- United States

- /

- IT

- /

- NasdaqGS:HCKT

Discovering Undiscovered Gems in the US This December 2024

Reviewed by Simply Wall St

The United States market has experienced a flat performance over the last week, but it has shown notable growth of 26% over the past year, with earnings projected to increase by 15% annually. In this context of steady expansion, identifying stocks that are not only poised for growth but also remain underappreciated can offer unique opportunities for investors seeking to capitalize on emerging potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Ceragon Networks (NasdaqGS:CRNT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ceragon Networks Ltd. offers wireless transport solutions to cellular operators and other wireless service providers across various regions including North America, Europe, Africa, the Asia Pacific, the Middle East, India, and Latin America with a market cap of $403.59 million.

Operations: Ceragon Networks generates revenue primarily from its wireless transport solutions, totaling $377.62 million. The company's financial performance is characterized by a focus on delivering innovative solutions to various global markets.

Ceragon Networks is making strides in the communications sector, with a focus on expanding in India and leveraging millimeter-wave technology. The company's recent earnings report highlights a significant increase, with third-quarter sales reaching US$102.67 million compared to US$87.26 million last year, and net income rising to US$12.22 million from US$3.37 million. Ceragon's debt-to-equity ratio has increased from 10.6% to 16% over five years, yet it remains profitable with interest payments well covered by EBIT at 140x coverage. Analysts project future earnings growth and set a price target range of $4.50 to $10 per share.

Hackett Group (NasdaqGS:HCKT)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Hackett Group, Inc. is an intellectual property-based executive advisory, strategic consulting, and digital transformation company operating in the United States, Europe, and internationally with a market cap of $886.03 million.

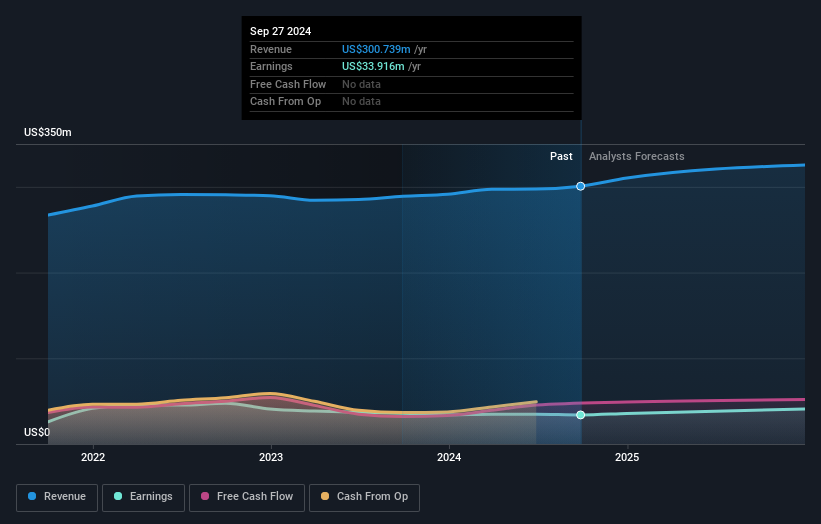

Operations: Hackett generates revenue primarily from its Global S&BT segment at $169.38 million, followed by Oracle Solutions at $86.53 million and SAP Solutions at $51.11 million.

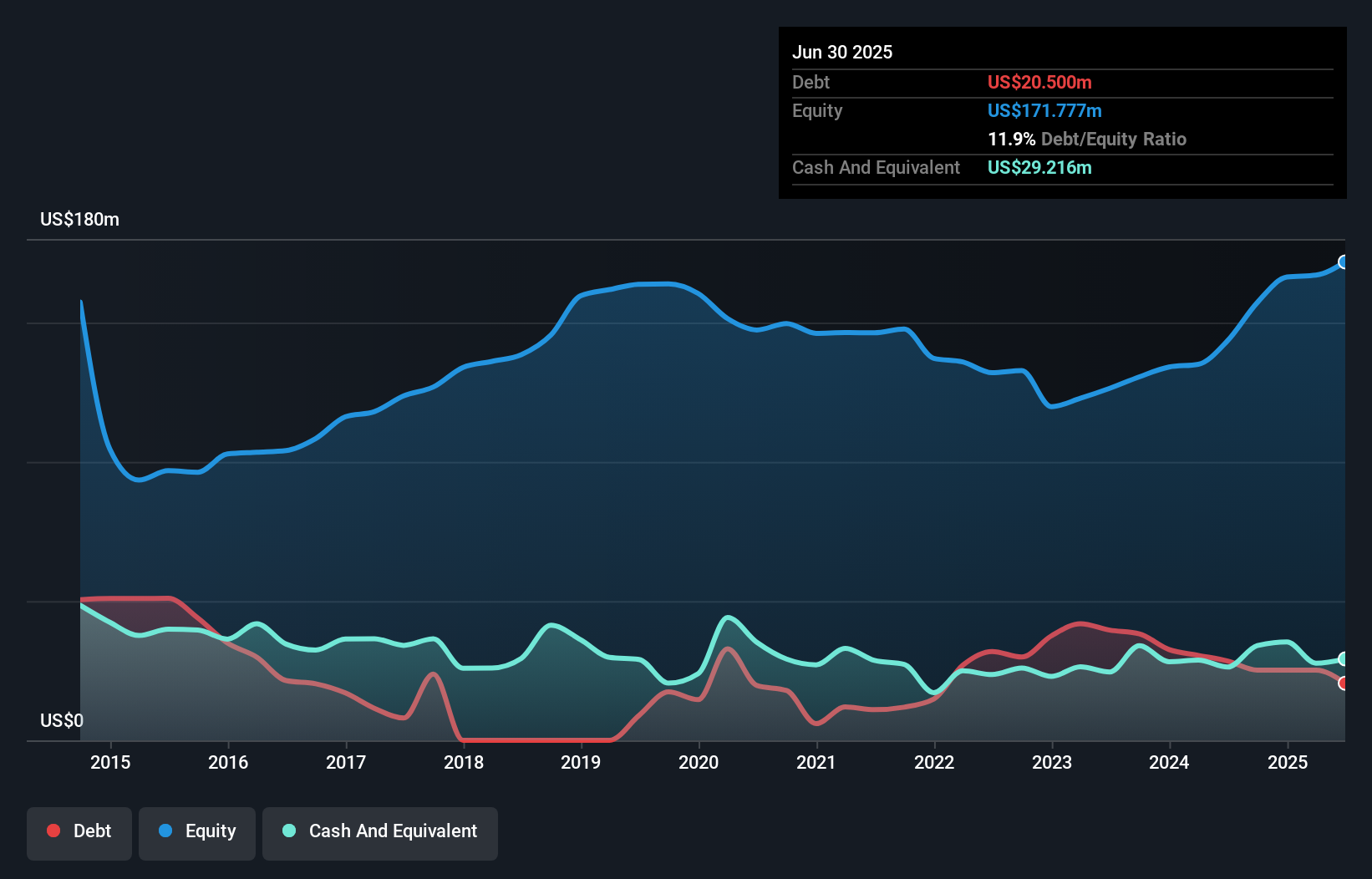

Hackett Group's strategic push into GenAI consulting and recent acquisitions are set to create high-margin revenue streams, enhancing its financial landscape. The company repurchased 64,887 shares worth US$1.74 million recently, reflecting active capital management. Despite a dip in net income to US$8.59 million for Q3 2024 from US$9.42 million the previous year, sales improved slightly to US$77.95 million from US$74.63 million year-on-year. With a satisfactory net debt to equity ratio of 8.8% and EBIT covering interest payments by 27 times, Hackett demonstrates robust financial health while navigating industry challenges like negative earnings growth of -5.9%.

Teekay (NYSE:TK)

Simply Wall St Value Rating: ★★★★★★

Overview: Teekay Corporation Ltd. provides crude oil and marine transportation services globally, with a market cap of approximately $536.68 million.

Operations: Teekay generates revenue primarily from its Teekay Tankers segment, which contributed $1.19 billion, and the Teekay Parent segment, which added $111.50 million.

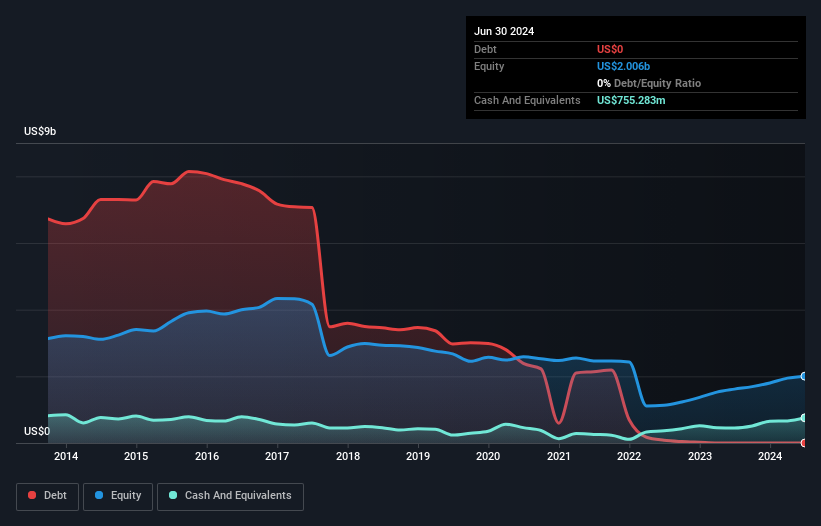

Teekay, a notable player in the oil and gas industry, stands out for its debt-free status, contrasting sharply with its past five-year debt-to-equity ratio of 122.8%. Despite recent earnings growth challenges at -6.8%, Teekay's free cash flow remains positive, hitting US$629.83 million as of September 2024. The company has been actively repurchasing shares, completing buybacks totaling US$25 million this year alone. Recent board changes aim to streamline operations with a focus on Teekay Tankers as the primary platform. Trading significantly below estimated fair value suggests potential upside for investors seeking undervalued opportunities in this sector.

- Delve into the full analysis health report here for a deeper understanding of Teekay.

Review our historical performance report to gain insights into Teekay's's past performance.

Seize The Opportunity

- Access the full spectrum of 239 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Hackett Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hackett Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HCKT

Hackett Group

Operates as an intellectual property platform-based generative artificial intelligence strategic consulting and executive advisory digital transformation in the United States, Europe, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives