- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:FEIM

Is FEIM’s Share Buyback a Vote of Confidence Amid Soft Sales and Quantum Bets?

Reviewed by Simply Wall St

- Frequency Electronics, Inc. reported weaker fiscal first-quarter 2026 results with sales declining to US$13.81 million and net income falling to US$634,000, down from the previous year.

- The company simultaneously authorized a new US$20 million share repurchase program and highlighted ongoing investment in quantum sensing and key defense sector programs.

- With revenue softness offset by management’s expanded buyback and innovation in quantum sensing, we’ll explore the impact on Frequency Electronics’ investment story.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

What Is Frequency Electronics' Investment Narrative?

To own Frequency Electronics, I think you need to believe not just in its focus on high-precision timing for defense and space systems, but also in management’s ability to handle both volatility and innovation. The drop in fiscal Q1 2026 sales and net income after a standout prior year is a reminder that customer contract timing and defense spending cycles can quickly shift results. However, the Board’s new US$20 million share buyback, on the heels of revenue weakness, signals both confidence and a possible effort to cushion the recent pullback, visible in the sharp short-term share price decline. The biggest catalyst in the short run likely remains how effectively new investments in quantum sensing and defense programs will recover momentum. Short-term risks are oriented around continued revenue lumpiness, customer-driven order delays and whether the ramp in innovation can offset contract volatility. The impact of the recent news accentuates these balancing acts, potentially making performance through the next couple of quarters more sensitive to new project execution and customer delivery timing. Contrast this with the uncertainty in contract timing, something investors should watch closely.

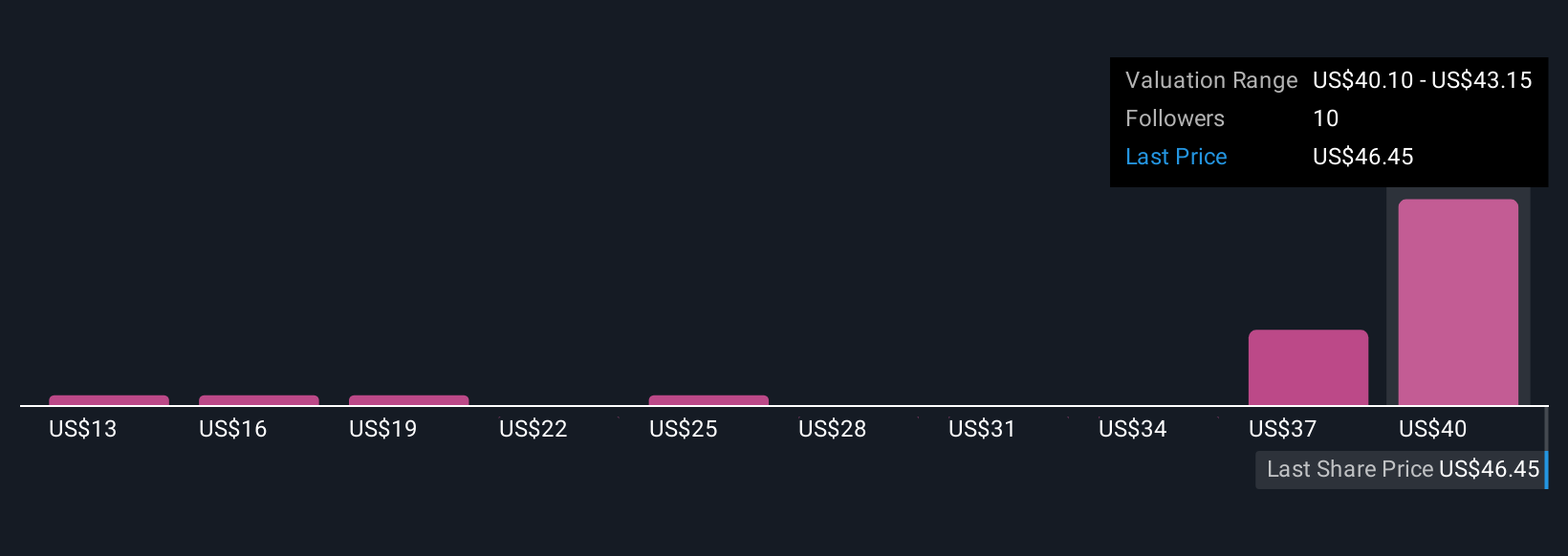

Despite retreating, Frequency Electronics' shares might still be trading 38% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 6 other fair value estimates on Frequency Electronics - why the stock might be worth less than half the current price!

Build Your Own Frequency Electronics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Frequency Electronics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Frequency Electronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Frequency Electronics' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FEIM

Frequency Electronics

Engages in the design, development, manufacture, marketing, and sale of precision time and frequency control products and components for microwave integrated circuit applications.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)