- United States

- /

- Communications

- /

- NasdaqGM:CMBM

Discover 3 US Penny Stocks With Market Caps Under $400M

Reviewed by Simply Wall St

As the U.S. market attempts to rebound from a recent selloff, investors are closely monitoring economic indicators that could influence interest rate decisions. In this context, penny stocks—typically smaller or newer companies—remain an intriguing investment area despite being a somewhat outdated term. These stocks can offer hidden value and growth potential when backed by strong financials, and we'll explore three such companies that stand out for their balance sheet resilience and potential for long-term success.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7975 | $5.81M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.39 | $1.85B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $105.8M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.9352 | $11.7M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.32 | $11.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.57 | $48.06M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.63 | $32.99M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.02 | $93.54M | ★★★★★☆ |

Click here to see the full list of 724 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Cambium Networks (NasdaqGM:CMBM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cambium Networks Corporation, along with its subsidiaries, designs, develops, and manufactures wireless broadband and Wi-Fi networking infrastructure solutions with a market cap of $26.13 million.

Operations: The company's revenue is primarily generated from its Computer Networks segment, which accounts for $172.22 million.

Market Cap: $26.13M

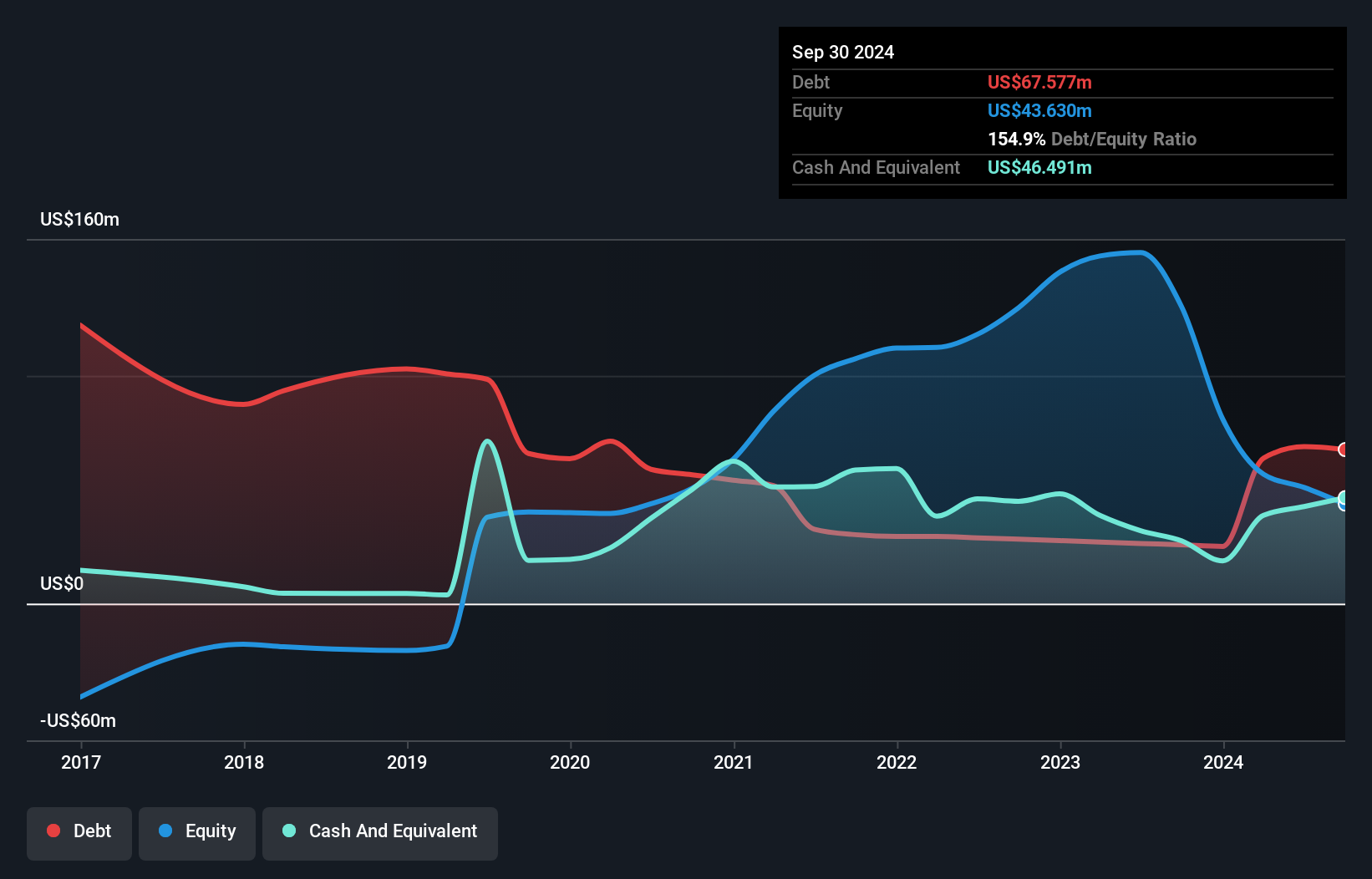

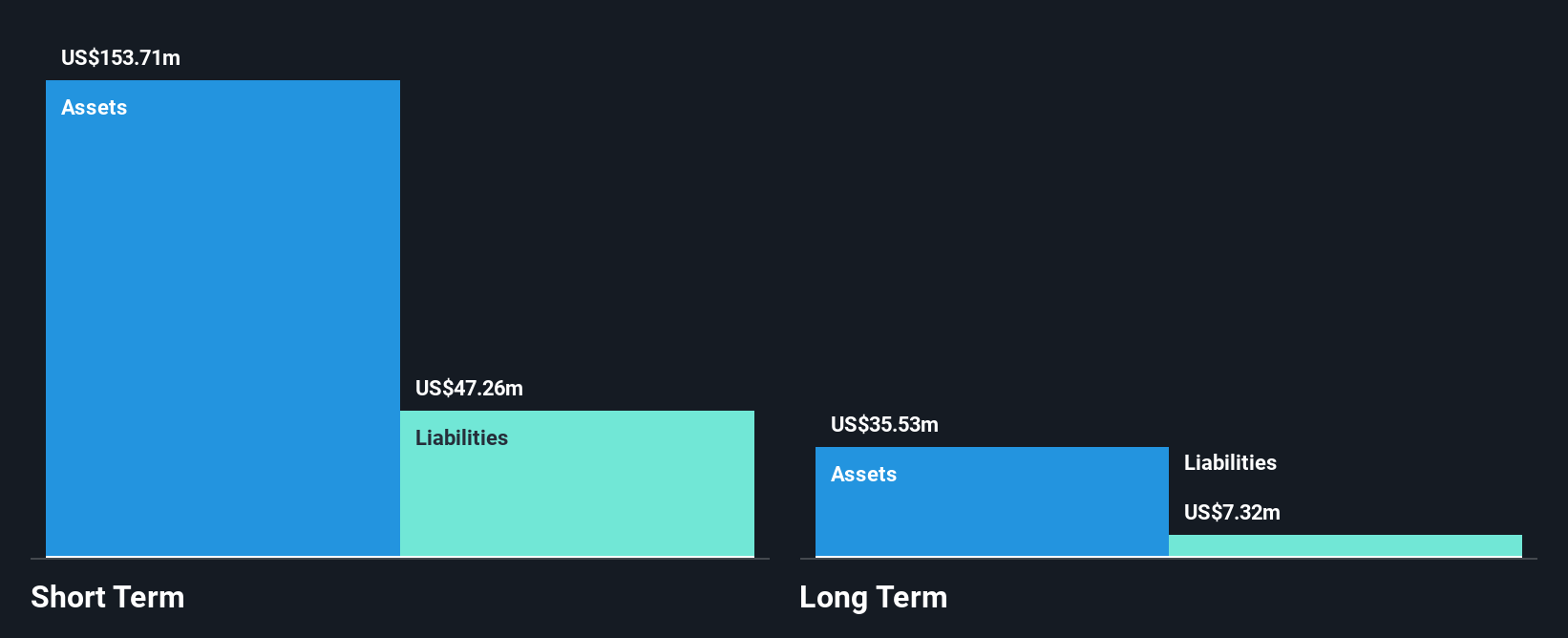

Cambium Networks, with a market cap of US$26.13 million, is navigating challenges typical of penny stocks. Despite being unprofitable and having a negative return on equity, its revenue from the Computer Networks segment reached US$172.22 million. Recent financials show a net loss reduction to US$9.68 million for Q3 2024, down from US$26.2 million the previous year, indicating some improvement in financial management under seasoned leadership with an average tenure of 8.1 years. The company has sufficient cash runway for over two years and maintains short-term assets exceeding both short- and long-term liabilities.

- Get an in-depth perspective on Cambium Networks' performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Cambium Networks' future.

Expensify (NasdaqGS:EXFY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Expensify, Inc. offers a cloud-based expense management software platform for individuals and businesses of all sizes globally, with a market cap of approximately $309.59 million.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $137.44 million.

Market Cap: $309.59M

Expensify, Inc., with a market cap of US$309.59 million, is currently unprofitable and faces challenges typical of penny stocks. Despite this, it has managed to reduce its net loss significantly to US$2.2 million in Q3 2024 from US$17 million the previous year, suggesting some operational improvements. The company maintains a strong balance sheet with short-term assets of US$138.5 million exceeding both short- and long-term liabilities. Recent share buybacks indicate management's confidence in the company's valuation, having repurchased 1.83 million shares for US$11.12 million since May 2022 under its buyback program.

- Click to explore a detailed breakdown of our findings in Expensify's financial health report.

- Gain insights into Expensify's future direction by reviewing our growth report.

Fossil Group (NasdaqGS:FOSL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fossil Group, Inc., along with its subsidiaries, designs, develops, markets, and distributes consumer fashion accessories globally and has a market cap of approximately $1 billion.

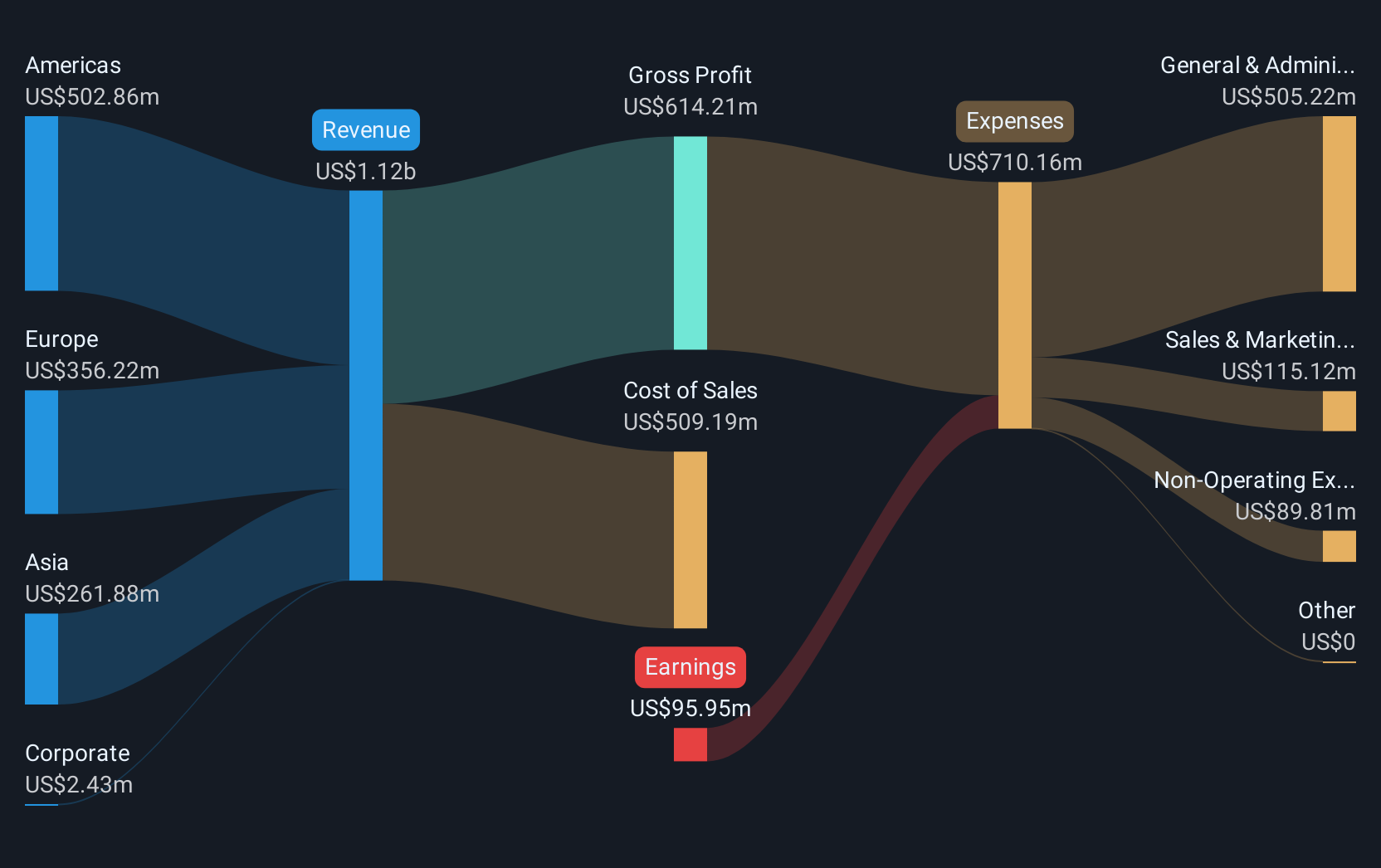

Operations: The company's revenue is derived from several regions, with $280.60 million from Asia, $386.37 million from Europe, and $554.52 million from the Americas, along with a corporate segment contributing $2.47 million.

Market Cap: $100M

Fossil Group, Inc., with a market cap of approximately US$1 billion, remains unprofitable but has shown some financial resilience typical of penny stocks. Despite a decline in sales to US$287.82 million for Q3 2024 from US$344.12 million the previous year, its net loss narrowed significantly to US$32.03 million from US$61.06 million, indicating cost management efforts. The company maintains sufficient liquidity with short-term assets exceeding liabilities and has a cash runway extending over three years despite shrinking free cash flow. Recent earnings guidance reflects challenges such as consumer softness and strategic exits impacting revenue expectations for 2024.

- Dive into the specifics of Fossil Group here with our thorough balance sheet health report.

- Gain insights into Fossil Group's past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Jump into our full catalog of 724 US Penny Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CMBM

Cambium Networks

Designs, develops, and manufactures fixed wireless, fiber broadband, and enterprise networking infrastructure solutions in North America, Europe, the Middle East, Africa, the Caribbean and Latin America, and the Asia Pacific.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.