- United States

- /

- Communications

- /

- NasdaqGM:CLFD

Top Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market experiences a period of relative stability, with the S&P 500 aiming to extend its winning streak and investor sentiment buoyed by recent trade developments between the U.S. and China, attention turns to growth companies that stand out through strong insider ownership. In times of economic confidence, stocks with high insider ownership can be appealing as they often reflect management's belief in the company's potential for sustained growth and resilience against market fluctuations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.1% | 37.4% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| AST SpaceMobile (NasdaqGS:ASTS) | 13.4% | 64.6% |

| FTC Solar (NasdaqCM:FTCI) | 27.9% | 61.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.1% | 44.8% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| BBB Foods (NYSE:TBBB) | 16.2% | 30.2% |

| Enovix (NasdaqGS:ENVX) | 12.1% | 58.4% |

| Upstart Holdings (NasdaqGS:UPST) | 12.5% | 102.6% |

Let's explore several standout options from the results in the screener.

Clearfield (NasdaqGM:CLFD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Clearfield, Inc. manufactures and sells various fiber connectivity products both in the United States and internationally, with a market cap of approximately $518.25 million.

Operations: The company's revenue primarily comes from its Clearfield segment, generating $140.25 million, and Nestor Cables, contributing $40.16 million.

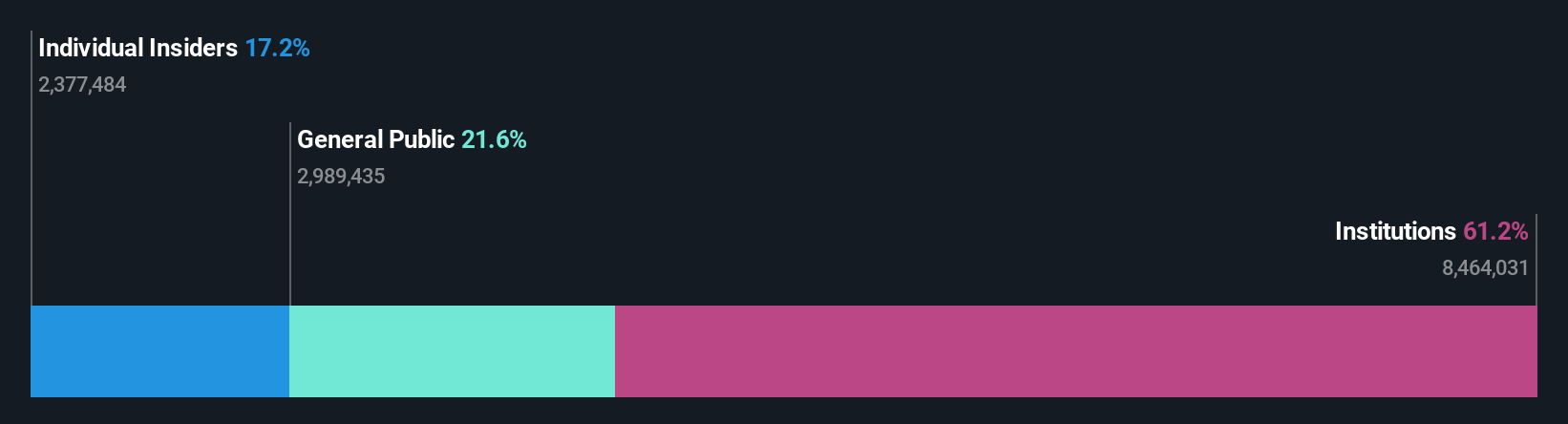

Insider Ownership: 17.2%

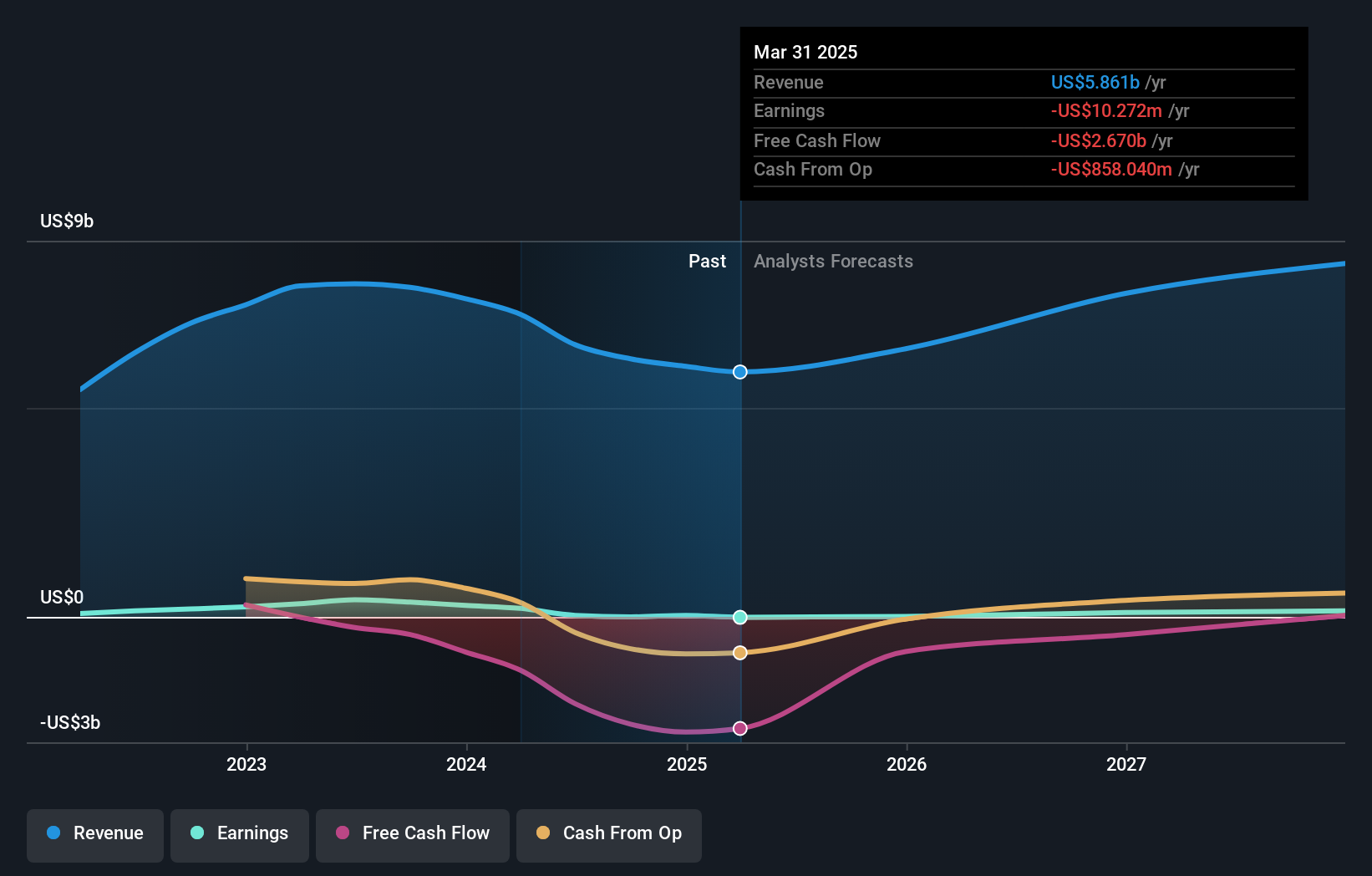

Clearfield has experienced significant insider selling recently, though insiders have bought more shares than sold over the past three months. The company reported strong second-quarter sales of US$47.17 million, up from US$36.91 million a year ago, and a net income turnaround to US$1.33 million from a prior loss. Clearfield's revenue is expected to grow at 10.7% annually, outpacing the broader U.S. market forecast of 8.5%.

- Click here to discover the nuances of Clearfield with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Clearfield's current price could be inflated.

Canadian Solar (NasdaqGS:CSIQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Canadian Solar Inc. operates globally, offering solar energy and battery storage products and solutions, with a market cap of approximately $715.82 million.

Operations: Canadian Solar Inc. generates revenue through its provision of solar energy and battery storage products and solutions across Asia, the Americas, Europe, and other international markets.

Insider Ownership: 20.9%

Canadian Solar's recent earnings report showed a net loss of US$33.97 million for Q1 2025, contrasting with a profit the previous year, and sales decreased to US$1.2 billion from US$1.3 billion. Despite this, revenue is projected to grow at 12.9% annually, outpacing the broader U.S. market forecast of 8.6%. The company trades significantly below its estimated fair value and has launched innovative products like SolBank 3.0 Plus to enhance energy storage solutions.

- Click to explore a detailed breakdown of our findings in Canadian Solar's earnings growth report.

- In light of our recent valuation report, it seems possible that Canadian Solar is trading behind its estimated value.

WK Kellogg Co (NYSE:KLG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: WK Kellogg Co is a food company operating in the United States, Canada, Mexico, and the Caribbean with a market cap of approximately $1.49 billion.

Operations: The company's revenue primarily comes from the manufacturing, marketing, and sales of cereal products, totaling $2.66 billion.

Insider Ownership: 12.3%

WK Kellogg Co's earnings are expected to grow significantly at 27.3% annually, outpacing the broader U.S. market, despite a forecasted decline in revenue by 0.3% per year. The company trades well below its estimated fair value but faces challenges with declining profit margins and high debt levels relative to operating cash flow. Recent earnings showed a drop in net income to US$18 million from US$33 million, prompting lowered sales growth guidance for 2025.

- Take a closer look at WK Kellogg Co's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, WK Kellogg Co's share price might be too pessimistic.

Where To Now?

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 191 more companies for you to explore.Click here to unveil our expertly curated list of 194 Fast Growing US Companies With High Insider Ownership.

- Interested In Other Possibilities? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Clearfield, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CLFD

Clearfield

Manufactures and sells various fiber connectivity products in the United States and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives