- United States

- /

- Communications

- /

- NasdaqGS:CMTL

Comtech (CMTL) Q1 Loss Deepens, Reinforcing Bearish Narratives on Profitability Turnaround

Reviewed by Simply Wall St

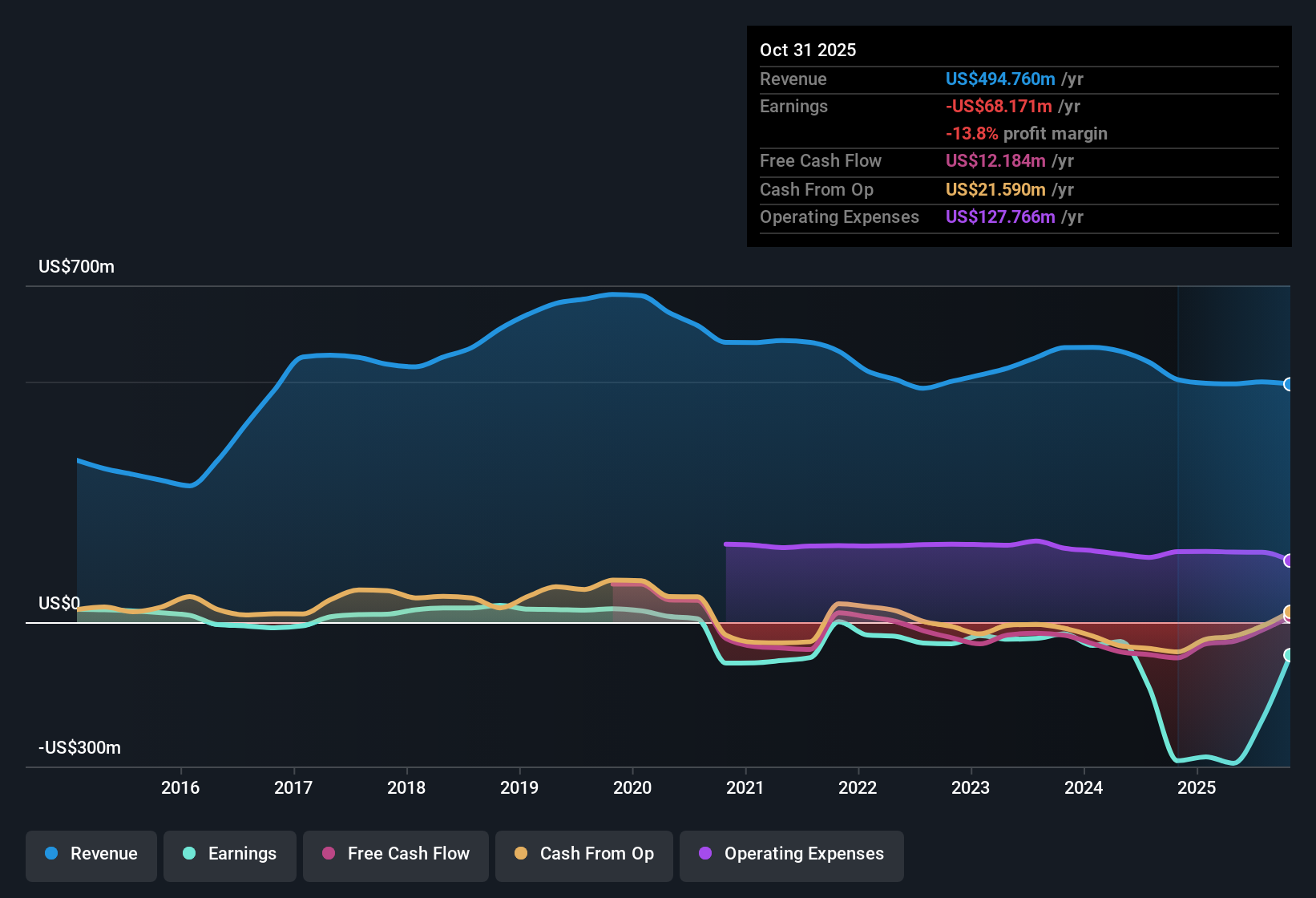

Comtech Telecommunications (CMTL) opened fiscal Q1 2026 with revenue of about $111 million and a basic EPS loss of roughly $0.67, putting margins firmly in the red for the quarter. The company has seen quarterly revenue move around the low $100 million range in recent periods, from about $116 million in Q1 2025 to $130 million in Q4 2025 before landing at $111 million this quarter. Basic EPS has stayed negative throughout, ranging from a steep $5.29 loss a year ago to a $0.39 loss last quarter and $0.67 this time, so the market is likely to read these results as another chapter in a margin compression story rather than a clean reset.

See our full analysis for Comtech Telecommunications.With the latest numbers on the table, the next step is to see how this quarter’s margin picture lines up with the dominant narratives around Comtech’s growth prospects and long road back to profitability.

See what the community is saying about Comtech Telecommunications

Five year losses worsening at 33.7 percent a year

- Over the last five years, Comtech’s losses have grown at an average rate of 33.7 percent per year, and for Q1 2026 the company reported a net loss of about 19.8 million dollars on 111.0 million dollars of revenue.

- Bears argue that this pattern shows a business structurally struggling to fix its cost base, and the recent numbers line up with that concern.

- On a trailing twelve month basis, net loss was about 17.0 million dollars on 494.8 million dollars of revenue, and the company is not forecast to be profitable at any point over the next three years.

- Earnings are also projected to decline at roughly 45.6 percent per year while revenue is expected to shrink about 2.8 percent per year. This supports the bearish view that the profit line is moving the wrong way even before any macro shock is considered.

Trailing losses shrink from 204 point 3 to 17 point 0 million dollars

- Comtech’s trailing twelve month net loss narrowed from about 204.3 million dollars at Q4 2025 to 17.0 million dollars by Q1 2026, even though revenue over that window dipped slightly from 499.5 million to 494.8 million dollars.

- Supporters of the bullish narrative point to this swing as evidence that the transformation plan and capital actions may be starting to show up in the numbers, but it also highlights how much execution is still required.

- Consensus commentary notes that operational improvements, cost management and a 40 million dollar capital infusion are intended to lift profitability and cut interest expense. This fits with the sharp reduction in trailing losses versus the prior year.

- At the same time, the Satellite and Space segment still needs a turnaround and the company has already breached financial covenants, so the reduced trailing loss does not yet overturn the broader track record of weak earnings.

Cheap valuation against weak growth outlook

- At a share price of 3.06 dollars, Comtech trades on a price to sales ratio of about 0.2 times, well below the peer average of 0.9 times and the wider US communications industry at 2.0 times, while a DCF fair value of about 4.39 dollars sits roughly 30 percent above the current price.

- Analysts’ consensus view treats this discount as a potential opportunity, but only if the business can beat the muted growth and loss forecasts baked into current models.

- Forecasts call for revenue to edge down about 2.8 percent per year over the next three years and for earnings to fall about 45.6 percent per year on average. This helps explain why the stock might stay cheap despite the 6.00 dollar analyst price target.

- The valuation gap, both versus peers and versus the DCF fair value, therefore hinges on whether the transformation efforts and strategic moves can eventually deliver the kind of margin lift that is not yet visible in the current loss making profile.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Comtech Telecommunications on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers in a different light, and turn that view into your own narrative in just a few minutes with Do it your way.

A great starting point for your Comtech Telecommunications research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Comtech’s deep, persistent losses, shrinking revenue outlook and covenant breaches underline how fragile its balance sheet and overall financial health remain.

If that kind of pressure makes you uneasy, use our solid balance sheet and fundamentals stocks screener (1944 results) today to focus on companies with stronger finances, lower leverage and healthier cushions against shocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMTL

Comtech Telecommunications

Provides critical communications technology and solutions in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)