- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:FEIM

Is Frequency Electronics (NASDAQ:FEIM) Weighed On By Its Debt Load?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Frequency Electronics, Inc. (NASDAQ:FEIM) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Frequency Electronics

How Much Debt Does Frequency Electronics Carry?

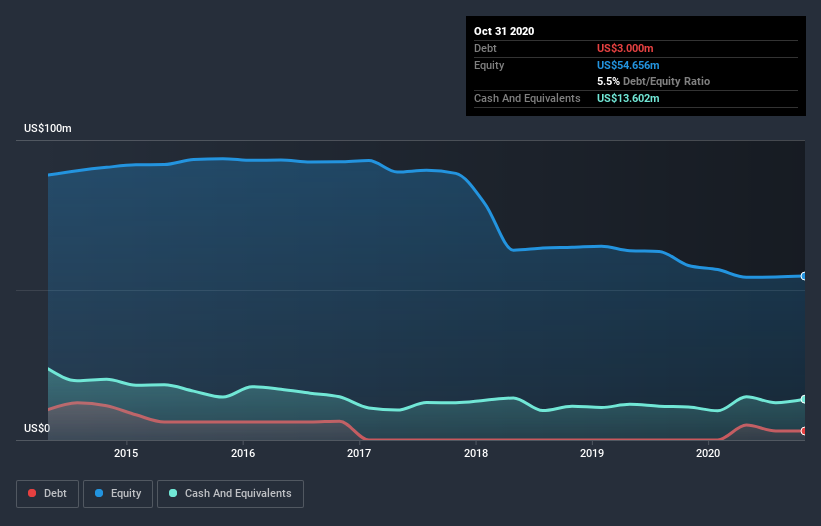

As you can see below, at the end of October 2020, Frequency Electronics had US$3.00m of debt, up from none a year ago. Click the image for more detail. However, it does have US$13.6m in cash offsetting this, leading to net cash of US$10.6m.

How Healthy Is Frequency Electronics' Balance Sheet?

The latest balance sheet data shows that Frequency Electronics had liabilities of US$11.2m due within a year, and liabilities of US$23.7m falling due after that. On the other hand, it had cash of US$13.6m and US$13.5m worth of receivables due within a year. So its liabilities total US$7.86m more than the combination of its cash and short-term receivables.

Of course, Frequency Electronics has a market capitalization of US$111.5m, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Frequency Electronics boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Frequency Electronics will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Frequency Electronics made a loss at the EBIT level, and saw its revenue drop to US$47m, which is a fall of 2.4%. That's not what we would hope to see.

So How Risky Is Frequency Electronics?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Frequency Electronics lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of US$597k and booked a US$4.5m accounting loss. While this does make the company a bit risky, it's important to remember it has net cash of US$10.6m. That means it could keep spending at its current rate for more than two years. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Frequency Electronics (1 is concerning!) that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Frequency Electronics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:FEIM

Frequency Electronics

Engages in the design, development, manufacture, marketing, and sale of precision time and frequency control products and components for microwave integrated circuit applications.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Apple Inc. (AAPL) — Durable Compounder With Services-Led Earnings Upside

Mota-Engil's Intrinsic and Historical Valuation

Ferrari's Intrinsic and Historical Valuation

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

The "Sleeping Giant" Stumbles, Then Wakes Up