- United States

- /

- Software

- /

- NasdaqGM:TLS

3 US Penny Stocks With Market Caps At Least $40M To Watch

Reviewed by Simply Wall St

The U.S. stock market has been navigating through mixed signals, with major indices like the Dow Jones and S&P 500 experiencing slight declines while the Nasdaq continues its upward trajectory. In such a fluctuating landscape, identifying promising investment opportunities becomes crucial. Penny stocks, often seen as remnants of past market eras, continue to offer intriguing possibilities due to their affordability and potential for growth when backed by solid financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7988 | $5.8M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.15 | $485.02M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $3.47 | $45.02M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.62 | $2.1B | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.42 | $147.91M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.77 | $114.05M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.57 | $52.63M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.63 | $137.99M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.09 | $96.23M | ★★★★★☆ |

Click here to see the full list of 752 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

iCAD (NasdaqCM:ICAD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: iCAD, Inc. provides cancer detection and therapy solutions in the United States with a market cap of approximately $49.81 million.

Operations: The company generates revenue from its Detection segment, which reported $18.80 million.

Market Cap: $49.81M

iCAD, Inc., with a market cap of approximately US$49.81 million, is navigating its unprofitable status by focusing on growth through innovative AI solutions for cancer detection. Despite recent shareholder dilution and high share price volatility, the company has made strides in expanding its ProFound Cloud platform globally, securing distribution partnerships and regulatory clearances in key markets like South Africa and the UAE. Revenue increased to US$5.03 million in Q2 2024 from US$4.17 million a year prior, while losses narrowed slightly over six months compared to the previous year, indicating gradual financial improvement amidst strategic expansion efforts.

- Click to explore a detailed breakdown of our findings in iCAD's financial health report.

- Examine iCAD's earnings growth report to understand how analysts expect it to perform.

Telos (NasdaqGM:TLS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Telos Corporation, along with its subsidiaries, offers cyber, cloud, and enterprise security solutions globally and has a market capitalization of approximately $275.30 million.

Operations: The company generates revenue from Secure Networks, contributing $58.41 million, and Security Solutions, which accounts for $76.95 million.

Market Cap: $275.3M

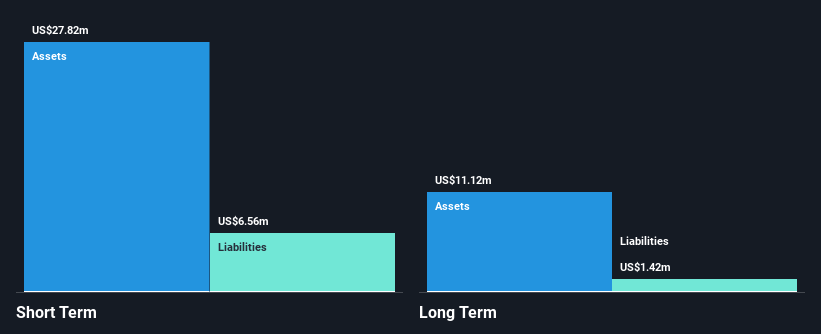

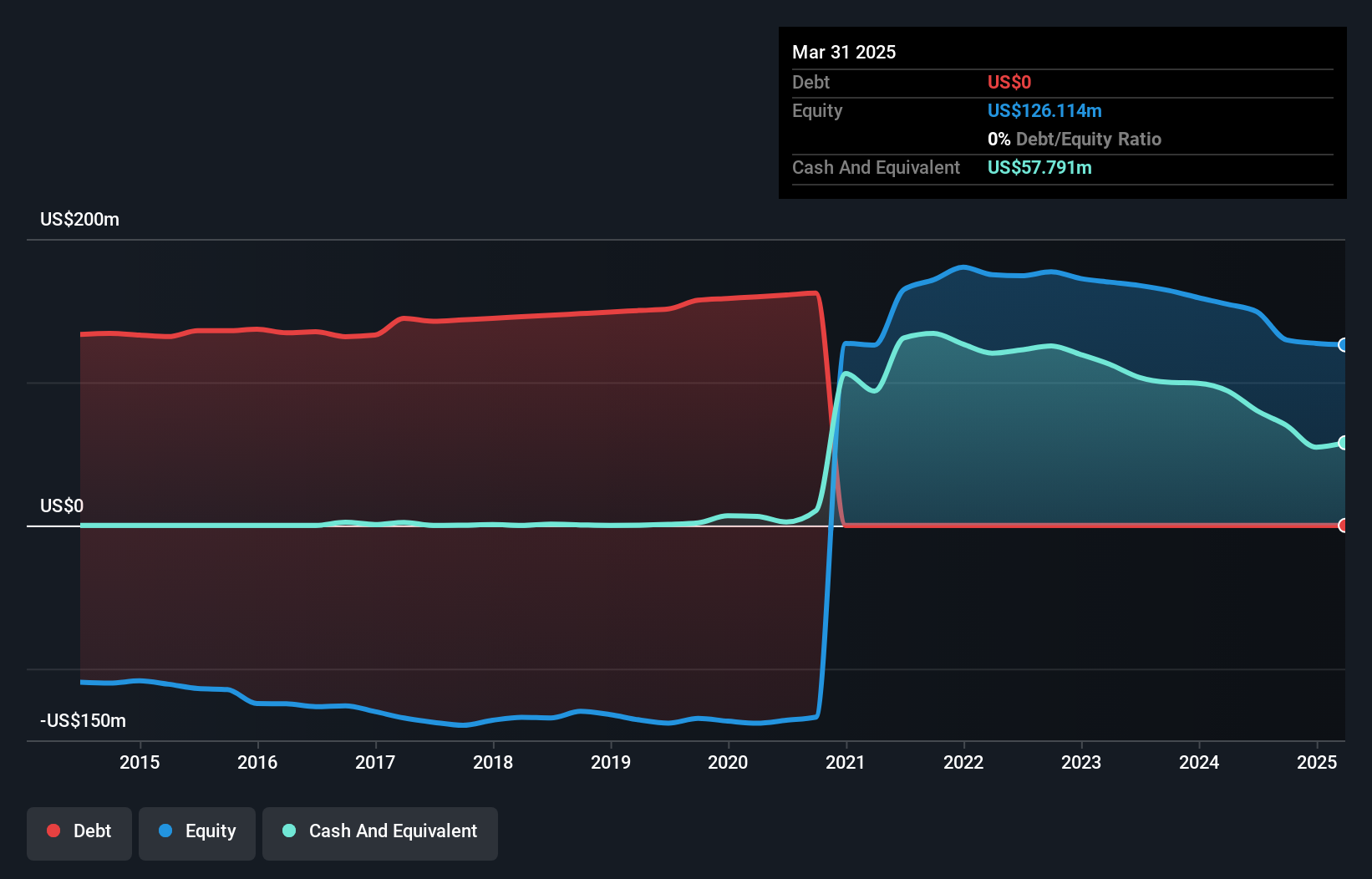

Telos Corporation, with a market cap of approximately US$275.30 million, is expanding its TSA PreCheck enrollment centers across the U.S., enhancing consumer convenience and potentially boosting revenue streams. Despite being debt-free and having sufficient short-term assets to cover liabilities, Telos remains unprofitable with increasing losses over five years. The company has experienced shareholder dilution and heightened share price volatility recently. Revenue from Secure Networks and Security Solutions totaled US$135.36 million, but forecasts suggest continued unprofitability for the next three years despite projected revenue growth of 20.57% annually, highlighting ongoing financial challenges amidst expansion efforts.

- Click here and access our complete financial health analysis report to understand the dynamics of Telos.

- Learn about Telos' future growth trajectory here.

Ceragon Networks (NasdaqGS:CRNT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ceragon Networks Ltd. offers wireless transport solutions for cellular operators and other wireless service providers across various global regions, with a market cap of $224.98 million.

Operations: The company generates $362.21 million in revenue from its role as a global innovator and leading solutions provider of wireless transport.

Market Cap: $224.98M

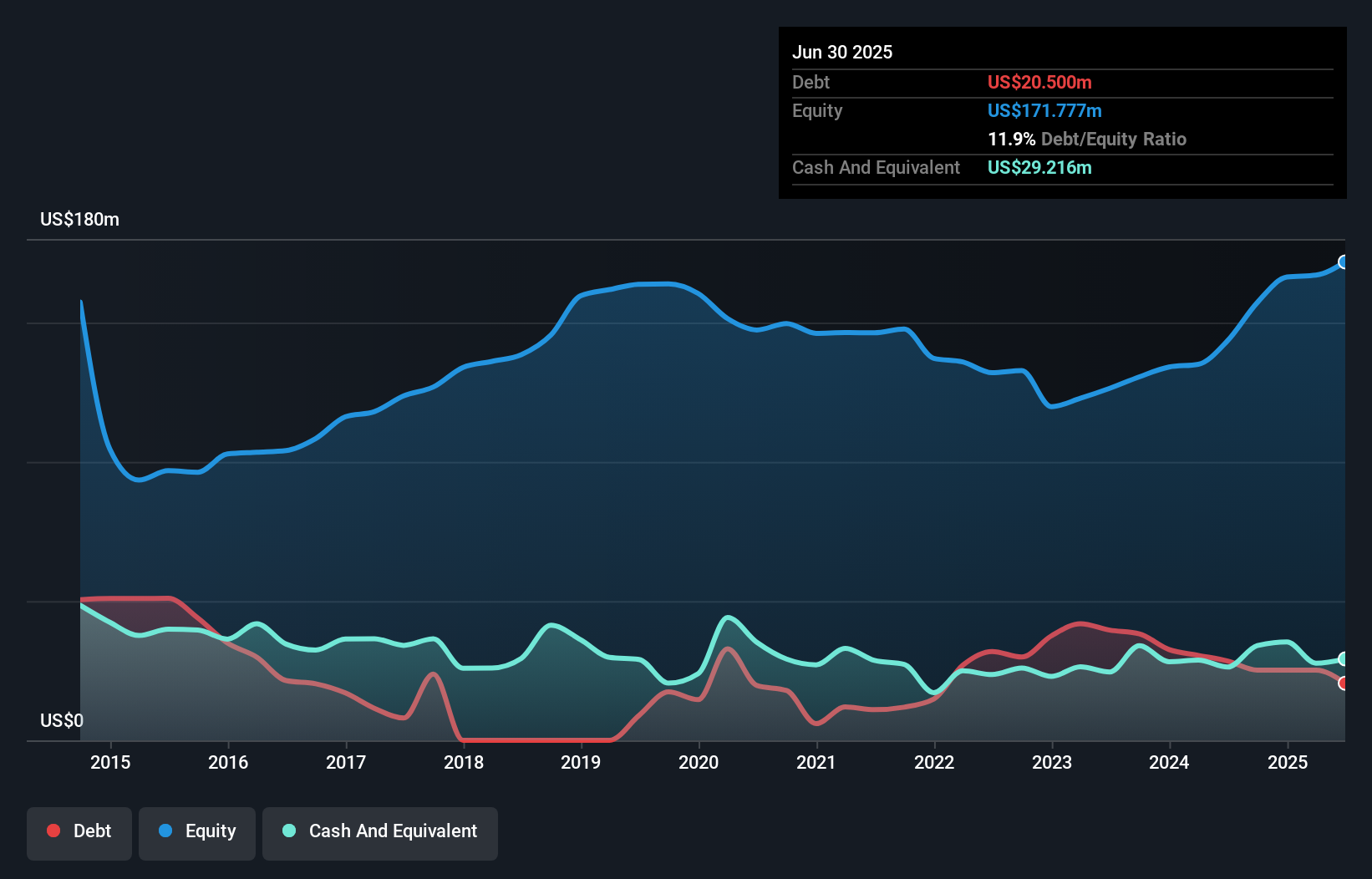

Ceragon Networks Ltd., with a market cap of US$224.98 million, has shown financial stability and growth in recent quarters. The company reported a significant increase in net income to US$7.83 million for Q2 2024 from US$2.09 million the previous year, reflecting its transition to profitability. Despite a low return on equity of 7.2%, Ceragon's interest payments are well covered by EBIT, indicating sound debt management with satisfactory net debt levels at 1.5%. Recent events include presentations at major industry conferences and filing a shelf registration for ordinary shares linked to an ESOP offering, suggesting strategic positioning for future opportunities.

- Dive into the specifics of Ceragon Networks here with our thorough balance sheet health report.

- Understand Ceragon Networks' earnings outlook by examining our growth report.

Seize The Opportunity

- Dive into all 752 of the US Penny Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TLS

Telos

Provides cyber, cloud, and enterprise security solutions in the United States and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives