- United States

- /

- Communications

- /

- NasdaqGS:CSCO

Does Cisco Still Offer Value After a 36% Share Price Gain?

Reviewed by Bailey Pemberton

How Has Cisco Systems Stock Been Performing?

Cisco Systems has quietly been rewarding patient shareholders, with the stock up 36.1% over the past year and 98.4% over the last five years, turning what many once saw as a mature tech name into a solid compounder. Even in the short term, the picture is constructive, with a 5.2% gain over the last 30 days, a modest 0.2% pullback over the past week, and the shares recently closing around $77.80.

This backdrop matters because it shapes how investors interpret Cisco's current valuation, whether they see the recent run as justified or as a reason for caution. Before looking at the numbers, it is helpful to explore what is driving sentiment and how the market's expectations may be shifting beneath the surface.

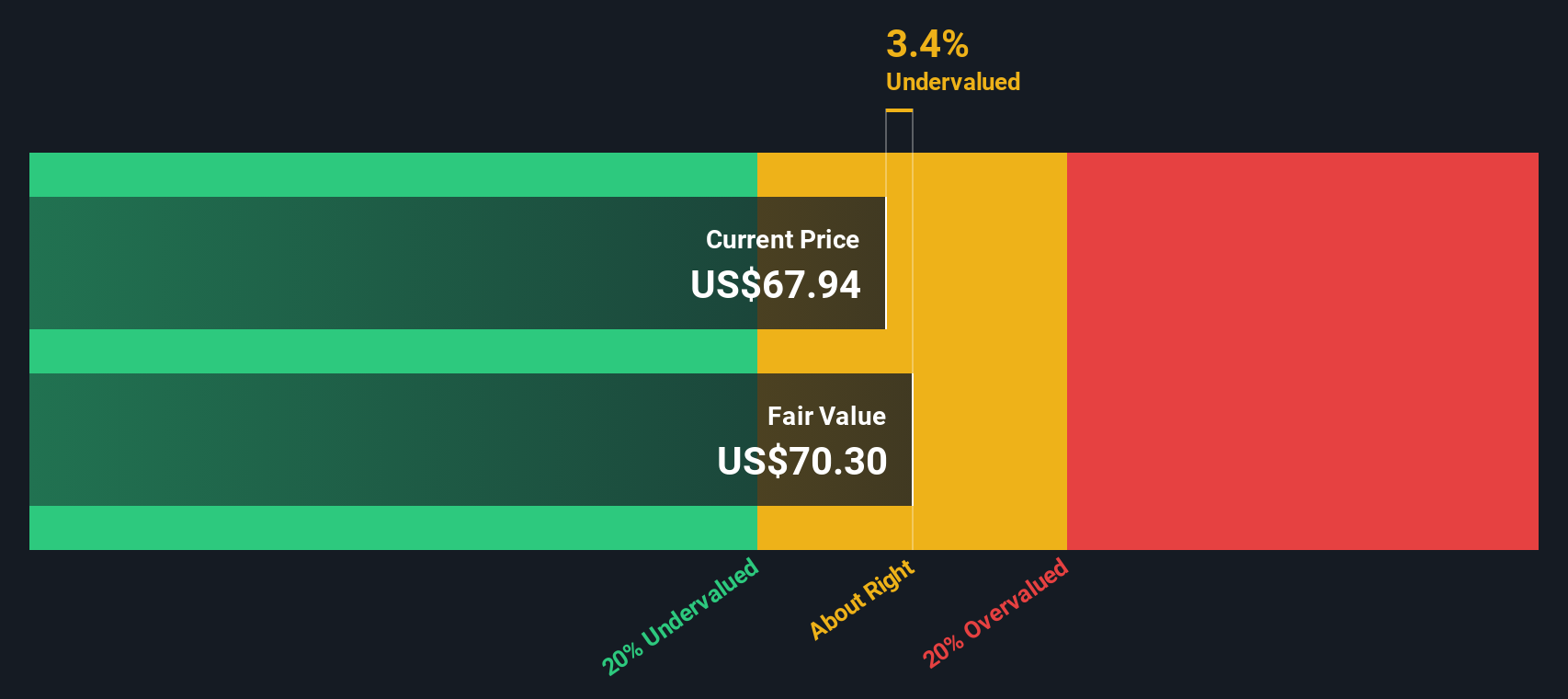

Approach 1: Cisco Systems Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting those back to today in $ terms. For Cisco Systems, the model starts with last twelve month free cash flow of about $12.9 billion and uses analyst forecasts for the next several years, then extends those trends further into the future using a 2 Stage Free Cash Flow to Equity approach.

On this basis, free cash flow is projected to rise to roughly $19.1 billion by 2030, with incremental growth thereafter driven by more modest assumed increases. Adding up all those discounted cash flows results in an estimated intrinsic value of about $82.01 per share, compared with the recent share price around $77.80. That implies Cisco is trading at roughly a 5.1% discount to the model's fair value, suggesting the stock is slightly undervalued but broadly in line with its cash flow outlook.

Result: ABOUT RIGHT

Cisco Systems is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

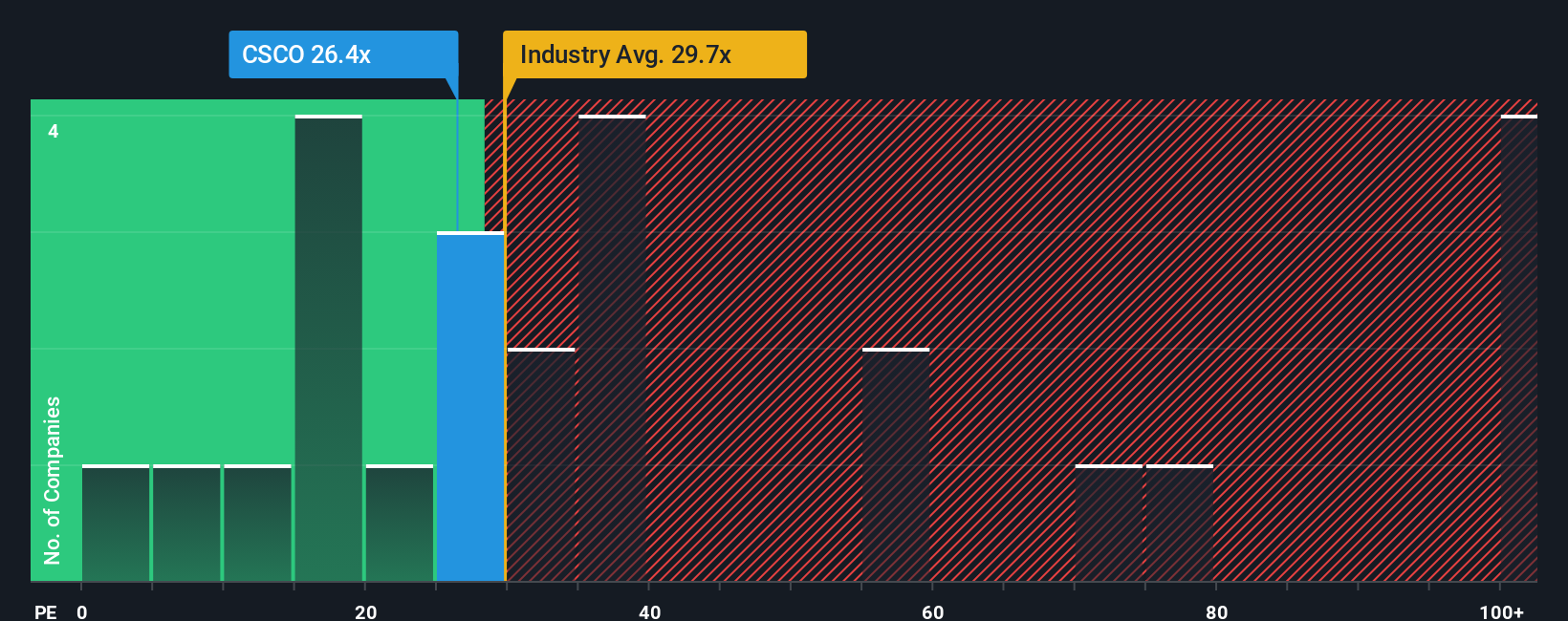

Approach 2: Cisco Systems Price vs Earnings

For established, profitable businesses like Cisco, the price to earnings multiple is a straightforward way to judge valuation because it links what investors pay today to the profits the company is already generating. A higher PE can be justified when earnings are expected to grow faster or are perceived as lower risk, while slower growth or higher uncertainty usually argues for a lower, more conservative PE.

Cisco currently trades on a PE of about 29.8x, below both the communications industry average of roughly 34.4x and the peer group average near 35.1x. This indicates the market is assigning it a modest discount relative to similar companies. Simply Wall St’s proprietary Fair Ratio for Cisco is around 30.3x, which represents the PE one might expect once factors like earnings growth, profitability, industry, market cap and specific risks are all weighed together.

This Fair Ratio is a more tailored benchmark than a simple comparison with peers or the sector. It adjusts for Cisco’s particular strengths and risk profile rather than assuming all companies deserve the same multiple. With the Fair Ratio only slightly above the actual PE, Cisco’s shares appear broadly in line with what its fundamentals warrant.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cisco Systems Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simply your story about Cisco, tied to your own assumptions for future revenue, earnings and margins, that then flow through to a forecast and a Fair Value you can compare to today’s price.

On Simply Wall St’s Community page, millions of investors use Narratives as an easy, accessible tool to connect what they believe about a company with the numbers on the screen. Instead of just accepting a PE or target price, they can see how their view of Cisco’s AI networking cycle, security execution or subscription transition translates into a dynamic valuation that automatically updates as new news or earnings are released.

For Cisco, one investor might build a bullish Narrative anchored to the high end of analyst expectations, assuming robust AI infrastructure demand, rising margins and a Fair Value closer to $87. A more cautious investor might anchor to the low end around $61, emphasizing security and execution risks. By setting up these contrasting Narratives side by side, both can quickly see whether today’s price looks like an opportunity to buy, a signal to trim, or a reason to wait.

Do you think there's more to the story for Cisco Systems? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSCO

Cisco Systems

Designs, develops, and sells technologies that help to power, secure, and draw insights from the internet in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)