- United States

- /

- Communications

- /

- NasdaqGS:COMM

Assessing CommScope After Its 200% Rally and Recent Earnings Report in 2025

Reviewed by Bailey Pemberton

If you have been eyeing CommScope Holding Company and wondering whether its recent rally is just another market blip or a sign of deeper value, you are not alone. Investors love a stock with momentum, and CommScope has certainly caught attention. Year to date, it has powered ahead by an impressive 200.8%, and over the past year, it sits up 166.2%. Admittedly, the last thirty days were a bit more volatile with a slip of 4.8%, but the past week already saw a 3.1% rebound, suggesting traders are watching closely for their next cue. Over a five-year stretch, shareholders have enjoyed gains of 65.6%, showing the company’s story is as much about endurance as it is about rapid growth.

This kind of price action often reflects shifting sentiment about growth potential and risk, especially when weighed alongside broader market shifts. As investors recalibrate their expectations after industry changes and evolving demand for network infrastructure, CommScope’s valuation remains front and center. Notably, the company scores a 4 out of 6 on our value checklist. This means it’s undervalued in a strong majority of key metrics, but not across the board.

With so much movement in the share price and a valuation score that catches the eye, how can you tell if CommScope is truly undervalued, fairly priced, or something else entirely? Let’s dive into the most common valuation methods to see where the company stands right now, and keep reading for an even more insightful way to think about value by the end of this article.

Approach 1: CommScope Holding Company Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future cash flows and then discounts those amounts back to reflect their value in today’s dollars. This approach aims to estimate what a business is truly worth based on its ability to generate cash in the years ahead.

For CommScope Holding Company, the most recent Free Cash Flow (FCF) stands at $236.8 million. Analyst estimates provide forecasts for the next several years, and after five years, projections are extrapolated. By 2027, FCF is expected to reach $717 million; a decade from now (2035), the projections extend to approximately $1.51 billion, though in today’s dollars this is discounted to $472.9 million. All figures are reported in $USD, which matches the listing currency.

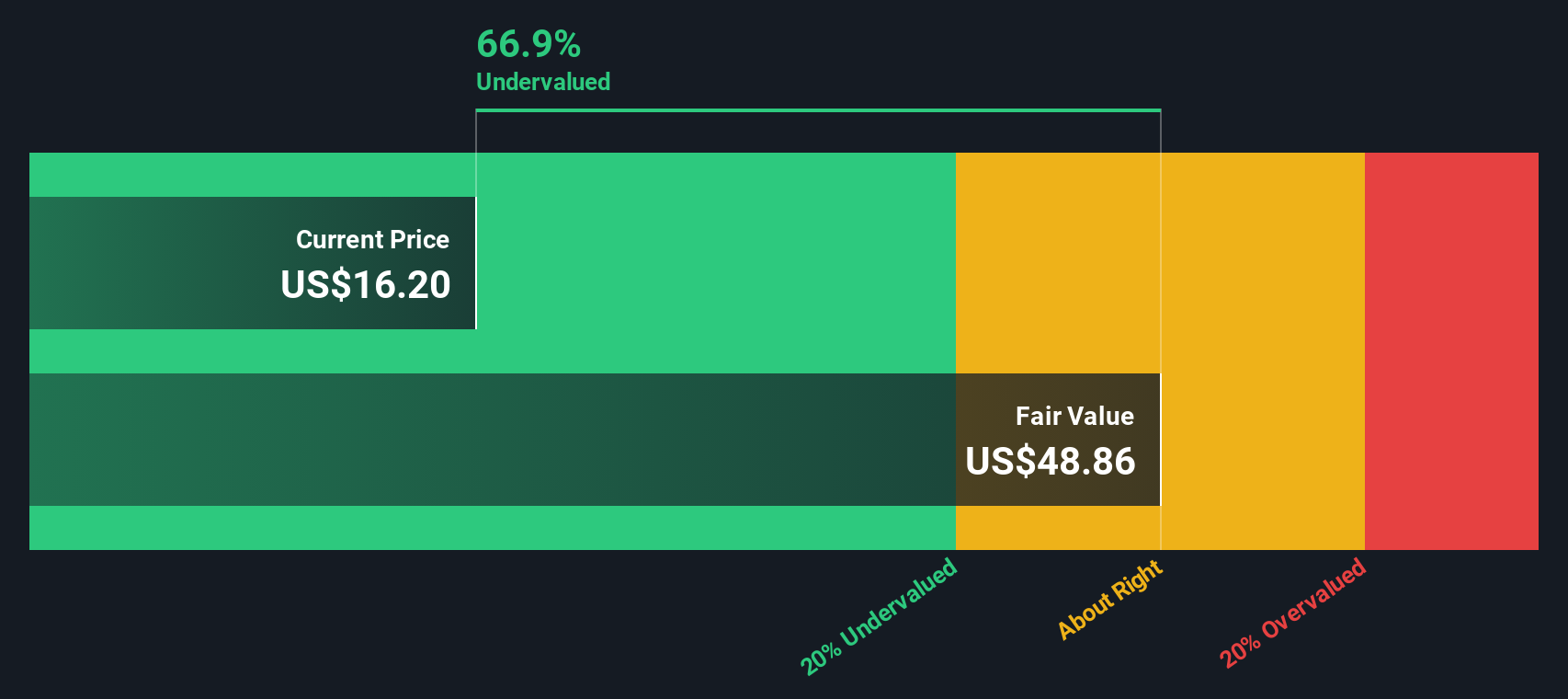

Using this cash flow trajectory, the DCF model places an intrinsic value of $48.86 per share on CommScope. This implies that the stock is trading at a 68.2% discount to its fair value. In other words, the market price is well below what the projected cash flows suggest it should be.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CommScope Holding Company is undervalued by 68.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: CommScope Holding Company Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used to value profitable companies because it directly relates a stock’s price to its ability to generate profits. A lower PE ratio can indicate that a stock is undervalued, provided that profits are solid and sustainable. A higher PE may suggest the opposite, unless justified by high growth or low risk. Ultimately, how high or low a fair PE should be depends on factors such as expected earnings growth, the company’s risk profile, and the overall trajectory of its industry.

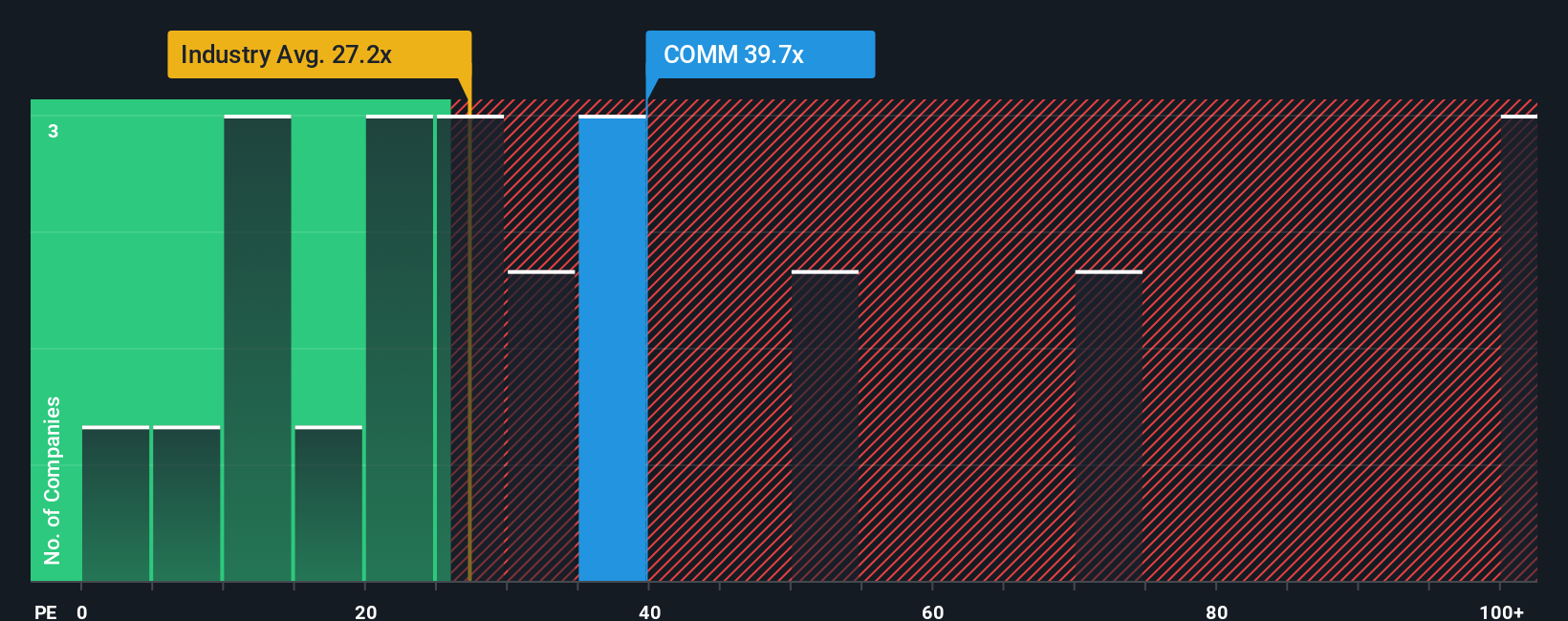

Currently, CommScope trades at a PE ratio of 38.07x. This is almost in line with the peer average of 38.71x and noticeably above the broader communications industry average of 30.71x. At a glance, the company appears to be valued similarly to its closest direct competitors, despite having a higher multiple than the industry overall.

However, just looking at peer and industry averages does not paint the full picture. Simply Wall St’s proprietary “Fair Ratio” refines this traditional approach by accounting for CommScope’s unique earnings growth prospects, profit margins, scale, and risk relative to industry peers. For CommScope, the Fair Ratio stands at 24.40x, which is considerably lower than both its actual PE and peer averages. Since the current PE is well above the Fair Ratio, this suggests the stock is trading above its justified value based on fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CommScope Holding Company Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. Narratives are a simple, powerful tool that let you build and share your own story behind CommScope Holding Company by linking your assumptions about future revenue, margins, and fair value directly to the company's financial outlook. Rather than just looking at the numbers, Narratives connect the company's business trajectory, industry shifts, and your unique insights to a dynamic forecast and a fair value estimate. This makes it easier to see how your perspective stacks up.

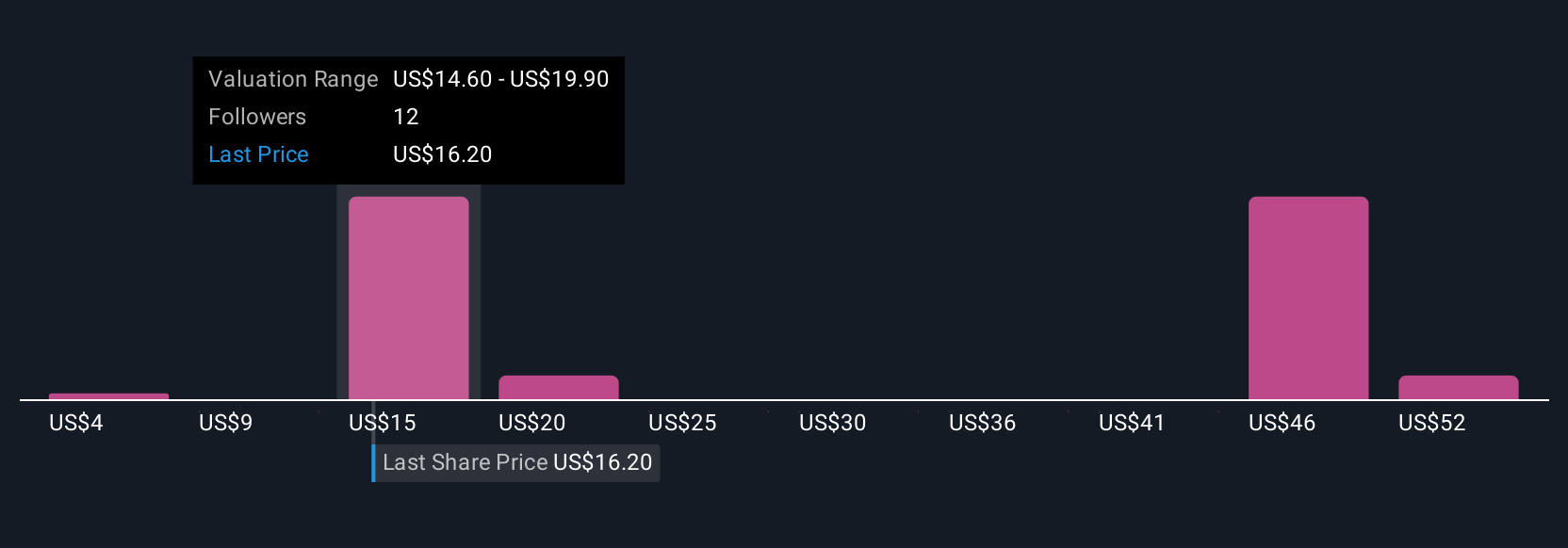

On Simply Wall St's Community page, millions of investors use Narratives to decide when to buy or sell by comparing their estimated Fair Value to the current Price. These Narratives automatically update as new news or earnings come in. For example, one investor may expect CommScope to thrive as next-gen broadband and enterprise networking ramps up, which leads them to assign a higher fair value and stronger growth assumptions. Another might be cautious due to the company’s reliance on less predictable segments after recent divestitures and therefore forecast lower future revenues and a more conservative fair value. Narratives help you turn your personal view into a confident, data-backed decision.

Do you think there's more to the story for CommScope Holding Company? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COMM

CommScope Holding Company

Provides infrastructure solutions for communications, data center, and entertainment networks.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives