Last Update 07 Aug 25

With both consensus revenue growth (2.7% p.a.) and future P/E (11.44x) estimates unchanged, analysts see no significant change in Hackett Group’s outlook, reflected in the steady price target of $28.33.

What's in the News

- Repurchased 176,507 shares for $4.32 million, completing 85.96% of buyback announced in 2002, totaling $285.45 million.

- Announced collaboration with Celonis to deliver enterprise automation solutions integrating AI and process intelligence, including the certification of Celonis process intelligence operating benchmark framework.

- Issued Q3 2025 revenue guidance of $73.0 million to $74.5 million.

- Increased equity buyback authorization by $13 million, raising the total available for future repurchases to $30 million.

Valuation Changes

Summary of Valuation Changes for Hackett Group

- The Consensus Analyst Price Target remained effectively unchanged, at $28.33.

- The Consensus Revenue Growth forecasts for Hackett Group remained effectively unchanged, at 2.7% per annum.

- The Future P/E for Hackett Group remained effectively unchanged, at 11.44x.

Key Takeaways

- Expanding AI-driven products, partnerships, and recurring revenue streams is set to accelerate growth, enhance margins, and increase pricing power.

- Investments in proprietary technology, client-focused innovation, and operational efficiency are driving stronger service delivery, larger pipelines, and improved earnings quality.

- Delays in Gen AI monetization, declining legacy revenues, execution risks, rising costs, and client uncertainty threaten margin growth, stability, and predictable revenue for Hackett Group.

Catalysts

About Hackett Group- Operates as an intellectual property platform-based generative artificial intelligence strategic consulting and executive advisory digital transformation in the United States, Europe, and internationally.

- The imminent full release and licensing of AI XPLR version 4, paired with ZBrain and a new JV focused on a SaaS platform, is poised to transform Hackett Group's revenue mix by unlocking high-margin, recurring licensing and ARR streams, which should drive faster revenue growth and boost operating/net margins.

- The accelerated adoption of Gen AI solutions across enterprise clients-evidenced by strong growth in Gen AI consulting, high client engagement, and a rising share of AI in new projects-is expected to expand Hackett's addressable market and result in a sustained, higher-value project pipeline, directly supporting top-line and earnings growth.

- Strategic alliances, such as the just-announced Celonis partnership and active discussions with additional channel partners, will enhance Hackett Group's access to large enterprise client bases and speed go-to-market for its differentiated Gen AI offerings, likely increasing new client acquisition and bolstering revenue growth.

- Ongoing investment in integrating proprietary IP, process intelligence, and Gen AI into advisory and benchmarking solutions-along with positive client feedback on recently launched features-positions Hackett Group to reinforce pricing power and margin expansion as clients increasingly require advanced, technology-enabled transformation support.

- Productivity improvements and cost efficiencies from Gen AI-assisted platforms (like Accelerator), coupled with targeted restructuring, are expected to improve service delivery margins and allow Hackett to redeploy resources towards higher-growth, higher-margin areas, strengthening overall earnings and margin trajectory.

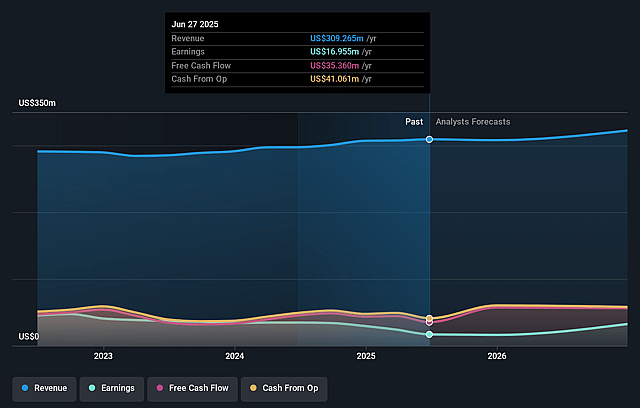

Hackett Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hackett Group's revenue will grow by 2.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.5% today to 16.4% in 3 years time.

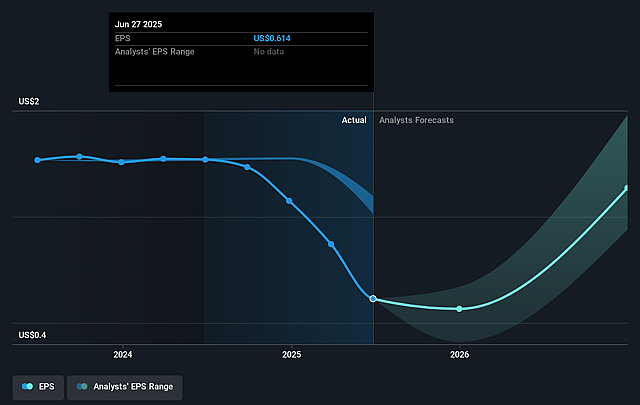

- Analysts expect earnings to reach $54.8 million (and earnings per share of $1.87) by about September 2028, up from $17.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.0x on those 2028 earnings, down from 34.0x today. This future PE is lower than the current PE for the US IT industry at 29.0x.

- Analysts expect the number of shares outstanding to decline by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.93%, as per the Simply Wall St company report.

Hackett Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged delays in licensing and monetization of key Gen AI platforms (like AI XPLR), as highlighted by management's acknowledgment that licensable products are still not released and prospects are taking longer than expected, could limit revenue growth and recurring ARR expansion in the near to medium term, negatively impacting topline growth.

- Ongoing weakness and uncertain recovery in core legacy segments such as Oracle Solutions and OneStream, with management projecting a 20%+ year-over-year decline for Oracle in Q3 and continued negative revenue impact from the inability to replace large engagements, suggest potential for flat or declining segment revenues and earnings volatility.

- Rising dependence on rapid innovation and pivot to Gen AI may pose operational and execution risks-if client adoption of proprietary solutions or new SaaS offerings lags, or if competitors outpace Hackett in feature development, this could threaten margin expansion and reduce the pricing power the company anticipates.

- Increasing SG&A expenses (up year-over-year as a percentage of revenues) and the need for restructuring charges, particularly as headcount is adjusted for AI productivity gains, highlight cost pressures and risks of sub-optimal utilization during project transitions, with potential negative impact on net margins and near-term profitability.

- Elevated client decision-making uncertainty, as seen in delayed project starts and shifting IT budgets, could persist as organizations navigate macro conditions and evolving Gen AI technology landscapes, which may result in continued lumpy demand, longer sales cycles, and unpredictable cash flow and revenue forecasts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $28.333 for Hackett Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $334.4 million, earnings will come to $54.8 million, and it would be trading on a PE ratio of 18.0x, assuming you use a discount rate of 8.9%.

- Given the current share price of $20.93, the analyst price target of $28.33 is 26.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Hackett Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.