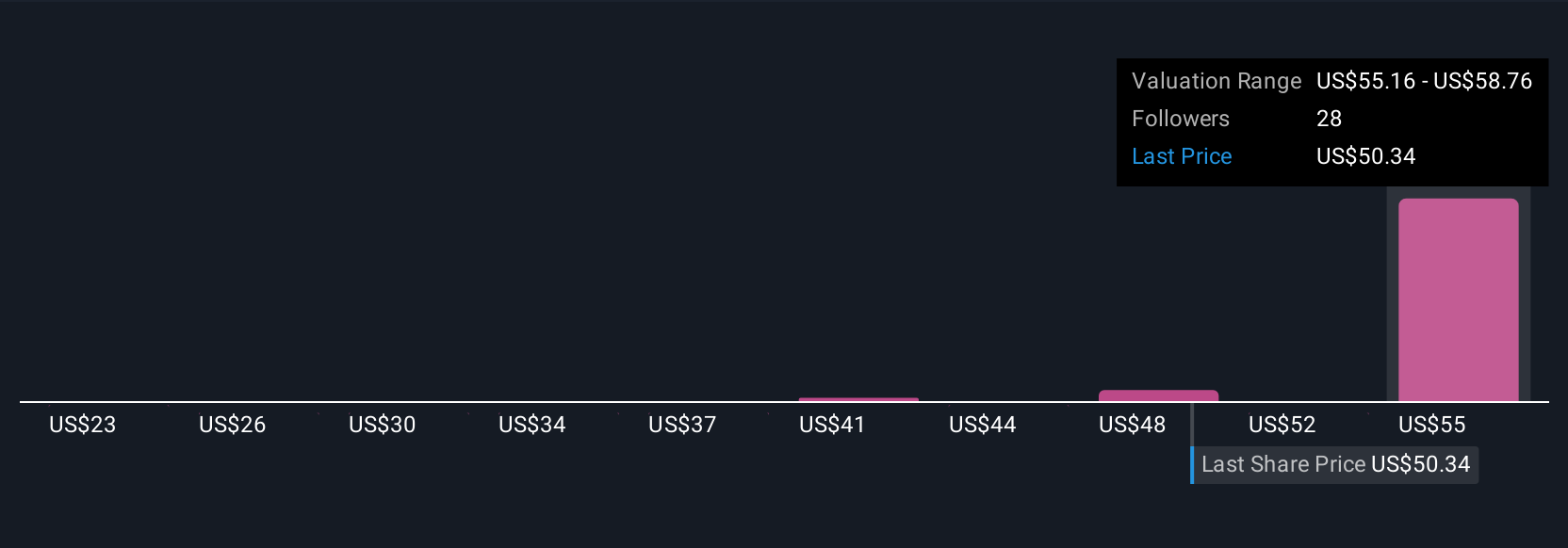

Five fair value estimates for Flex from the Simply Wall St Community range widely from US$45.00 to US$74.37 per share. While many see upside in Flex riding industry demand for data center innovation, opinions differ on the company’s ability to manage customer concentration and margin risks, take a closer look at these contrasting views.

Explore 5 other fair value estimates on Flex - why the stock might be worth as much as 24% more than the current price!

Build Your Own Flex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flex research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Flex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flex's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLEX

Flex

Provides technology innovation, supply chain, and manufacturing solutions to data center, communications, enterprise, consumer, automotive, industrial, healthcare, industrial, and power industries.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Investing in the future with RGYAS as fair value hits 228.23

The global leader in cash handling

Wolters Kluwer - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.