- United States

- /

- Communications

- /

- NasdaqGM:CLFD

3 Stocks That May Be Undervalued In May 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.6% decline, yet it remains up by 9.1% over the past year with earnings projected to grow by 14% annually. In this context of fluctuating market conditions and promising earnings forecasts, identifying stocks that may be undervalued could offer potential opportunities for investors seeking value in their portfolios.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Mid Penn Bancorp (NasdaqGM:MPB) | $26.65 | $52.26 | 49% |

| Burke & Herbert Financial Services (NasdaqCM:BHRB) | $55.38 | $108.54 | 49% |

| Super Group (SGHC) (NYSE:SGHC) | $8.41 | $16.48 | 49% |

| UMH Properties (NYSE:UMH) | $16.47 | $32.47 | 49.3% |

| Advanced Flower Capital (NasdaqGM:AFCG) | $4.72 | $9.39 | 49.7% |

| Excelerate Energy (NYSE:EE) | $28.93 | $57.38 | 49.6% |

| TXO Partners (NYSE:TXO) | $15.30 | $29.94 | 48.9% |

| ZEEKR Intelligent Technology Holding (NYSE:ZK) | $29.17 | $57.37 | 49.2% |

| FinWise Bancorp (NasdaqGM:FINW) | $14.445 | $28.38 | 49.1% |

| Clearfield (NasdaqGM:CLFD) | $38.30 | $74.77 | 48.8% |

Let's uncover some gems from our specialized screener.

Clearfield (NasdaqGM:CLFD)

Overview: Clearfield, Inc. manufactures and sells fiber connectivity products both in the United States and internationally, with a market cap of approximately $529.73 million.

Operations: The company generates revenue from its Clearfield segment, contributing $140.25 million, and the Nestor Cables segment, adding $40.16 million.

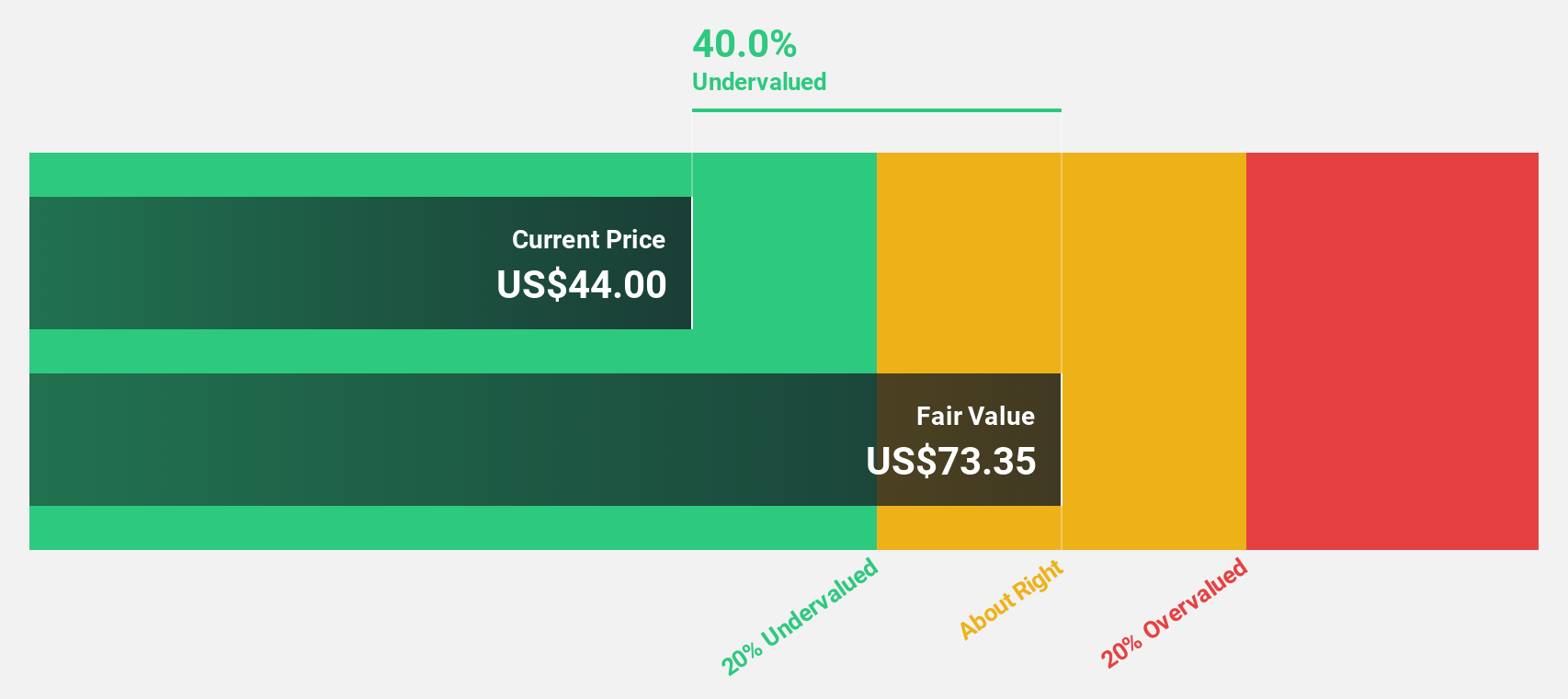

Estimated Discount To Fair Value: 48.8%

Clearfield, Inc. appears undervalued based on cash flows, trading at US$38.3, significantly below its estimated fair value of US$74.77. Recent earnings results show a turnaround with net income of US$1.33 million for Q2 2025 compared to a loss last year and improved sales figures. Analysts expect annual profit growth above market averages over the next three years, despite revenue growth forecasts being moderate at 10.7% per year.

- Our expertly prepared growth report on Clearfield implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Clearfield here with our thorough financial health report.

Rapid7 (NasdaqGM:RPD)

Overview: Rapid7, Inc. offers cybersecurity software and services through its Rapid7, Nexpose, and Metasploit brands, with a market cap of $1.47 billion.

Operations: The company's revenue is primarily derived from its Security Software & Services segment, which generated $849.16 million.

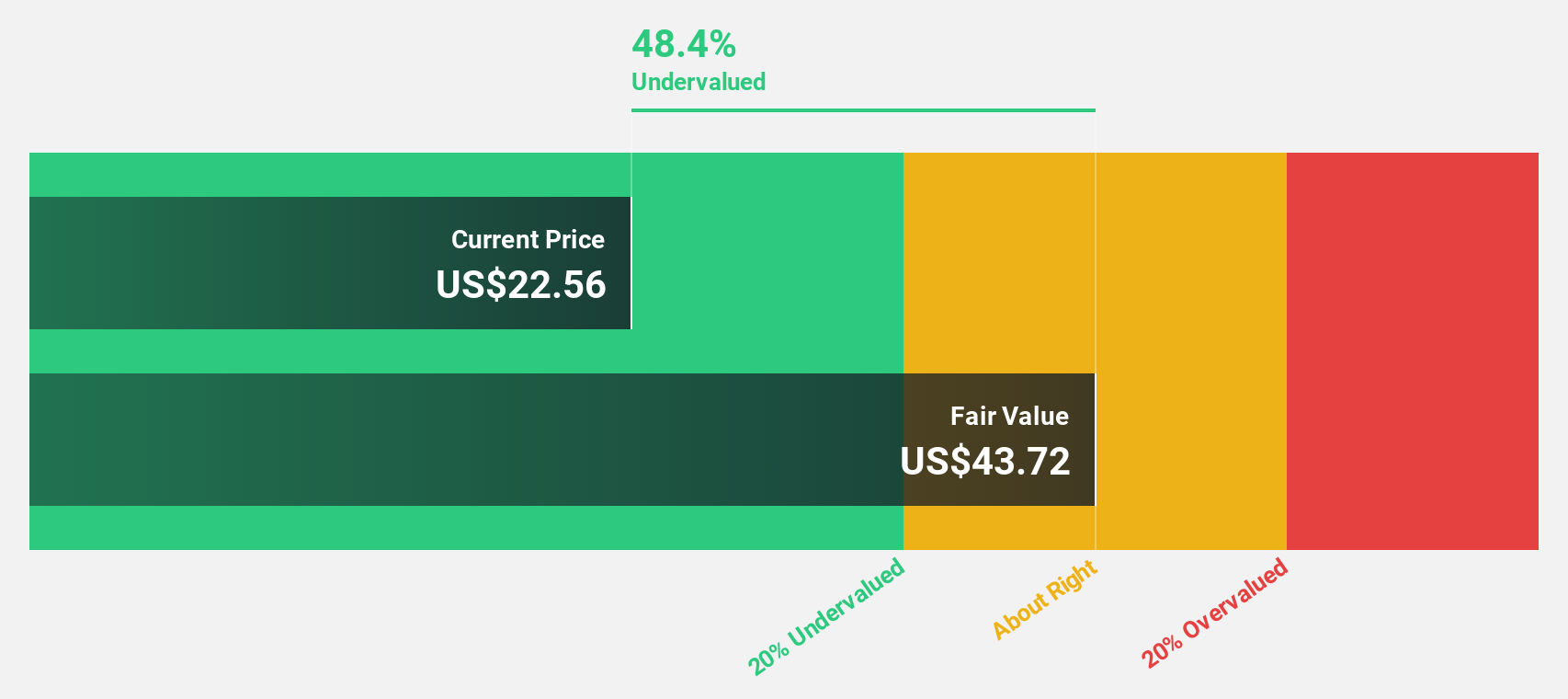

Estimated Discount To Fair Value: 45.8%

Rapid7 is trading at US$22.96, significantly below its estimated fair value of US$42.38, highlighting potential undervaluation based on cash flows. The company recently became profitable and forecasts indicate earnings growth of 26.1% annually, outpacing the broader US market despite slower revenue growth projections. However, debt coverage by operating cash flow remains inadequate, necessitating careful consideration of financial health amidst promising profit forecasts and strategic product enhancements in cybersecurity solutions.

- Our earnings growth report unveils the potential for significant increases in Rapid7's future results.

- Take a closer look at Rapid7's balance sheet health here in our report.

SmartStop Self Storage REIT (NYSE:SMA)

Overview: SmartStop Self Storage REIT, Inc. is a leading owner and operator of self-storage facilities in the United States and Canada, with a market cap of $1.40 billion.

Operations: SmartStop generates revenue primarily from its self-storage operations, amounting to $225.51 million, and its managed REIT platform, contributing $11.59 million.

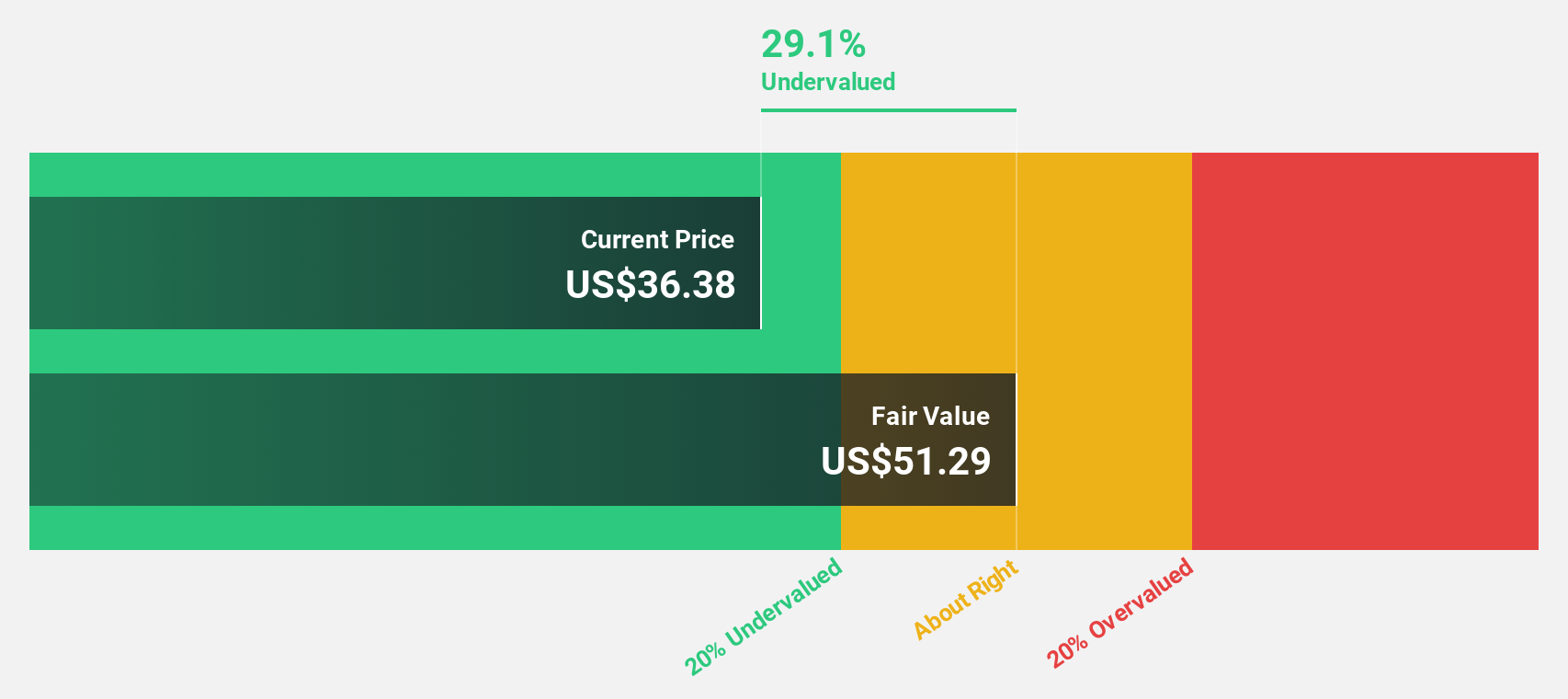

Estimated Discount To Fair Value: 22.7%

SmartStop Self Storage REIT is trading at US$36.6, below its estimated fair value of US$47.36, indicating potential undervaluation based on cash flows. Despite a net loss in Q1 2025 and slower revenue growth forecasts compared to high-growth sectors, the company expects significant earnings growth of 57.42% annually over the next three years. Recent debt restructuring has improved financial flexibility, though dividend sustainability remains a concern due to coverage issues by earnings or free cash flows.

- Our growth report here indicates SmartStop Self Storage REIT may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of SmartStop Self Storage REIT stock in this financial health report.

Where To Now?

- Click this link to deep-dive into the 169 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CLFD

Clearfield

Designs, manufactures, and distributes fiber management, protection, and delivery products in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)