- United States

- /

- Tech Hardware

- /

- NasdaqGS:CRSR

Could Corsair's (CRSR) Latest Hardware Releases Reinforce Its Premium Brand Position in Gaming?

Reviewed by Sasha Jovanovic

- In late September 2025, Corsair announced the global release of new VANGUARD PRO 96 and VANGUARD 96 gaming keyboards, the SABRE v2 PRO Ultralight Wireless Gaming Mouse, and the FRAME 4500X PC case, each featuring innovations in speed, customization, and advanced design for gamers and creators.

- These consecutive product launches emphasize Corsair's ongoing push to strengthen its presence in high-performance, premium gaming peripherals and PC hardware.

- We'll now assess how Corsair's latest push into modular, customizable hardware could influence its longer-term investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Corsair Gaming Investment Narrative Recap

To be a Corsair Gaming shareholder, one needs to believe that sustained innovation in high-performance gaming peripherals and PC hardware will drive revenue growth and margin expansion, despite ongoing losses and an uncertain profit timeline. While Corsair’s recent launches in modular keyboards, ultralight mice, and premium PC cases show focus on advanced, customizable products, the short-term impact on major revenue drivers, like upgrade cycles and core gaming demand, appears limited, and competitive pricing pressures remain a risk. The largest risk for now is still margin uncertainty tied to new and potential semiconductor tariffs and their effects on costs and profitability.

Corsair’s FRAME 4500X PC case stands out among the recent announcements, expanding its high-end modular component ecosystem for builders and creators, a move closely related to market catalysts such as increased upgrade activity spurred by new games and technology trends. The seamless integration with Corsair’s iCUE LINK platform supports not just user customization, but also higher attach rates for peripherals and accessories which could support the company’s efforts at margin and revenue improvement.

But on the other hand, investors should be aware that continued tariff uncertainty raises material questions about margin stability, especially if...

Read the full narrative on Corsair Gaming (it's free!)

Corsair Gaming's outlook anticipates $1.9 billion in revenue and $75.7 million in earnings by 2028. Achieving this would require a 10.6% annual revenue growth rate and a $159.8 million increase in earnings from the current level of -$84.1 million.

Uncover how Corsair Gaming's forecasts yield a $11.17 fair value, a 40% upside to its current price.

Exploring Other Perspectives

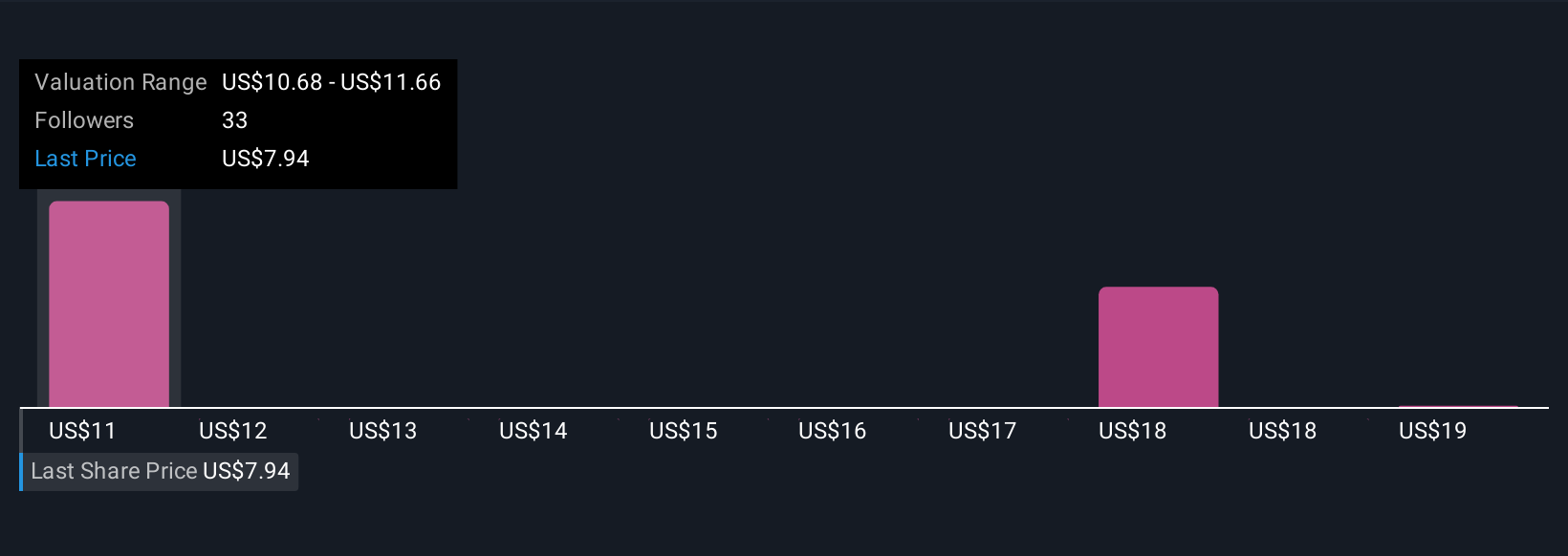

Six community estimates from the Simply Wall St Community put Corsair’s fair value between US$10.68 and US$20.44. With recent customizable product launches playing into rising hardware upgrade activity, consider how differing views reflect both enthusiasm and caution about Corsair’s near-term profitability and competitive pressures.

Explore 6 other fair value estimates on Corsair Gaming - why the stock might be worth over 2x more than the current price!

Build Your Own Corsair Gaming Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Corsair Gaming research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Corsair Gaming research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Corsair Gaming's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRSR

Corsair Gaming

Designs and sells gaming and streaming peripherals, components, and systems in Europe, the Middle East, North Africa, North America, Latin America, and the Asia Pacific.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives