- United States

- /

- Communications

- /

- NasdaqGS:CSCO

Here is Why Cisco Systems (NASDAQ:CSCO) Passes our Dividend Checklist

After the latest rally, Cisco Systems, Inc. (NASDAQ: CSCO) is looking to end the year on a strong note. It seems that the stock is successfully turning around, finally recapturing the levels from 2019.

Yet, some institutions are seeing further upside potential, maintaining it as one of their top IT picks for this decade.

Check our latest analysis of Cisco Systems.

Evercore ISI recently listed Cisco as one of the top picks in the IT sector as a thematic opportunity for the decade. Evercore noted opportunities in the product cycles, macro tailwinds, and merger and acquisition activity.

Meanwhile, Cisco CEO Chuck Robbins reflected on the mild disappointment in the software growth rate, explaining how the supply chain issues impacted the software development.

Looking forward, Mr.Robbins sees hybrid work as an important factor for future growth. The company looks to drive the revenues by providing advanced technological solutions for providers like Verizon Business that recently announced the implementation of Cisco-managed SD-WAN services.

At the same time, Cisco declared a US$0.37 / share quarterly dividend. It is payable on January 26 and ex-div on January 4.

A Look into the Dividend

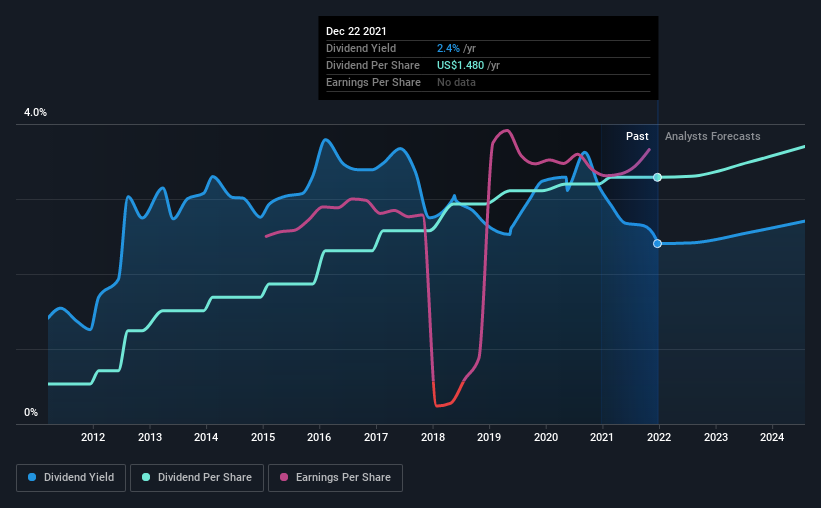

A 2.4% yield is nothing to get excited about, but investors probably think the long payment history suggests Cisco Systems has some staying power. The company also conducted a buyback equivalent to around 0.9% of its market capitalization during the year. Some simple research can reduce the risk of buying Cisco Systems for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Cisco Systems paid out 54% of its profit as dividends over the trailing twelve-month period. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

We also measure dividends paid against a company's levered free cash flow to see if enough cash was generated to cover the dividend. Cisco Systems paid out a conservative 44% of its free cash flow as dividends last year. It's positive to see that both profits and cash flow cover cisco Systems' dividend since this is generally a sign that the dividend is sustainable. A lower payout ratio usually suggests a more significant margin of safety before the dividend gets cut.

While the above analysis focuses on dividends relative to a company's earnings, we note Cisco Systems' strong net cash position, which will let it pay larger dividends for a time, should it choose.

Dividend Volatility and Growth Potential

Before buying a stock for its income, we want to see if the dividends have been stable in the past and if the company has a track record of maintaining its dividend. This article only scrutinizes the last decade of Cisco Systems' dividend payments. During this period, the dividend has been stable, implying the business could have relatively consistent earnings power. During the past 10-year period, the first annual payment was US$0.2 in 2011, compared to US$1.5 last year. Dividends per share have grown at approximately 20% per year over this time, which is impressive.

Looking at the earnings per share (EPS), Cisco Systems has grown its earnings per share at 5.1% per annum over the past five years. The rate at which earnings have grown is acceptable, and by paying out more than half of its earnings as dividends, the company is striking a reasonable balance between reinvestment and returns to shareholders.

Conclusion

Our dividend checklist looks at 3 key factors - whether the dividends are affordable stable and if the growth prospects also support the dividend growth.

Needless to say, Cisco Systems does well on our list. Its dividend yield is slightly higher than the industry average, but the payout ratio is reasonable. The earnings growth hasn't been impressive, but the dividend growth has been consistent through the last decade.

Investors generally tend to favor companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analyzing a company. Growing earnings tend to be the best dividend stocks over the long term. See what the 25 analysts we track are forecasting for Cisco Systems for free with public analyst estimates for the company.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:CSCO

Cisco Systems

Designs, develops, and sells technologies that help to power, secure, and draw insights from the internet in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)