- United States

- /

- Communications

- /

- NasdaqGS:CSCO

Assessing Cisco Systems (CSCO) Valuation After Recent Share Price Pullback Without Clear News Catalyst

Reviewed by Simply Wall St

Cisco Systems stock moves without a clear news catalyst

Cisco Systems (CSCO) shares have been moving without a clear single event driving sentiment, which can prompt investors to look more closely at the company’s recent returns and financial profile.

See our latest analysis for Cisco Systems.

Cisco’s recent share price pullback, including a 5.55% 1 month share price return and 3.09% year to date share price return, contrasts with a stronger 21.29% 1 year total shareholder return and 65.98% 3 year total shareholder return. This hints at cooling short term momentum against a broader record of gains.

If this kind of shift in sentiment has you rethinking your watchlist, it could be a good moment to widen your radar with high growth tech and AI stocks.

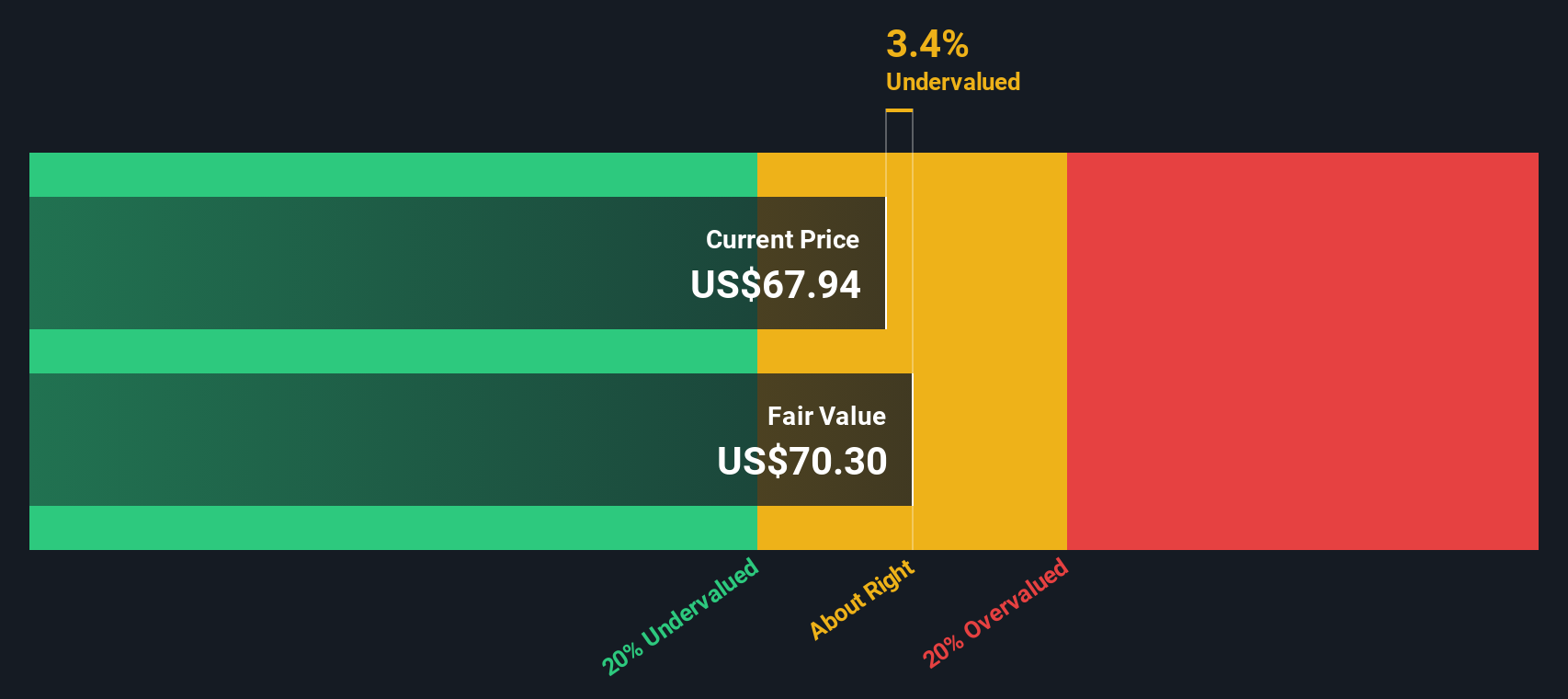

With Cisco trading at $73.69 and sitting at an estimated 12.09% intrinsic discount and 16.70% below its US$85.999 price target, you have to ask: is this a genuine entry point, or is the market already factoring in future growth?

Price-to-Earnings of 28.2x: Is it justified?

At a last close of US$73.69, Cisco is trading on a P/E of 28.2x, which screens as good value both against its own fair ratio and its peers.

The P/E multiple compares Cisco’s share price to its earnings per share, so it is a quick way to see how much investors are paying for each dollar of profit.

CSCO is flagged as good value based on its P/E of 28.2x versus an estimated fair P/E of 29.8x, which suggests the market price is slightly below the level the fair ratio model points to. Cisco also has high quality earnings and a Return on Equity of 22%, which can help explain why the earnings multiple is not at a steep discount.

Against the broader US Communications industry, Cisco’s 28.2x P/E is described as good value both versus the industry average and the peer average of 35.6x, so the stock changes hands at a lower earnings multiple than many comparable companies even after a strong multi year total return profile.

Explore the SWS fair ratio for Cisco Systems

Result: Price-to-Earnings of 28.2x (UNDERVALUED)

However, you also have to weigh risks such as slower revenue growth at 5.25% annually, as well as the possibility that tech hardware spending cycles cool sentiment further.

Find out about the key risks to this Cisco Systems narrative.

Another View: What Our DCF Model Suggests

Cisco screens as good value on its 28.2x P/E, and our DCF model also points to undervaluation, with the shares at US$73.69 versus an estimated future cash flow value of US$83.82. That is roughly a 12% gap, which raises a simple question: is the market being too cautious about Cisco’s cash generation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cisco Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 883 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cisco Systems Narrative

If you see the numbers differently or want to rely on your own view of Cisco, you can build a complete story in just a few minutes with Do it your way.

A great starting point for your Cisco Systems research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop at one company. Use the Simply Wall St Screener to spot fresh ideas before others notice them.

- Target growth potential early by reviewing these 3528 penny stocks with strong financials that already show stronger financials than many expect at this end of the market.

- Tap into long term tech themes by scanning these 24 AI penny stocks that are tied to artificial intelligence trends across multiple sectors.

- Focus on price and quality together by sifting through these 883 undervalued stocks based on cash flows that our models flag as trading below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSCO

Cisco Systems

Designs, develops, and sells technologies that help to power, secure, and draw insights from the internet in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Nova Ljubljanska Banka d.d. future looks bright with a profit margin change of 38%

Viohalco S.A. (VIO.AT): Greece's Leading Integrated Metals Processor

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!